FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

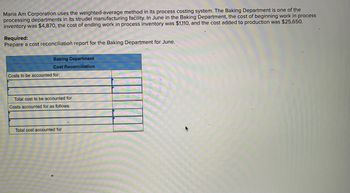

Transcribed Image Text:Maria Am Corporation uses the weighted-average method in its process costing system. The Baking Department is one of the

processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process

inventory was $4,870, the cost of ending work in process inventory was $1,110, and the cost added to production was $25,650.

Required:

Prepare a cost reconciliation report for the Baking Department for June.

Baking Department

Cost Reconciliation

Costs to be accounted for:

Total cost to be accounted for

Costs accounted for as follows:

Total cost accounted for

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): Work in Process—Mixing Department June 1 balance 30,000 Completed and transferred to Finished Goods ? Materials 142,840 Direct labor 91,500 Overhead 109,000 June 30 balance ? The June 1 work in process inventory consisted of 4,800 units with $17,140 in materials cost and $12,860 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 37,300 units were started into production. The June 30 work in process inventory…arrow_forwardPureform, Inc., uses the FIFO method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow Units Materials: Labor Overhead Work in process inventory, beginning Units started in process 81,000 $ 77,300 $ 39,500 $52,600 774,000 Units transferred out 830,000 Work in process inventory, ending 25,000 Cost added during the month $1,788,020 $272,405 $ 311,320 The beginning work in process inventory was 85% complete with respect to materials and 70% complete with respect to labor and overhead. The ending work in process inventory was 65% complete with respect to materials and 20% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month, 2. Compute the first department's cost per equivalent unit for materials, labor, overhead, and in total for the month. (Round your answers to 2 decimal…arrow_forwardMaria Am Corporation uses the weighted-average method in its process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process Inventory was $3,570, the cost of ending work in process Inventory was $2,860, and the cost added to production was $43,120. Required: Prepare a cost reconciliation report for the Baking Department for June. Baking Department Cost Reconciliation Costs to be accounted for: Total cost to be accounted for Costs accounted for as follows: Total cost accounted for $ $ 0 0arrow_forward

- Maria Am Corporation uses the weighted-average method in its process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process inventory was $4,830, the cost of ending work in process inventory was $1,110, and the cost added to production was $25,400. Required: Prepare a cost reconciliation report for the Baking Department for June. Baking Department Cost Reconciliation Costs to be accounted for: Total cost to be accounted for Costs accounted for as follows: Total cost accounted forarrow_forwardMaria Am Corporation uses the weighted-average method in its process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process inventory was $4,850, the cost of ending work in process inventory was $1,140, and the cost added to production was $25,700. Required: Prepare a cost reconciliation report for the Baking Department for June.arrow_forwardClopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): Work in Process-Mixing Department 28,000 120,000 79,500 97,000 June 1 balance Materials Direct labor Overhead June 30 balance Debit The June 1 work in process inventory consisted of 5,000 units with $16,000 in materials cost and $12,000 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 50% complete with respect to conversion. During June, 37,500 units were started into production. The June 30 work in process inventory consisted of 8,000 units that were 100% complete with respect to materials and 40% complete with respect to conversion. Foundational 5-7 (Static) Total cost of…arrow_forward

- [The following information applies to the questions displayed below.] Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): June 1 balance Materials Direct labor Overhead June 30 balance Work in Process-Mixing Department Debit Credit 45,000 140,400 Completed and transferred to Finished Goods 89,500 107,000 ? The June 1 work in process inventory consisted of 6,000 units with $24,250 in materials cost and $20,750 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 38,500 units were started into production. The June 30 work in process inventory consisted of 10,000 units that were…arrow_forwardam.104.arrow_forwardBixby Carpet Manufacturing Inc. uses a process costing system and calculates per-unit costs using the weighted average method. The following data relates to the first production department (the Weaving Department) of its Rayon carpet brand for the month of November. Note that since carpet is sold by the square yard, each “unit” refers to a square yard of carpet: Beginning Work in Process Inventory: 300 units, 40% complete with respect to conversion. Ending Work in Process Inventory: 400 units, 25% complete with respect to conversion. All direct materials are added at the beginning of the process, and conversion costs are assumed to be incurred uniformly throughout production. The cost of direct materials in beginning Work in Process Inventory was $21,200, and conversion costs in beginning Work in Process were $4,900.During the month, $110,800 of direct materials were added to production. Direct labor for the period was $23,120. Overhead is allocated on at 25% of direct…arrow_forward

- 9arrow_forwardam.105.arrow_forwardMcGregor's Hot Sauce uses a process costing system to determine its product's cost. The last of the three processes is packaging. The Packaging Department reported the following information for the month of July: (Click the icon to view the reported information for July.) The units in ending work in process inventory were 90% complete with respect to direct materials but only 60% complete with respect to conversion. Requirement Summarize the flow of physical units and compute output in terms of equivalent units in order to arrive at the missing figures (a) through (1). McGregor's Hot Sauce Packaging Department Month Ended July 31 Flow of Production Units to account for: Beginning work in process, July 1 Plus: Transferred in during July Total physical units to account for Units accounted for: Completed and transferred out during July Plus: Ending work in process, July 31 Total physical units accounted for Total Equivalent Units Step 1: Flow of Physical Step 2: Equivalent Units Units…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education