FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

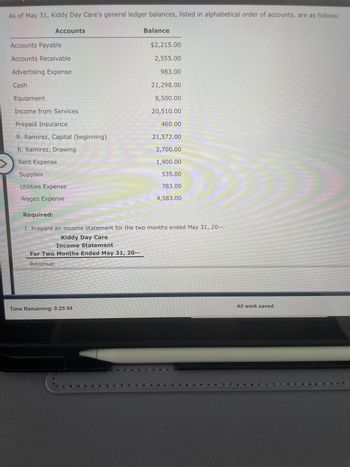

Transcribed Image Text:As of May 31, Kiddy Day Care's general ledger balances, listed in alphabetical order of accounts, are as follows:

Accounts

Balance

Accounts Payable

$2,215.00

Accounts Receivable

2,555.00

Advertising Expense

983.00

Cash

21,298.00

Equipment

8,500.00

Income from Services

20,510.00

Prepaid Insurance

460.00

R. Ramirez, Capital (beginning)

21,572.00

R. Ramirez, Drawing

2,700.00

Rent Expense

1,900.00

Supplies

535.00

Utilities Expense

783.00

4,583.00

Wages Expense

Required:

1. Prepare an income statement for the two months ended May 31, 20--.

Kiddy Day Care

Income Statement

For Two Months Ended May 31, 20--

Revenue:

Time Remaining: 0:25:54

All work saved.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please answer in text form, in proper formatarrow_forwardJournal Entries for Accounts and Notes ReceivableLancaster, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $18,000, 60 day, eight percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received a $21,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $17,000, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $25,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $22,500. Dec.31 Made the…arrow_forwardThe accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and Year 2. December 31 Cash Accounts receivable Office supplies Office equipment Trucks Building Land Accounts payable Note payable Numerator: Year 1 $ 48,814 26,497 4,180 128,303 50,206 3. Compute the Year 2 year-end debt ratio. 1 1 / 0 0 69,660 0 Year 2 Debt Ratio Denominator: $ 8,493 20,773 3,061 136,668 59,206 167,368 41,767 34,550 109, 135 = = Debt Ratio Debt ratioarrow_forward

- What is the Correct Answerarrow_forward10. Elly's credit card record for the last 7 months is below. Based on the information from the table, what will be her new balance at the end of month 7? End of Month Previous New Payment Finance Principal New Balance Charges Received Charges Paid Balance 1 $0.00 $2200.00 $0.00 $0.00 $0.00 $2200.00 5 6 234567 2 $2200.00 $0.00 $44.00 $33.00 $11.00 $2189.00 $2189.00 $0.00 $43.78 $32.84 $10.95 52178.06 4 $2178.06 $0.00 $43.56 $32.67 $10.89 $2167.16 $2167.16 $0.00 $43.34 $32.51 $10.84 $2156.33 $2156.33 $0.00 $43.13 $32.34 $10.78 $2145.55 $2145.55 $0.00 $42.91 $32.18 $10.73 $?arrow_forwardMaxwell Inc., analyzed its accounts receivable balances at December 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectible: % Considered Age Group Balance Uncollectible 0-30 days past due $300,000 1% 31-60 days past due 54,000 3% 61-120 days past due 60,000 6% 121-180 days past due 21,000 10% Over 180 days past due 6,000 20% $441,000 The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $2,520 on December 31, before any adjustments. a. Determine the amount of the adjustment for estimated credit losses on December 31. b. Determine the financial statement effect of a write off of Porter Company's account on the following May 12, in the amount of $1,440. Use negative signs with answers, when appropriate. If a transaction increases and decreases the same Balance Sheet category, enter the increase amount in the first row and the decrease amount directly below (in…arrow_forward

- Show work.arrow_forwardCompute the balance in the subsidiary accounts at the end of the month!arrow_forwardOswego Clay Pipe Company provides services of $46,000 to Southeast Water District #45 on April 12 of the current year with terms 1/15, n/60. What would Oswego record on April 23, assuming the customer made the correct payment on that date? A. Cash Sales Revenue Accounts Receivable B. Cash Sales Discounts Accounts Receivable Interest Revenue C. Cash Sales Discounts Accounts Receivable D. Cash Accounts Receivable Sales Revenue Select one: O A. Option A OB. Option B O C. Option C OD. Option D Clear my choice 45,540 460 46,000 460 45,540 460 46,000 46,000 46,000 460 46,000 45,540 460arrow_forward

- Blossom Company has a balance in its Accounts Receivable control account of $11,300 on January 1, 2022. The subsidiary ledger contains three accounts: Bixler Company, balance $4,200: Cuddyer Company, balance $2,200, and Freeze Company. During January the following receivable-related transactions occurred. Bixler Company Cuddyer Company Freeze Company (a) Credit Sales Collections $9,000 $7,900 2.600 8.800 7.100 8.500 Returns $0 3.000 Balance in the Freeze Company subsidiary account S 0 What is the January 1 balance in the Freeze Company subsidiary account?arrow_forwardThe following data (in millions) were adapted from recent financial statements of CVS Health Corporation (CVS). Year 2 Year 1 Sales $256,776 $194,579 Operating income 12,467 10,170 Average accounts receivable 18,624 15,406 1. Compute the accounts receivable turnover for Years 1 and 2. Round to one decimal place. Accounts Receivable Turnover Year 2 fill in the blank 1 Year 1 fill in the blank 2 2. Compute the days' sales in receivables for Years 1 and 2. Assume there are 365 days in the year, and round to the nearest day. Number of Days' Salesin Receivables Year 2 fill in the blank 3 days Year 1 fill in the blank 4 days 3. Compute the return on sales for Years 1 and 2. Round to one decimal place. Return on Sales Year 2 fill in the blank 5 % Year 1 fill in the blank 6 % 4. Based on the results in parts 1, 2, and 3, all the following are true except: The change in accounts receivable turnover from Year 1 to…arrow_forwardnaruarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education