FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

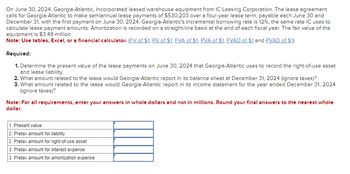

Transcribed Image Text:On June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from IC Leasing Corporation. The lease agreement

calls for Georgia-Atlantic to make semiannual lease payments of $530,203 over a four-year lease term, payable each June 30 and

December 31, with the first payment on June 30, 2024. Georgia-Atlantic's incremental borrowing rate is 12%, the same rate IC uses to

calculate lease payment amounts. Amortization is recorded on a straight-line basis at the end of each fiscal year. The fair value of the

equipment is $3.49 million.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

1. Determine the present value of the lease payments on June 30, 2024 that Georgia-Atlantic uses to record the right-of-use asset

and lease liability.

2. What amount related to the lease would Georgia-Atlantic report in its balance sheet at December 31, 2024 (ignore taxes)?

3. What amount related to the lease would Georgia-Atlantic report in its income statement for the year ended December 31, 2024

(ignore taxes)?

Note: For all requirements, enter your answers in whole dollars and not in millions. Round your final answers to the nearest whole

dollar.

1. Present value

2. Pretax amount for liability

2. Pretax amount for right-of-use asset

3. Pretax amount for interest expense

3. Pretax amount for amortization expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Memanarrow_forwardBall Company leased machinery to Denver Company on July 1, 2021, for a ten-year period expiring June 30, 2031. Equal annual payments under the lease are $250,000 and are due on July 1 of each year. The first payment was made on July 1, 2021. The rate of interest used by Harter and Stine is 9%. The lease receivable before the first payment is $1,750,000 and the cost of the machinery on Ball’s accounting records was $1,550,000. Assuming that the lease is appropriately recorded as a sale for accounting purposes by Ball, what amount of interest revenue would Ball record for the year ended December 31, 2021? a. $67,500 b. $135,000 c. $157,500 d. $0arrow_forwardOn December 31, 2021, Lang Corporation leased a ship from Fort Company for an eight-year period expiring December 30, 2029. Equal annual payments of $100,000 are due on December 31 of each year, beginning with December 31, 2021. The lease is properly classified as a finance lease on Lang 's books. The present value at December 31, 2021 of the eight lease payments over the lease term discounted at 10% is $586,843. Required: Prepare the journal entry that Lang should record on December 31, 2021.arrow_forward

- On June 30, 2024, Georgia-Atlantic, Incorporated leased warehouse equipment from Builders, Incorporated The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $463,866 over a 4-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment on June 30, 2024. Georgia-Atlantic's incremental borrowing rate is 11.0%, the same rate Builders used to calculate lease payment amounts. Builders manufactured the equipment at a cost of $2.6 million. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Determine the price at which Builders is "selling" the equipment (present value of the lease payments) on June 30, 2024. 2. What amount related to the lease would Builders report in its balance sheet on December 31, 2024 (ignore taxes)? 3. What line item amounts related to the lease would Builders report in its income statement for the year ended…arrow_forwardUramilabenarrow_forwardOn January 1, 2025, Bridgeport Company contracts to lease equipment for 5 years, agreeing to make a payment of $128,104 at the beginning of each year, starting January 1, 2025. The leased equipment is to be capitalized at $572,000. The asset is to be amortized on a double-declining-balance basis, and the obligation is to be reduced on an effective-interest basis. Bridgeport's incremental borrowing rate is 7%, and the implicit rate in the lease is 6%, which is known by Bridgeport. Title to the equipment transfers to Bridgeport at the end of the lease. The asset has an estimated useful life of 5 years and no residual value.arrow_forward

- NutraLabs, Incorporated, leased a protein analyzer to Werner Chemical, Incorporated, on September 30, 2024. NutraLabs manufactured the machine at a cost of $5.1 million. The five-year lease agreement calls for Werner to make quarterly lease payments of $385,022, payable each September 30, December 31, March 31, and June 30, with the first payment on September 30, 2024. NutraLabs’ implicit interest rate is 16%. The useful life of the equipment is five years. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Determine the price at which NutraLabs is “selling” the equipment (present value of the lease payments) on September 30, 2024. What pretax amounts related to the lease would NutraLabs report in its balance sheet on December 31, 2024? What pretax amounts related to the lease would NutraLabs report in its income statement for the year ended December 31, 2024? What pretax amounts related to the lease…arrow_forwardTechnoid Incorporated sells computer systems. Technoid leases computers to Lone Star Company on January 1, 2024. The manufacturing cost of the computers was $17 million. This noncancelable lease had the following terms: Lease payments: $2,691,724 semiannually; first payment on January 1, 2024; remaining payments on June 30 and December 31 each year through June 30, 2028. Lease term: 5 years (10 semiannual payments). No residual value; no purchase option. Economic life of equipment: 5 years. Implicit interest rate and lessee's incremental borrowing rate: 6% semiannually. Fair value of the computers on January 1, 2024: $21 million. What is the interest revenue that Technoid would report for this lease in its income statement for the year ended December 31, 2024? Note: Round your answer to the nearest whole dollar.Multiple Choice $0 $2,101,400 $1,098,497 None of these answer choices is correct.arrow_forwardBrown Enterprises enter into a 4 year lease with ABC Leasing Company. The lease qualifies as an operating lease. The first lease payment of $100,000 was due on January 1, 2024, on the date the lease was executed and all subsequent lease payments due on December 31. The present value of the lease payments was $348,685 and Brown Enterprises correctly recorded the right of use asset and lease liability on January 1, 2024 for this amount. The implicit rate in the lease is 10%. On its 2024 income statement, when Brown Enterprises reports its lease expense for 2024, it will be made up of which of the following components? (Choose all that apply) DAROU amortization $75,132 8. Interest expense $12,829 OCROU amortization $87,171 OD. Interest expense $24,869 Quesdan 12 of 25arrow_forward

- On June 30, 2024, Blue, Incorporated leased a machine from Big Leasing Corporation. The lease agreement qualifies as a finance lease and calls for Blue to make semiannual lease payments of $212,190 over a four-year lease term, payable each June 30 and December 31, with the first payment on June 30, 2024. Blue’s incremental borrowing rate is 10%, the same rate Big uses to calculate lease payment amounts. Determine the present value of the lease payments on June 30, 2024, that Blue uses to record the right-of-use asset and lease liability. What would be the amounts related to the lease that Blue would report in its balance sheet at December 31, 2024? (Ignore taxes.) What would be the amounts related to the lease that Blue would report in its income statement for the year ended December 31, 2024? (Ignore taxes.)arrow_forwardOn January 1, 2023, Shrek Inc. enters into a seven-year non-cancellable lease with Fiona Ltd. for machinery having an estimated useful life of nine years and a fair value of $4,300,000. Shrek's incremental borrowing rate is 8% and Fiona's implicit rate is 6%. Shrek uses the straight-line depreciation method to depreciate assets. Shrek will make annual lease payments on January 1 of each year. The lease includes a guarantee by Shrek Inc. that Fiona Ltd. will realize $100,000 from selling the asset at the expiration of the lease, which Shrek expects to pay. Both companies adhere to IFRS. Instructions a) Calculate the lease payment Fiona Ltd. will charge Shrek (assuming no mark-up of the machinery from fair value). Round to the nearest dollar. b) Calculate the present value of the lease payments. Round to the nearest dollar. c) What kind of lease is this to Shrek Inc.? Why? d) Present the journal entries that Shrek Inc. would record during the first year of the lease. Round to the nearest…arrow_forwardSagararrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education