Concept explainers

As of December 31 (the end of the prior quarter), the company’s general ledger showed the following account balances:

| Debits | Credits | |

|---|---|---|

| Cash | $ 44,000 | |

| 203,200 | ||

| Inventory | 58,350 | |

| Buildings and equipment (net) | 354,000 | |

| Accounts payable | $ 86,325 | |

| Common stock | 500,000 | |

| 73,225 | ||

| $ 659,550 | $ 659,550 |

Actual sales for December and budgeted sales for the next four months are as follows:

| December(actual) | $ 254,000 |

|---|---|

| January | $ 389,000 |

| February | $ 586,000 |

| March | $ 300,000 |

| April | $ 197,000 |

-

Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales.

-

The company’s gross margin is 40% of sales. (In other words, cost of goods sold is 60% of sales.)

-

Monthly expenses are budgeted as follows: salaries and wages, $19,000 per month: advertising, $59,000 per month; shipping, 5% of sales; other expenses, 3% of sales.

Depreciation , including depreciation on new assets acquired during the quarter, will be $42,740 for the quarter. -

Each month’s ending inventory should equal 25% of the following month’s cost of goods sold.

-

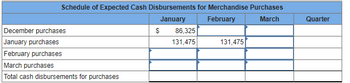

One-half of a month’s inventory purchases is paid for in the month of purchase; the other half is paid in the following month.

-

During February, the company will purchase a new copy machine for $1,400 cash. During March, other equipment will be purchased for cash at a cost of $72,000.

-

During January, the company will declare and pay $45,000 in cash dividends.

-

Management wants to maintain a minimum cash balance of $30,000. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Using the data above, complete the following statements and schedules for the first quarter:

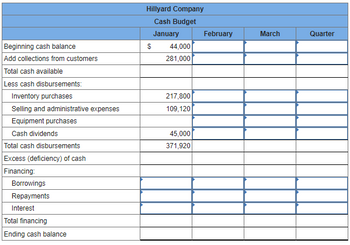

2-b. Schedule of expected cash disbursements for merchandise purchases:

3.

Step by stepSolved in 6 steps with 5 images

Using the data above, complete the following statements and schedules for the first quarter:

4. Prepare an absorption costing income statement for the quarter ending March 31.

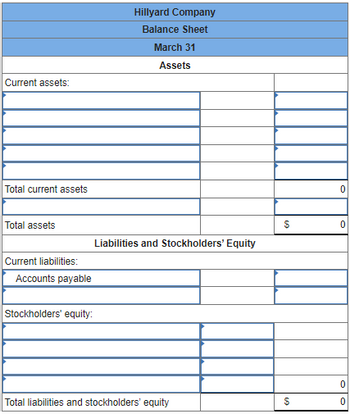

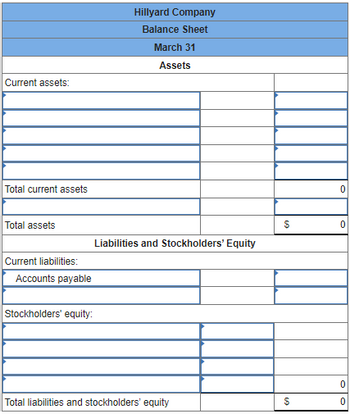

5. Prepare a

Answer choices for Income Statment

[rows 1, 9-15, 17]: (Accounts payable,

[Rows 3-6]: (Beginning inventory, Ending inventory, Goods available for sale, Purchases)

Row 7: (Gross Loss, Gross margin)

Row 16: (Net operating income, Net operating loss)

Row 18: (Net income, Net loss)

Answer Choices for Balance sheet (all rows)

(Accounts payable, Accounts receivable, Buildings and equipment net, Cash, Common stock, Cost of goods sold, Interest expense, Inventory, Note payable, Prepaid insurance, Retained earnings)

Using the data above, complete the following statements and schedules for the first quarter:

