FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1a. Journalize the entries to record the 20Y1 transactions. Round all amounts to the nearest dollar. Refer to the Chart of Accounts for exact wording of account titles.

JOURNAL

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT | ASSETS | LIABILITIES | EQUITY | |

|---|---|---|---|---|---|---|---|---|

|

1

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

1b. Journalize the entries to record the 20Y2 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar.

JOURNAL

ACCOUNTING EQUATION

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT | ASSETS | LIABILITIES | EQUITY | |

|---|---|---|---|---|---|---|---|---|

|

1

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

1c. Journalize the entries to record the 20Y3 transactions. Refer to the Chart of Accounts for exact wording of account titles. Round all amounts to the nearest dollar.

JOURNAL

ACCOUNTING EQUATION

| DATE | DESCRIPTION | POST. REF. | DEBIT | CREDIT | ASSETS | LIABILITIES | EQUITY | |

|---|---|---|---|---|---|---|---|---|

|

1

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

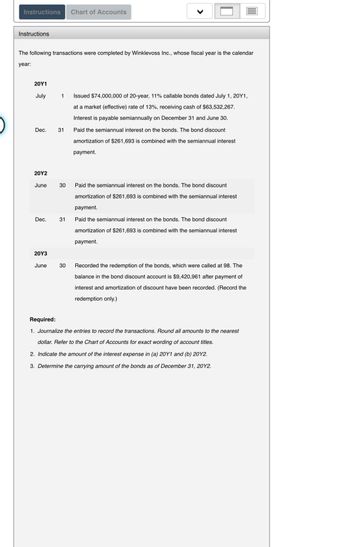

Transcribed Image Text:Instructions Chart of Accounts

Instructions

The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar

year:

20Y1

July

Dec.

20Y2

June

Dec.

20Y3

June

1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, 20Y1,

at a market (effective) rate of 13%, receiving cash of $63,532,267.

Interest is payable semiannually on December 31 and June 30.

Paid the semiannual interest on the bonds. The bond discount

amortization of $261,693 is combined with the semiannual interest

payment.

31

30

31

Paid the semiannual interest on the bonds. The bond discount

amortization of $261,693 is combined with the semiannual interest

payment.

Paid the semiannual interest on the bonds. The bond discount

amortization of $261,693 is combined with the semiannual interest

payment.

30 Recorded the redemption of the bonds, which were called at 98. The

balance in the bond discount account is $9,420,961 after payment of

interest and amortization of discount have been recorded. (Record the

redemption only.)

Required:

1. Journalize the entries to record the transactions. Round all amounts to the nearest

dollar. Refer to the Chart of Accounts for exact wording of account titles.

2. Indicate the amount of the interest expense in (a) 20Y1 and (b) 20Y2.

3. Determine the carrying amount of the bonds as of December 31, 2012.

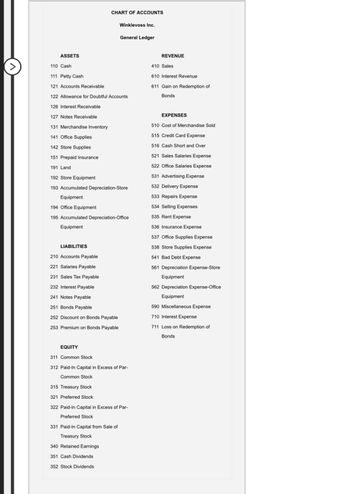

Transcribed Image Text:ASSETS

110 Cash

126 Interest Receivable

111 Petty Cash

121 Accounts Receivable

122 Allowance for Doubtful Accounts

CHART OF ACCOUNTS

LIABILITIES

127 Notes Receivable

131 Merchandise Inventory

141 Office Supplies

142 Store Supplies

151 Prepaid Insurance

191 Land

192 Store Equipment

193 Accumulated Depreciation-Store

Equipment

210 Accounts Payable

221 Salaries Payable

231 Sales Tax Payable

232 Interest Payable

194 Office Equipment

195 Accumulated Depreciation-Office

Equipment

Winklevoss Inc.

