Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

calculate the:

-after-tax cost of debt

-the cost of

-the

-the cost of newly issued common stock using the DCF method

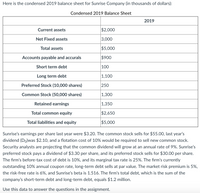

Transcribed Image Text:Here is the condensed 2019 balance sheet for Sunrise Company (in thousands of dollars):

Condensed 2019 Balance Sheet

2019

Current assets

$2,000

Net Fixed assets

3,000

Total assets

$5,000

Accounts payable and accurals

$900

Short term debt

100

Long term debt

|1,100

Preferred Stock (10,000 shares)

250

Common Stock (50,000 shares)

|1,300

Retained earnings

|1,350

Total common equity

$2,650

Total liabilities and equity

$5,000

Sunrise's earnings per share last year were $3.20. The common stock sells for $55.00, last year's

dividend (Do)was $2.10, and a flotation cost of 10% would be required to sell new common stock.

Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Sunrise's

preferred stock pays a dividend of $3.30 per share, and its preferred stock sells for $30.00 per share.

The firm's before-tax cost of debt is 10%, and its marginal tax rate is 25%. The firm's currently

outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%,

the risk-free rate is 6%, and Sunrise's beta is 1.516. The firm's total debt, which is the sum of the

company's short-term debt and long-term debt, equals $1.2 million.

Use this data to answer the questions in the assignment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- NPAT Less prefernce dividend is used in O a. Return on Equity O b. Return on Equity share capital О с. Return on Capital Employed O d. Debt service ratioarrow_forwardWhen using discounted dividend method to estimate stock price, which of the following should be used as the discount rate? - required return of debt - risk free rate - required return of the equity - WACC - Bank deposit ratearrow_forwardExplain how to calculate rate of return on common stockholder’s equity.arrow_forward

- The optimal distribution strategy achieves a balance between capital gains and current dividends in order to raise the stock price of the company. true or falsearrow_forwardDescribe how preferred dividends affect the calculation of EPS.arrow_forwardThe return on equity ratio equals net income divided by common stock. True or Falsearrow_forward

- Match each ratio that follows to its use. Items may be used more than once.arrow_forwardDefine each of the following terms:a. Target payout ratio; optimal dividend policyb. Dividend irrelevance theory; bird-in-the-hand fallacyc. Information content (signaling) hypothesis; clienteles; clientele effectd. Catering theory; residual dividend modele. Low-regular-dividend-plus-extrasf. Declaration date; holder-of-record date; ex-dividend date; payment dateg. Dividend reinvestment plan (DRIP)h. Stock split; stock dividendi. Stock repurchasearrow_forwardReturn on equity (ROE) using the traditional DuPont formula equals to A. (net profit margin) (interest component) (solvency ratio) B. (net profit margin) (interest component) (liquidity ratio) C. (net profit margin) (total asset turnover) (quick ratio) D. (net profit margin) (total asset turnover) (solvency ratio)arrow_forward

- Which is not one of the three sources of return for an investor in a common stock? A-debt repurchase B-dividend C-earnings growth d-valuation changearrow_forwardthe ratio of dividends per share to earnings per share is known as the dividends yield (T/F)arrow_forwardThe income statement of Small Town, Inc. is as shown below: Small Town, Inc. Comparative Income Statement Year Ended December 31, 2025 (In millions) Net Sales Cost of Goods Sold Gross Profit Operating Expenses: O A. 41.89% O B. 60.81% O C. 39.19% O D. 28.38% $ 7,400 2,900 4,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education