4. Prepare an absorption costing income statement for the quarter ending March 31.

5. Prepare a

Answer choices for Income Statment

[rows 1, 9-15, 17]: (Accounts payable,

[Rows 3-6]: (Beginning inventory, Ending inventory, Goods available for sale, Purchases)

Row 7: (Gross Loss, Gross margin)

Row 16: (Net operating income, Net operating loss)

Row 18: (Net income, Net loss)

Answer Choices for Balance sheet (all rows)

(Accounts payable, Accounts receivable, Buildings and equipment net, Cash, Common stock, Cost of goods sold, Interest expense, Inventory, Note payable, Prepaid insurance, Retained earnings)

- [The following information applies to the questions displayed below.] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company’s balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash $ 76,000 Accounts receivable 137,000 Inventory 86,100 Plant and equipment, net of depreciation 230,000 Total assets $ 529,100 Liabilities and Stockholders’ Equity Accounts payable $91,000 Common stock 312,000 Retained earnings 126,100 Total liabilities and stockholders’ equity $ 529,100 Beech’s managers have made the following additional assumptions and estimates: Estimated sales for July, August, September, and October will be $410,000, $430,000, $420,000, and $440,000, respectively. All sales are on credit and all credit sales are collected. Each month’s credit sales are collected 35% in the month of sale and 65% in the month…arrow_forwardAssume that a merchandising company provided the following beginning and ending budgeted balance sheets for a forthcoming month: Beginning Balances Ending Balances Cash $30,000 $38,000 Accounts Receivable $13,000 $16,000 Inventory $20,000 $18,000 Buildings and equipment $100,000 $100,000 Accumulated depreciation (25,000) (30,000) Total Assets From above: 138,000 $142,000 Accounts payable $4,000 $5,000 Common stock $60,000 $60,000 Retained earnings $74,000 $ 77,000 Total liabilities and stockholders' equity $138,000 $142,000 Assume that all of the company's sales are on account and it has no uncollectible accounts. If the cash collected from customers during the period is $120,000, then how much sales must be shown on the company's budgeted income statement?arrow_forwardBeech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company’s balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 ASSETS LIABILITIES & OWNERS' EQUITY Cash $90,000 Accounts payable $71,100 Accounts receivable 136,000 Accrued expenses 0 Inventory 62,000 Common stock 327,000 Plant and equipment, net of depreciation 210,000 Retained earnings 99,900 Total assets $498,000 Total liabilities and stockholders’ equity $498,000 Beech’s managers have made the following additional assumptions and estimates: Estimated sales for July, August, September, and October will be $210,000, $230,000, $220,000, and $240,000, respectively. All sales are on credit and all credit sales are collected. Each month’s credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts…arrow_forward

- Summit Company has budgeted purchases of merchandise inventory of $457,500 in January and $533,750 in February. Assume Summit pays for inventory purchases 40% in the month of the purchase and 60% in the month after purchase. The Accounts Payable balance on December 31 is $97,350. Prepare a schedule of cash payments for purchases for January and February. Cash Payments January February Total merchandise inventory purchases Cash Payments Merchandise Inventory: Dec.—Dec. 31 Accounts Payable, paid in Jan. Jan.—Jan. merchandise inventory purchases paid in Jan. Jan.—Jan. merchandise inventory purchases paid in Feb. Feb.—Feb. merchandise inventory purchases paid in Feb. Total payments for merchandise inventoryarrow_forwardHoover Corp., a wholesaler of music equipment, issued $11,200,000 of 20-year, 9% callable bonds on March 1, 20Y2, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions. Refer to the Chart of Accounts for exact wording of account titles. 20Y2 Mar. 1 Issued the bonds for cash at their face amount. Sept. 1 Paid the interest on the bonds. 20Y4 Sept. 1 Called the bond issue at 102, the rate provided in the bond indenture. (Omit entry for payment of interest.)arrow_forwardWarshaw Company budgets payroll at $3,500 per month plus a percentage of monthly sales. The June operating expenses budget includes total payroll of $12,000 with budgeted sales of $170,000. Sales for July are budgeted at $130,000 while purchases of inventory for July are budgeted at $970,000. Depreciation and insurance for July are estimated at $1,300 and $800, respectively. Office and administrative expenses related to purchasing inventory are budgeted at 55% of purchases for the month. The purchase of $2,200in equipment and $2,000 furniture is expected in July. If the percentage of monthly sales used in budgeting payroll increases 30%, what would the total payroll budgeted for July be?arrow_forward

