Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

help me solve this in excel please!!! show all steps/screenshot excel please will give thumbs up ASAP

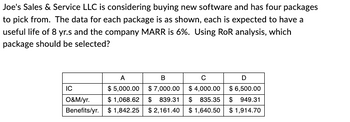

Transcribed Image Text:Joe's Sales & Service LLC is considering buying new software and has four packages

to pick from. The data for each package is as shown, each is expected to have a

useful life of 8 yr.s and the company MARR is 6%. Using RoR analysis, which

package should be selected?

A

B

$5,000.00 $ 7,000.00

$ 839.31

$ 2,161.40

IC

O&M/yr. $1,068.62

Benefits/yr. $1,842.25

C

$4,000.00

$ 835.35

$ 1,640.50

D

$6,500.00

$949.31

$ 1,914.70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please help with parts a,b, and carrow_forwardsanjuarrow_forwardSafari File Edit View History Bookmarks Window Help uLink - Student... W 1. 2. uLink - Student... 3. 4. learn-eu-central-1-prod-fleet01-xythos.content.blackboardcdn.com uLink - Student... 21 445 Entity A enters into the following transactions. You are required to show the impact of the transactions below on the accounting equation. e Content 9 Bb https://learn-eu-... Entity A purchased 1 000 bags of cement from K Ltd on credit. K Ltd normally sells a bag for R45. Entity A received a 10% discount for the 1 000 bags. Entity A returned 150 bags of cement, as they were defective. On the same day, the outstanding balance was settled through an online payment. This transaction did not affect the discount offered to Entity A. Select the correct values from the dropdown menus in the table provided in the Blackboard activity. MAR 7 In an attempt to assist the business, the owner of Entity A deposited R100 000 into the entity's bank account. A quarter of the amount is payable to the owner and…arrow_forward

- Analyze each of the following transactions in terms of their effects on the accounting equation of Osgood Delivery Service. Enter the correct amounts in the columns of the spreadsheetarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help C Netflix MInbox (228 X MACC101 Pr X Accounting X Accounting X M Question 1 X M Question 1 xb Answered: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 9 Homework 13 30.12 points Saved Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 eBook Ask Print References February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight…arrow_forward

- Conne X + meducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fmybsc.bryantstratton.edu%252Fwe - Connect Assignment 1 i Saved F Required information [The following information applies to the questions displayed below.] Following are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner, invested $14,500 cash and $62,350 of photography equipment in the company. August 2 The company paid $4,000 cash for an insurance policy covering the next 24 months. August 5 The company purchased supplies for $2,755 cash. August 20 The company received $2,950 cash from taking photos for customers. August 31 The company paid $885 cash for August utilities. Open a ledger account for Cash in balance column format. Post general journal entries that impact cash from above transaction ledger account for cash. ces 101: Cash Date Debit Credit Balance of 10 www www Next > ( Rain off and on re to search ins O 4 R 15 % 5 T 40 6 O Y 17 < Prev…arrow_forwardezto.mheducation.com/ext/map/index.html?_con=con&external_browser3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/KEZASSBKEP. Other book G Gmail YouTube O Maps SMƏN E9 O Translate Saved Help Save & Exit Submit Chapter 9 Assessment i Venus Company applies overhead based on direct labor hours. The variable overhead standard is 10 hours at $3.50 per hour. During October, Venus Company 14 spent $157,600 for variable overhead. 47,440 labor hours were used to produce 4,800 units. What is the over- or underapplied variable overhead? Skipped Multiple Choice $10,400 overapplied $8,440 overapplied $8,440 underapplied O $1,960 overappliedarrow_forwardSHORT ANSWER Briefly describe a business transaction that would cause Assets to Increase and Liabilities to Increase. Type your answer below. You do not need to write your response on your PDF upload. The more in depth the response, the more points will be awarded. (note, there are multiple acceptable responses) Edit View Insert Format Tools Table 12pt v Paragraph A O words G Search or type URL % & # %24arrow_forward

- Image 1 is the information Do #2 on image 2 plzarrow_forwardoogle Chrome File Edit View History Bookmarks Tab Profiles Window Help MInbox (240)-abigailoforiwaa X Gmail x iConnect-Home M Question 8-Mid-Term Exam + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exami Saved Help 8 Skipped Ask Refer to Apple's financial statements in Appendix A for the following questions. Required: 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 28, 2019, and (b) September 29, 2018? 2. What amount of total assets does it report for each of the fiscal years ended (a) September 28, 2019, and (b) September 29, 2018? 3. Compute its debt ratio for each of the fiscal years ended (a) September 28, 2019, and (b) September 29, 2018. 4. In which fiscal year did it employ more financial leverage: September 28, 2019, or September 29, 2018? Complete this question by entering your answers in the tabs below. Mc Graw Hill Required 1 Required 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education