Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

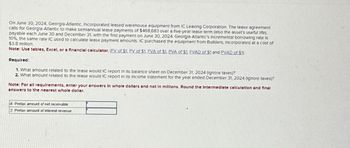

Transcribed Image Text:On June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement

calls for Georgia-Atlantic to make semiannual lease payments of $468,683 over a five-year lease term (also the asset's useful life),

payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's Incremental borrowing rate is

10%, the same rate IC used to calculate lease payment amounts. IC purchased the equipment from Builders, Incorporated at a cost of

$3.8 million.

Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1)

Required:

1. What amount related to the lease would IC report in its balance sheet on December 31, 2024 (Ignore taxes)?

2. What amount related to the lease would IC report in its income statement for the year ended December 31, 2024 (Ignore taxes)?

Note: For all requirements, enter your answers in whole dollars and not in millions. Round the Intermediate calculation and final

answers to the nearest whole dollar.

Pretax amount of net receivable

2. Pretax amount of interest revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- 1.arrow_forwardSunland Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2025. Annual rental payments of $47,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Sunland's incremental borrowing rate is 8%. Sunland is unaware of the rate being used by the lessor. At the end of the lease, Sunland has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Sunland uses the straight-line method of depreciation on similar owned equipment. Click here to view factor tables. (a) Your answer is partially correct. Prepare the journal entries, that Sunland should record on December 31, 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forward7arrow_forward

- Asvinarrow_forwardOn January 1, 2024, Taco King leased retail space from Fogelman Properties. The 10-year finance lease requires quarterly variable lease payments equal to 3% of Taco King's sales revenue, with a quarterly sales minimum of $520,000. Payments at the beginning of each quarter are based on previous quarter sales. During the previous five-year period, Taco King has generated quarterly sales of over $710,000. Fogelman's Interest rate, known by Taco King, was 4%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Prepare the journal entries for Taco King at the beginning of the lease on January 1, 2024. 2. Prepare the journal entries for Taco King on April 1, 2024. First quarter sales were $720,000. Amortization is recorded quarterly. es Complete this question by entering your answers in the tabs below. Required Required 2 Prepare the journal entries for Taco King at the beginning of the lease on January 1,…arrow_forwardOn January 1, 2021, Taco King leased retail space from Fogelman Properties. The 10-year finance lease requires quarterly variable lease payments equal to 3% of Taco King's sales revenue, with a quarterly sales minimum of $520,000. Payments at the beginning of each quarter are based on previous quarter sales. During the previous 5-year period, Taco King has generated quarterly sales of over $710.000. Fogelman's interest rate, known by Taco King, was 4%. ( EV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Prepare the journal entries for Taco King at the beginning of the lease at January 1, 2021. 2. Prepare the journal entries for Taco King at April 1, 2021. First quarter sales were $720,000. Amortization is recorded quarterly Required 1 Required 2 Prepare the journal entries for Taco King at the beginning of the lease at January 1, 2021. (If no entry is required for a transaction/event, select "No…arrow_forward

- On December 31, 2021, Fins signs a four-year truck lease. The truck has a current value of $58,600. Four annual payments of $10,000 will be paid and the first payment will be made on December 31, 2021. After that time, the truck with a previous useful life of 8 years will be returned to the lessor. Fins has an incremental borrowing rate of 6%. The present value of a 4-year annuity payable of $10,000 at an annual rate of 6% is $36,700. The lessor has an implicit annual interest rate of 8% built into the contract. Fins is aware of this implied rate. The present value of a 4-year annuity due for $10,000 at an annual rate of 8% is $35,770. What liability should Fins report on its balance sheet as of December 31, 2021? A) 26,700 B)25,770 C) 10,000 D) 0arrow_forwardOn June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $468,683 over a five-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's Incremental borrowing rate is 10%, the same rate IC used to calculate lease payment amounts. IC purchased the equipment from Builders, Incorporated at a cost of $3.8 million. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. What amount related to the lease would IC report in its balance sheet on December 31, 2024 (Ignore taxes)? 2. What amount related to the lease would IC report in its income statement for the year ended December 31, 2024 (Ignore taxes)? Note: For all requirements, enter your answers in whole dollars and not in millions. Round the…arrow_forwardOn 1 January 20X1, Dynamic entered into a three year lease for a lorry. Lease payments are $10,000 per year for the first two years and $15,000 for the third year. All payments are due at the end of the year. The present value of the lease payments was $31,552, and Dynamic incurred initial direct costs of $3,000. Dynamic's rate of borrowing is 5%. Prepare extracts from Dynamic's financial statements in respect of the lease agreement for the year ended 31 December 20X1.arrow_forward

- On June 30, 2021, Georgia-Atlantic, Inc. leased warehouse equipment from Builders, Inc. The lease agreement calls for Georgia- Atlantic to make semiannual lease payments of $583.573 over a 4-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's Incremental borrowing rate is 11.0%, the same rate Builders used to calculate lease payment amounts. Builders manufactured the equipment at a cost of $3.4 million. (FV of $1. PV of $1. FVA of $1, PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Determine the price at which Builders is "selling" the equipment (present value of the lease payments) at June 30, 2021. 2. What amount related to the lease would Builders report in its balance sheet at December 31, 2021 (Ignore taxes)? 3. What line item amounts related to the lease would Builders report in its Income statement for the year ended December 31,…arrow_forwardOn January 1, 2024, Taco King leased retail space from Fogelman Properties. The 10-year finance lease requires quarterly variable lease payments equal to 2% of Taco King's sales revenue, with a quarterly sales minimum of $590,000. Payments at the beginning of each quarter are based on previous quarter sales. During the previous five-year period, Taco King has generated quarterly sales of over $745,000. Fogelman's interest rate, known by Taco King, was 8%. Note: Use Excel, or a financial calculator. Required: 1. Prepare the journal entries for Taco King at the beginning of the lease on January 1, 2024. 2. Prepare the journal entries for Taco King on April 1, 2024. First quarter sales were $755,000, Amortization is recorded quarterly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries for Taco King at the beginning of the lease on January 1, 2024. Note: If no entry is required for a transaction/event, select "No journal…arrow_forwardWilson Foods Corporation leased a commercial food processor on September 30, 2021. The five-year finance lease agreement calls for Wilson to make quarterly lease payments of $313,238, payable each September 30, December 31, March 31, June 30, with the first payment at September 30, 2021. Wilson’s incremental borrowing rate is 12%. Wilson records amortization on a straight-line basis at the end of each fiscal year. Wilson recorded the lease as follows: September 30, 2021 Right-of-use asset (calculated below) 4,800,000 Lease payable (calculated below) 4,800,000 Lease payable 313,238 Cash (first payment) 313,238 Calculation of the present value of lease payments$313,238 × 15.3238* = $4,800,000 (rounded)*Present value of an annuity due of $1: n = 20, i = 3% Required:What would be the pretax amounts related to the lease that Wilson would report in its statement of cash flows for the year ended December 31, 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education