Concept explainers

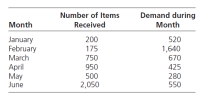

Penalty costs can be assessed only against the number of units of demand that cannot be satisfied, or against the number of units weighted by the amount of time that an order stays on the books. Consider the following history of supply and demand transactions for a particular part: (given)

Assume that starting inventory at the beginning of January is 480 units.

a. Determine the ending inventory each month. Assume that excess demands are back-ordered.

b. Assume that each time a unit is demanded that cannot be supplied immediately, a one-time charge of $10 is made. Determine the stock-out cost incurred during the six months (1) if excess demand at the end of each month is lost, and (2) if excess demand at the end of each month is back-ordered.

c. Suppose that each stock-out costs $10 per unit per month that the demand remains unfilled. If demands are filled on a first-come, first-served basis, what is the total stock-out cost incurred during the six months using this type of cost criterion? (Assume that the demand occurs at the beginning of the month for purposes of your calculation.) Notice that you must assume that excess demands are back-ordered for this case to make any sense.

d. Discuss under what circumstances the cost criterion used in part (b) might be appropriate and under what circumstances the cost criterion used in part (c) might be appropriate.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

- Walsh Company manufactured 30,000 units during July. There were no units in inventory on July 1. Costs and expenses for July were as follows: Total Num Total Cost Number of Units Unit Cost Manufacturing costs: Variable $660,000 30,000 $22.00 Fixed 300,000 30,000 10.00 Total 960,000 Selling and administrative expenses: Variable $200,000 Fixed 160,000 Total. $360,000 If the company sells 25,000 units at $75 (units manufactured exceed units sold), prepare an income statement for July using: b. Variable costingarrow_forwardMarlin Company has the following projected costs for manufacturing and selling and administrative expenses: (Click the icon to view the projected costs.) Prepare a schedule of cash payments for Marlin for January, February, and March. Determine the balances in Prepaid Property Taxes, Accounts Payable, and Utilities Payable as of March 31. (Assume the company started operations in January. If an input field is not used in the table leave the input field empty; do not enter a zero.) Cash Payments Direct Materials: Accounts Payable balance, January 1 January-Direct material purchases paid in February February-Direct material purchases paid in March Total payments for direct materials Direct Labor: Total payments for direct labor January February March Total Data table Direct materials purchases Direct labor costs Depreciation on plant Utilities for plant Property taxes on plant Depreciation on office Utilities for office Property taxes on office Office salaries Print January February…arrow_forwardGurtner Corporation has provided the following data concerning last month’s operations. Cost of goods manufactured $170,000 Underapplied overhead $ 4,000 Beginning Ending Finished goods inventory $33,000 $40,000 Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold? Multiple Choice A. $170,000 B. $167,000 C. $203,000 D. $163,000arrow_forward

- Variable Costing Income Statement On April 30, the end of the first month of operations, Jopl Company prepared the following income statement, based on the absorption costing concept: Joplin Company Absorption Costing Income Statement For the Month Ended April 30 Sales (4,600 units) Cost of goods sold: Cost of goods manufactured (5,200 units) Inventory, April 30 (700 units) Total cost of goods sold Gross profit Selling and administrative expenses Operating income Joplin Company Variable Costing Income Statement For the Month Ended April 30 Variable cost of goods sold: If the fixed manufacturing costs were $29,484 and the fixed selling and administrative expenses were $12,590, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. 1:110 $109,200 (14,700) Fixed costs: $138,000 (94,500) $43,500 (25,700) $17,800arrow_forwardPlease do not give image formatarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Please do not give solution in image format thankuarrow_forwardMorning Company reports the following information for March: E (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate the gross profit and operating income for March using absorption costing. Morning Company Income Statement (Absorption Costing) For the Month Ended March 31 Data Table Net Sales Revenue 67,850 Variable Cost of Goods Solłd 19,300 Operating income Fixed Cost of Goods Sold 8,400 Variable Selfing and Administrative Costs 16,500 Requirements Fixed Selling and Administrative Costs 3,800 1. Calculate the gross profit and operating income for March using absorption costing. 2. Calculate the contribution margin and operating income for March using variable costing. Print Donearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education