- [The following information applies to the questions displayed below.] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company’s balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash $ 76,000 Accounts receivable 137,000 Inventory 86,100 Plant and equipment, net of depreciation 230,000 Total assets $ 529,100 Liabilities and Stockholders’ Equity Accounts payable $91,000 Common stock 312,000 Retained earnings 126,100 Total liabilities and stockholders’ equity $ 529,100 Beech’s managers have made the following additional assumptions and estimates: Estimated sales for July, August, September, and October will be $410,000, $430,000, $420,000, and $440,000, respectively. All sales are on credit and all credit sales are collected. Each month’s credit sales are collected 35% in the month of sale and 65% in the month…arrow_forwardHillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter: As of December 31 (the end of the prior quarter), the company’s general ledger showed the following account balances: Cash $ 64,000 Accounts receivable 219,200 Inventory 61,350 Buildings and equipment (net) 374,000 Accounts payable $ 92,325 Common stock 500,000 Retained earnings 126,225 $ 718,550 $ 718,550 Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 274,000 January $ 409,000 February $ 606,000 March $ 321,000 April $ 217,000 Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales. The company’s gross margin is…arrow_forwardOn March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company's sales are made on account. The following information has been provided by Spicer's management. Month Credit Sales January $ 300,000 (actual) February 400,000 (actual) March 629,000 (estimated) April 571,000 (estimated) May 800,000 (estimated) The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale 50 % Collections one month after the sale 30 Collections two months after the sale 15 Uncollectible accounts 5 Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400, 000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash balance at the ends of March, April, and May.arrow_forward

- Prepare the following budgets for the months of April, May, and June: 1. Sales budget. 2. Production budget.3. Direct materials budget. The management of Zigby Manufacturing prepared the following balance sheet for March 31. ZIGBY MANUFACTURING Balance Sheet March 31 Assets Liabilities and Equity Cash $ 65,000 Liabilities Accounts receivable 399,000 Accounts payable $ 204,500 Raw materials inventory 90,200 Loan payable 27,000 Finished goods inventory 308,028 Long-term note payable 500,000 $ 731,500 Equipment $ 630,000 Equity Less: Accumulated depreciation 165,000 465,000 Common stock 350,000 Retained earnings 245,728 595,728 Total assets $ 1,327,228 Total liabilities and equity $ 1,327,228 To prepare a master budget for April, May, and June, management gathers the following information. Sales for March total 22,800 units. Budgeted sales in units follow: April, 22,800; May, 16,000; June, 23,000; and July, 22,800.…arrow_forwardSchedule of Cash Collections of Accounts Receivable Pet Supplies Inc., a pet wholesale supplier, was organized on January 1. Projected sales for each of the first three months of operations are as follows: January $300,000 February 500,000 March 750,000 All sales are on account. Seventy-five percent of sales are expected to be collected in the month of the sale, 20% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for January, February, and March. Enter all amounts as positive numbers. Pet Supplies Inc. Schedule of Cash Collections from Sales For the Three Months Ending March 31 January February March January sales on account: Collected in January $fill in the blank 1 Collected in February $fill in the blank 2 Collected in March $fill in the blank 3 February sales on account: Collected in February fill in the blank 4…arrow_forwardWoodpecker Co. has $300,000 in accounts receivable on January 1. Budgeted sales for January are $964,000. Woodpecker Co. expects to sell 20% of its merchandise for cash. Of the remaining 80% of sales on account, 75% are expected to be collected in the month of sale and the remainder the following month. The January cash collections from sales are a.$642,720 b.$1,071,200 c.$1,371,200 d.$856,960arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education