FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

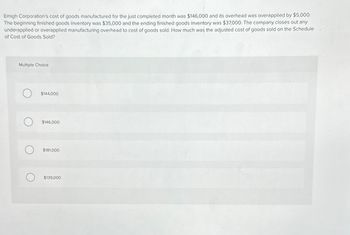

Transcribed Image Text:Emigh Corporation's cost of goods manufactured for the just completed month was $146,000 and its overhead was overapplied by $5,000.

The beginning finished goods inventory was $35,000 and the ending finished goods inventory was $37,000. The company closes out any

underapplied or overapplied manufacturing overhead to cost of goods sold. How much was the adjusted cost of goods sold on the Schedule

of Cost of Goods Sold?

Multiple Choice

$144,000

$146,000

$181,000

$139,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 7. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis? 8. What is Sweeten Company’s cost of goods sold for the year? 9. What are the company’s predetermined overhead rates in the Molding Department and the Fabrication Department?arrow_forwardThe following data is for a company that produces a single product. Selling price 193 Units in beginning inventory Units produced 3,090 2,910 Units sold Variable costs per unit: Direct materials 53 Direct labor 59 2$ Variable manufacturing overhead Variable selling and administrative expense 15 13 Fixed costs: Fixed manufacturing overhead Fixed selling and administrative $ 89,610 $ 8,730 Required: a. What is the unit product cost for the month under variable costing? b. What is the unit product cost for the month under absorption costing? c. Prepare a contribution format income statement for the month using variable costing. d. Prepare an income statement for the month using absorption costing. e. Reconcile the variable costing and absorption costing net operating incomes for the month. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E What is the unit product cost for the month under variable costing? Cost Per…arrow_forwardOber Corporation, which has only one product, has provided the following data concerning its most recent month of operations: Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense Required: $ 127 0 8,970 8,540 430 $ 37 $ 36.50 $ 5.50 $ 12.50 $ 183,885 $ 109,900 a. Prepare a contribution format income statement for the month using variable costing. b. Prepare an income statement for the month using absorption costing.arrow_forward

- The following data is for a company that produces a single product. selling price 24 193 Units in beginning inventory Units produced Units sold 3,090 2,910 Variable costs per unit: Direct materials 24 24 24 24 53 Direct labor 59 variable manufacturing overhead variable selling and administrative expense Fixed costs: 15 13 Fixed manufacturing overhead Fixed selling and administrative $ 89,610 $ 8,730 Required: a. What is the unit product cost for the month under varlable costing? b. What Is the unit product cost for the month under absorption costing? C. Prepare a contribution format Income statement for the month using varlable costing. d. Prepare an Income statement for the month using absorption costing. e. Reconcile the varlable costing and absorption costing net operating incomes for the month. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Prepare a contribution format income statement for the month using…arrow_forwardPlease provide correct solution for correct answerarrow_forwardD1.arrow_forward

- The following information is available for Barnes Company for the fiscal year ended December 31: Beginning finished goods inventory in units Units produced Units sold Sales 0 8,600 5,900 $ 767,000 $ 172,000 $ 86,000 Materials cost Variable conversion cost used Fixed manufacturing cost Indirect operating costs (fixed) $ 946,000 $ 118,000 The difference between the variable costing ending inventory and the absorption costing ending inventory is: Multiple Choice O 2,700 units times $115 per unit variable conversion cost plus $110 per unit fixed manufacturing cost 4 2,700 units times $115 per unit variable conversion cost plus $110 per unit fixed manufacturing cost plus $111.67 per unit indirect operating c 2,700 units times $105 per unit materials costarrow_forwardPlease help me fix this! Thanks!arrow_forwardAaron Corporation, which has only one product, has provided the following data concerning its most recent month of operations Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead $ 147 0 6,900 6,600 300 Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense What is the unit product cost for the month under variable costing? $ 24 $ 54 $ 18 $ 18 $ 186,300 $ 27,600 Multiple Choice $114 per unit $141 per unit $123 per unitarrow_forward

- Domesticarrow_forwardThe beginning inventory is 16,100 units. All of the units that were manufactured during the period and 16,100 units of the beginning inventory were sold. The beginning inventory fixed manufacturing costs are $41 per unit, and variable manufacturing costs are $96 per unit. a. Determine whether variable costing operating income is less than or greater than absorption costing operating income. b. Determine the difference in variable costing and absorption costing operating income.arrow_forwardGurtner Corporation has provided the following data concerning last month’s operations. Cost of goods manufactured $170,000 Underapplied overhead $ 4,000 Beginning Ending Finished goods inventory $33,000 $40,000 Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold. How much is the adjusted cost of goods sold on the Schedule of Cost of Goods Sold? Multiple Choice A. $170,000 B. $167,000 C. $203,000 D. $163,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education