FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

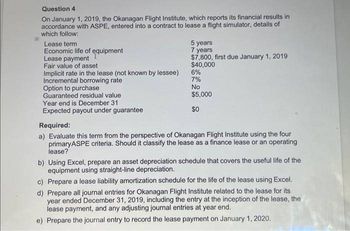

Transcribed Image Text:Question 4

On January 1, 2019, the Okanagan Flight Institute, which reports its financial results in

accordance with ASPE, entered into a contract to lease a flight simulator, details of

which follow:

Lease term

Economic life of equipment

Lease payment

Fair value of asset

Implicit rate in the lease (not known by lessee)

Incremental borrowing rate

Option to purchase

Guaranteed residual value

Year end is December 31

Expected payout under guarantee

5 years

7 years

$7,800, first due January 1, 2019

$40,000

6%

7%

No

$5,000

$0

Required:

a) Evaluate this term from the perspective of Okanagan Flight Institute using the four

primaryASPE criteria. Should it classify the lease as a finance lease or an operating

lease?

b) Using Excel, prepare an asset depreciation schedule that covers the useful life of the

equipment using straight-line depreciation.

c) Prepare a lease liability amortization schedule for the life of the lease using Excel.

d) Prepare all journal entries for Okanagan Flight Institute related to the lease for its

year ended December 31, 2019, including the entry at the inception of the lease, the

lease payment, and any adjusting journal entries at year end.

e) Prepare the journal entry to record the lease payment on January 1, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $509,761 over a five-year lease term, payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's incremental borrowing rate is 8%, the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straight-line basis at the end of each fiscal year. The fair value of the equipment is $4.30 million. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Determine the present value of the lease payments on June 30, 2024 that Georgia-Atlantic uses to record the right-of-use asset and lease liability. 2. What amount related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2024 (ignore taxes)? 3. What amount related to the lease would…arrow_forwardOn June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $468,683 over a five-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's Incremental borrowing rate is 10%, the same rate IC used to calculate lease payment amounts. IC purchased the equipment from Builders, Incorporated at a cost of $3.8 million. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. What amount related to the lease would IC report in its balance sheet on December 31, 2024 (Ignore taxes)? 2. What amount related to the lease would IC report in its income statement for the year ended December 31, 2024 (Ignore taxes)? Note: For all requirements, enter your answers in whole dollars and not in millions. Round the…arrow_forwardNEED ASAParrow_forward

- On January 1, 2020, Metlock Co. leased a building to Ivanhoe Inc. The relevant information related to the lease is as follows. 1. The lease arrangement is for 10 years. The building is expected to have a residual value at the end of the lease of $3,000,000 (unguaranteed). 2. The leased building has a cost of $3,500,000 and was purchased for cash on January 1, 2020. 3. The building is depreciated on a straight-line basis. Its estimated economic life is 50 years with no salvage value. 4. Lease payments are $270,000 per year and are made at the beginning of the year. 5. Ivanhoe has an incremental borrowing rate of 9%, and the rate implicit in the lease is unknown to Ivanhoe. 6. Both the lessor and the lessee are on a calendar-year basis. Click here to view factor tables.(For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (a) Prepare the journal entries that Metlock should make in 2020. (Credit account…arrow_forwardNeal Company entered into a nine-year capital lease on a warehouse on December 31, 2021. Lease payments of P520,000, which includes executory cost of P20,000 is due annually, beginning on December 31, 2022, and every December 31 thereafter. The cost of restoring the underlying asset to its original condition as required by the contract was estimated at the present value of P200,000. The interest rate implicit in the lease if 9%. The present value of an ordinary annuity of 1 for nine years at 9% is 5.6. Question: - What amount should be reported as lease liability on December 31, 2021? A. 2,800,000B. 2,912,000C. 4,500,000D. 4,680,000 - What amount should be recognized initially as cost of the right of use asset? A. 2,800,000B. 3,000,000C. 3,112,000D. 4,700,000arrow_forwardCullumber Company leased equipment from Ayayai Company on July 1, 2025, for an eight-year period expiring June 30, 2033. One of the lease terms is a guaranteed residual amount of $13200. The residual expected by Cullumber will be $8100. The lease meets the criteria of a finance lease. What is the residual value amount that would be included in the calculation of Cullumber's lease liability/right- of use asset? The present value of $8100. The present value of $13200. The present value of $5100. The residual would not be included in the calculation of the lease liability/right-of-use asset.arrow_forward

- Please help mearrow_forwardOn January 1, 2019, TharnCorporation leased a machinery from TypeCompany on a five-year lease term at P150,000 annual rental payments, paid in advance. There is a bargain purchase option on December 31, 2023 of P240,000. The economic life of the equipment is 15 years. The interest rate implicit in the lease is 12%. How much is the depreciation expense to be recognized in 2019 related to the right-of-use asset? A.P39,451 B.P49,451 C.P118,354 D.P148,354 Which of the following is part of the entry or entries to be recorded at the end of lease term assuming that Tharnfails to exercise its bargain purchase option? A. Debit Loss on Unexercised Bargain Purchase Option, P245,516 B.Debit Lease Liability, P325,236 C.Debit Interest Payable, P25,736 D.Credit Right-of-Use Asset, P741,771arrow_forwardOn 1st January 2019, LMN SAOG entered an agreement to lease an item of plant from a manufacturer for 4 years. The lease requires four annual payments in advance of OMR 200,000 each commencing from 1st January 2019. The plant would have a useful life of four years with no residual value. The present value of the total lease payments is OMR 700,000. The cost of capital used is 10%. Chose the correct journal entry for initial recognition of the lease? O a. Right to use asset (Debit) 500,000; Lease Liability (Credit) 500,000. O b. Lease Liability (Debit) 700,000; Right to use asset (Credit) 700,000. OC Right to use asset (Debit) 700,000; Lease Liability (Credit) 500,000; and bank (Credit) 200,000. O d. Plant (Debit) 700,000; Liability (Credit) 700,000.arrow_forward

- On June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $468,683 over a five-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's Incremental borrowing rate is 10%, the same rate IC used to calculate lease payment amounts. IC purchased the equipment from Builders, Incorporated at a cost of $3.8 million. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. What amount related to the lease would IC report in its balance sheet on December 31, 2024 (Ignore taxes)? 2. What amount related to the lease would IC report in its income statement for the year ended December 31, 2024 (Ignore taxes)? Note: For all requirements, enter your answers in whole dollars and not in millions. Round the…arrow_forwardOn June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $403,067 over a five-year lease term, payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's incremental borrowing rate is 8%, the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straight-line basis at the end of each fiscal year. The fair value of the equipment is $3.40 million. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Determine the present value of the lease payments on June 30, 2024 that Georgia-Atlantic uses to record the right-of-use asset and lease liability. 2. What amount related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2024 (ignore taxes)? 3. What amount related to the lease would…arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2021, for a three-year period ending December 31, 2023. The lease agreement specified annual payments of $32,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2022. The company had the option to purchase the machine on December 30, 2023, for $41,000 when its fair value was expected to be $56,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor’s implicit rate of return was 10%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education