FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Ask expert

1. Answer the following:

• Prepare a

• Prepare

•

Please refer to the picture below:

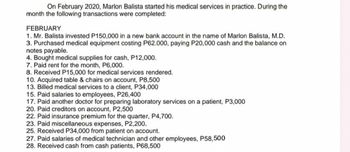

Transcribed Image Text:On February 2020, Marlon Balista started his medical services in practice. During the

month the following transactions were completed:

FEBRUARY

1. Mr. Balista invested P150,000 in a new bank account in the name of Marlon Balista, M.D.

3. Purchased medical equipment costing P62.000, paying P20,000 cash and the balance on

notes payable.

4. Bought medical supplies for cash, P12,000.

7. Paid rent for the month, P6,000.

8. Received P15,000 for medical services rendered.

10. Acquired table & chairs on account, P8,500

13. Billed medical services to a client, P34,000

15. Paid salaries to employees, P26,400

17. Paid another doctor for preparing laboratory services on a patient, P3,000

20. Paid creditors on account, P2,500

22. Paid insurance premium for the quarter, P4,700.

23. Paid miscellaneous expenses, P2,200.

25. Received P34,000 from patient on account.

27. Paid salaries of medical technician and other employees, P58,500

28. Received cash from cash patients, P68,500

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- While passing a journal entry for the following transaction which account would be debited? "Commission of $5,000 received"arrow_forwardThe following transactions occurred for Luminary Engineering: View the transactions. Journalize the transactions of Luminary Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Notes Payable; Luminary, Capital; Luminary, Withdrawals; Service Revenue; and Utilities Expense. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) July 2: Received $15,000 contribution from Bobby Luminary, owner, in exchange for capital. Date Jul. 2 Transactions Jul. 2 Accounts and Explanation Jul. 4 Jul. 5 Jul. 10 Jul. 12 Jul. 19 Jul. 21 Jul. 27 Debit Received $15,000 contribution from Bobby Luminary, owner, in exchange for capital. Paid utilities expense of $440. Purchased equipment on account, $2,600. Performed services for a client on account, $3,500. Borrowed $7,200 cash, signing a notes payable. Luminary withdrew $650 cash from the business. Purchased…arrow_forwardPrepare a journal entry on August 13 for cash received for services rendered, $10,150. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

- For each of the following, indicate if the statement reflects an input component, output component, or storage component of an accounting information system. 1. A credit card scanner at a grocery store is a(n) [ Select] component. 2. A report of patients who missed appointments at a doctor's office is a(n) [ Select] component. 3. Electronic files containing a list of current customers is aln) [ Select ] component. 4. A list of the day's cash and credit sales is aln) [ Select] component. 5. A purchase order for 1,000 bottles of windshield washing fluid to be used as inventory by an auto parts store is a(n) [ Select ] component.arrow_forwardWhich of the following journal entries will increase the total balance of the debit accounts in the ledger by $4,500? Select answer from the options below: A debit to Supplies for $4,500; a credit to Cash for $500; and a credit to Accounts Payable for $5,000. A debit to Supplies Expense for $4,500; a credit to Cash for $500; and a credit to Accounts Payable for $4,000. A debit to Accounts Payable for $4,500; and a credit to Cash for $4,500. A debit to Supplies Expense for $5,000; a credit to Cash for $500; and a credit to Accounts Payable for $4,500.arrow_forwardWhich of the following is not one of the three primary credit bureaus? Group of answer choices A. the amount of credit used each month. B. credit utilization. C. credit inquiries. D. credit payment history.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education