241 Notes Payable

251 Bonds Payable

252 Discount on Bonds Payable

253 Premium on Bonds Payable

General Ledger

315 Treasury Stock

321 Preferred Stock

EQUITY

311 Common Stock

312 Paid-In Capital in Excess of Par-

Common Stock

331 Paid-In Capital from Sale of

Treasury Stock

340 Retained Earnings

351 Cash Dividends

352 Stock Dividends

322 Paid-In Capital in Excess of Par-

Preferred Stock

REVENUE

410 Sales

610 Interest Revenue

611 Gain on Redemption of

Bonds

EXPENSES

510 Cost of Merchandise Sold

515 Credit Card Expense

516 Cash Short and Over

521 Sales Salaries Expense

522 Office Salaries Expense

531 Advertising Expense

532 Delivery Expense

533 Repairs Expense

534 Selling Expenses

535 Rent Expense

536 Insurance Expense

537 Office Supplies Expense

538 Store Supplies Expense

541 Bad Debt Expense

561 Depreciation Expense-Store

Equipment

562 Depreciation Expense-Office

Equipment

590 Miscellaneous Expense

710 Interest Expense

711 Loss on Redemption of

Bonds

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is/are not true about a proper journal entry? a. All credits are indented. b. A debit is never indented, even if a liability or owner's equity account is involved. c. In a compound entry, the largest amounts are listed first. d. An explanation is needed immediately after each debit and immediately after each credit. e. All debits are listed before the first credit. 2. MC.03.002 A book of original entry is known as a a. ledger account. b. trial balance. c. general ledger. d. T account. e. Journal. 3. MC.03.003 An accountant wanting to know the balance of a particular account would refer to the a. source document. b. chart of accounts. c. journal. d. book of original entry. e. ledger. 4. MC.03.004 The process of subtotaling both sides of an account and recording the amount on that side is known as a. journalizing. b. footing. c. balancing the accounts. d. taking a trial balance. e. posting.arrow_forwardFor the following accounts please indicate whether the normal balance is a debit or a credit. Wages Payable [ Select ] [ Select ] Debit Building [Sele Credit Wages Expense [ Select]arrow_forwardH5.arrow_forward

- 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Refer to the Chart of Accounts for exact wording of account titles. Insert the appropriate posting references in both the journal and the ledger as each item is posted. PAGE 18PAGE 19 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16…arrow_forward← 8:45 a. Trial balance b. General journal c. General ledger Accounting Records Label each of the examples below with the appropriate accounting record title and describe what each is used for: Date Date Totals Description Explanation HA2-1 a Debit P.R. DEBIT Debit Name CREDIT e Credit Credit ACCOUNT NO. BALANCE Done 3 Aarrow_forwardFor each account, indicate whether it appears in the general ledger or the subsidiary ledger. Accounts Payable - Igwe Choose. Accounts Receivable - Ukpolo Choose. Prepaid Rent Choose. Notes Payable Choose. Store Supplies Choose. Interest Expense Choose.arrow_forward

- Exercise 5: Prepare journal entries to record the following merchandising transactions of Dean Company, which applies the perpetual inventory system. Dean Company offers all of its credit customers credit terms of 2/10, n/30. May 1 Purchased merchandise from Swift Company for $7,800 under credit terms of 1/10, n/30, FOB shipping point, invoice dated May 1. 2 Purchased merchandise from Arrow Company for $10,600 under credit terms 2/5, n/20, FOB destination. 3 Sold merchandise to Bee Company for $5,600, FOB shipping point, invoice dated May 4. The merchandise had cost $3,000. 4 Paid S300 cash for the freight charges on the May I purchase of merchandise. 5 Received an $800 credit memorandum from Swift Company for the return of part of the merchandise purchased on May 1. 6 Paid Arrow Company the balance due within the discount period. 8 Sold merchandise to Nat Company for $3,300, FOB shipping point, invoice dated May 8. The merchandise had a cost of $1,500. 11 Paid Swift Company the…arrow_forwardSubject: accountingarrow_forwardThree different lease transactions are presented below for Sandhill Enterprises. Assume that all lease transactions start on January 1, 2024. Sandhill does not receive title to the properties, either during the lease term or at the end of it. The yearly rental for each of the leases is paid at the beginning of each year. Sandhill Enterprises prepares its financial statements using ASPE. Lease term Estimated economic life Yearly rental payment Fair market value of leased asset Present value of lease rental payments Interest rate Manufacturing Equipment 5 years 15 years $18,000 $126,000 $81,270 3.5% Vehicles 6 years 7 years $19,260 $109,200 $100,962 4% Office Equipment 3 years 5 years $5,010 $22,500 $12,912 8% Ass me that Sandhill Enterprises has purchased the vehicle for $109,200 instead of leasing it and that the amount borrowed was $109,200 at 8% interest, with interest payable at the end of each year. Prepare the entries for 2024. (List all debit entries before credit entries. Credit…arrow_forward

- Instructions The following equity investment transactions were completed by Romero Company during a recent year. Apr. July Sept. 10 Purchased 4,700 shares of Dixon Company for a price of $49 per share plus a brokerage commission of $120. 8 Received a quarterly dividend of $0.70 per share on the Dixon Company investment. 10 Sold 1,900 shares for a price of $41 per share less a brokerage commission of $75. Journalize the entries for these transactions. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers the nearest dollar.arrow_forwardAnswer full question.arrow_forwardFor each of the following accounts, indicate the effects of a debit and a credit on the accounts and the normal balance of the account. Debit Effect Credit Effect Normal Balance 1. Accounts Payable 2. Advertising Expense 3. Service Revenue 4. Accounts Receivable 5. Owner's Capital 6. Owner's Drawings > > > > > > > > > > > > > > >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education