Concept explainers

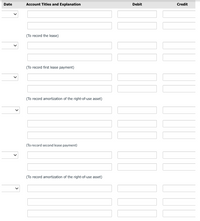

Assume that on December 31, 2019, Marin Aerospace signs a 8-year, non-cancelable lease agreement to lease a hanger from Aero Field Management Company. The following information pertains to this lease agreement:

| 1. | The agreement requires equal rental payments of $159,660 beginning on December 31, 2019. | |

| 2. | The fair value of the building on December 31, 2019 is $1,082,878. | |

| 3. | The building has an estimated economic life of 10 years, a guaranteed residual value of $50,900, and an expected residual value of $36,100. Marin |

|

| 4. | The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. | |

| 5. | Marin’s incremental borrowing rate is 6% per year. The lessor’s implicit rate is not known by Marin. |

Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Prepare the

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- On January 1, 2020, Elden Ring Co. signed a 12-year lease for warehouse space. The entity has an option to renew the lease for an additional 8-year period on or before January 1, 2024. During January 2022, the entity made substantial improvement to the warehouse. The cost of the improvement was P540,000 with an estimated useful life of 15 years. On December 31, 2022, the entity intended to exercise the renewal option. What is the carrying amount of the leasehold improvement as of December 31, 2022? O a. 510000 O b. 486000 O c. 504000 d. 513000arrow_forwardOn July 1, 2023, Crane Corp., which uses IFRS, signs a 4-year, non-cancellable lease agreement to lease a equipment from Blossom Ltd. The following information concerns the lease agreement. 1. The equipment's fair value on July 1, 2023 is $259,000. نه 3. The agreement requires equal rental payments of $58,000.00 beginning on July 1, 2023. The equipment has an estimated economic life of 5 years, with an unguaranteed residual value of $93,000. Crane Corp. depreciates similar equipment using the straight-line method, with no residual value. 4. The lease is non-renewable. At the termination of the lease, the equipment reverts to Blossom. 5. 6. Crane's incremental borrowing rate is 6% per year. The lessor's implicit rate is not known by Crane Corp. The yearly rental payment includes $6,543.59 of executory costs related to insurance on the equipment. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE.arrow_forwardLinda Leasing Company signs an agreement on January 1, 2025, to lease equipment to Swifty Company. The following information relates to this agreement. 1. The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic life of 5 years. 2. 3. The fair value of the asset at January 1, 2025, is $72,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $12,000, none of which is guaranteed. 4. The agreement requires equal annual rental payments of $21,250.90 to the lessor, beginning on January 1, 2025. 5. The lessee's incremental borrowing rate is 5%. The lessor's implicit rate is 4% and is unknown to the lessee. 6. Swifty uses the straight-line depreciation method for all equipment. Click here to view factor tables. Prepare all of the journal entries for the lessee for 2025 to record the lease agreement, the lease payments, and all expenses related to this lease.…arrow_forward

- Assume that on December 31, 2024, Kimberly-Clark Corp. signs a 10-year, non-cancelable lease agreement to lease a storage building from Sandhill Storage Company. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $66.999 beginning on December 31, 2024. 2. The fair value of the building on December 31, 2024, is $490,629. 3. 4. 5. The building has an estimated economic life of 12 years, a guaranteed residual value of $11,000, and an expected residual value of $8,100. Kimberly-Clark depreciates similar buildings on the straight-line method. The lease is nonrenewable. At the termination of the lease, the building reverts to the lessor. Kimberly-Clark's incremental borrowing rate is 8% per year. The lessor's implicit rate is not known by Kimberly-Clark Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided) (a) Your answer is partially correct. Prepare the journal…arrow_forwardOn December 31, 2019, Marin Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for Marin to make annual payments of $8,566 at the beginning of each year of the lease, starting December 31, 2019. The machine has an estimated useful life of 6 years and a $4,500 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Marin uses the straight-line method of depreciation for all of its plant assets. Marin’s incremental borrowing rate is 4%, and the lessor’s implicit rate is unknown.Click here to view factor tables. https://education.wiley.com/content/Kieso_Intermediate_Accounting_17e/media/simulations/interest_rate_tables.pdf a) Compute the present value of the lease payments. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places e.g. 5,275.) Present value of the lease payments $enter the Present value…arrow_forwardOn January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of $100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is $2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswell’s incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of $7,000 annually,…arrow_forward

- At January 1, 2024, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. • The lease agreement specifies annual payments of $32,000 beginning January 1, 2024, the beginning of the lease, and on each December 31 thereafter through 2031. . The equipment was acquired recently by Crescent at a cost of $243,000 (its fair value) and was expected to have a useful life of 13 years with no salvage value at the end of Its life. . Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $73,596. Crescent seeks a 9% return on Its lease Investments. . By this arrangement, the lease is deemed to be an operating lease. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. What will be the effect of the lease on Café Med's earnings for the first year (ignore taxes)? Note: Enter decreases with negative sign. 2. What…arrow_forwardHelp Save & Ex On September 30, 2024, Truckee Garbage leased equipment from a supplier and agreed to pay $140,000 annually for 15 years beginning September 30, 2025. Generally accepted accounting principles require that a liability be recorded for this lease agreement for the present value of scheduled payments. Accordingly, at inception of the lease, Truckee recorded a $1,405,261 lease liability. Required: Determine the interest rate implicit in the lease agreement. Note: Use tables, Excel, or a financial calculator. Round your answer to 1 decimal place. (FV of $1, PV of $1, EVA of $1, PVA of $1, EVAD of $1 and PVAD of $1) Interest rate implicit %arrow_forwardVinubhaiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education