FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

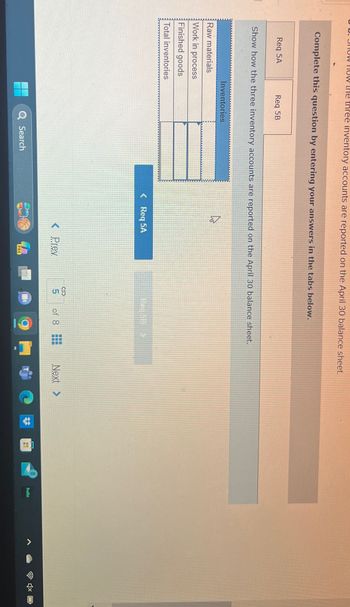

Transcribed Image Text:now how the three inventory accounts are reported on the April 30 balance sheet.

Complete this question by entering your answers in the tabs below.

Req 5A

Req 5B

Show how the three inventory accounts are reported on the April 30 balance sheet.

Raw materials

Work in process

Finished goods

Inventories

Total inventories

N

<Req 5A

<Prev

Q Search

PRE

35

of 8

Next >

8

hulu

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Requirement 1. Calculate direct materials inventory on August 31, 2022. Determine the formula and then calculate the direct materials inventory value at August 31, 2022. (Work in millions. Use a minus sign or parentheses for numbers to be subtracted.) Direct materials available for production Direct materials inventory, August 31, 2022 Requirement 2. Calculate fixed manufacturing overhead costs for August. (Work in millions. Use a minus sign or parentheses for numbers to be subtracted.) Fixed manufacturing overhead costsarrow_forwardok ences QS 14-12 (Algo) Preparing a balance sheet LO P1 Prepare the current assets section of the balance sheet at December 31 for Bin Manufacturing using the following information. Hint Not all information given is needed for the solution. Cash Accounts payable Raw materials inventory General and administrative expenses Accounts receivable, net Selling expenses Finished goods inventory Work in process inventory Prepaid insurance Cost of goods sold BIN MANUFACTURING Current Assets Section of the Balance Sheet December 31 Total current assets $ 22,100 2,100 8,100 42, 100 12, 100 12, 100 22, 100 18, 100 4,100 33, 100arrow_forwardGive typing answer with explanation and conclusion nvex Mechanical Supplies produces a product with the following costs as of July 1, 20X1: Material $6 Labor 4 Overhead 3 $13 Beginning inventory at these costs on July 1 was 6,100 units. From July 1 to December 1, Convex produced 17,000 units. These units had a material cost of $10 per unit. The costs for labor and overhead were the same. Convex uses FIFO inventory accounting. a. Assuming that Convex sold 19,000 units during the last six months of the year at $20 each, what would gross profit be? b. What is the value of ending inventory?arrow_forward

- Please do not give solution in image format thankuarrow_forwardCash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Cost of goods sold Factory overhead General and administrative expenses Totals Debit $ 68,000 37,000 23,500 0 9,000 3,000 Credit These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials requisition 12: Labor time ticket 52: Labor time ticket 53: Labor time ticket 54: BERGO BAY COMPANY List of Account Balances December 31 $ 10,800 13,800 30,000 93,000 175,900 113,000 25,000 45,000 $ 323,500 $ 323,500 $ 4,700 direct materials to Job 402 $ 7,300 direct materials to Job 404 Debit $ 1,500 indirect materials $ 6,000 direct labor to Job 402 $ 14,000 direct labor to Job 404 $5,000 indirect labor Jobs 402 and 404 are the only jobs in process at year-end. The predetermined overhead rate is 150% of direct labor cost. 3.…arrow_forwardPAS. LO 4.5 Complete the information in the cost computations shown here: Raw Materials Work in Pracess nventory $ 342 S 92 Beginning imventory Purchases Materials avalable for use Ending inentory Beginning inventory Materials used in production Drect labor 1,533 1,535 Overhead applied Manufacturing costs incurred Ending inventory 321 22441 Materials used in production Cost of Geods Marufactured Finished Goods Inventory Beginning inventory Coot of Goeds Mandactured Goods Available for Sale Ending inventory Cost of Goods Sold $25,002 21.788 ANSWER Raw Materials Beginning inventory Purchases Material available for use Ending inventey Materials used in production Work in Process Iaventory Beginning inventory Materials used in production Direct labor Overhead applied Manufacturing costs incurred Ending inventory Cast of goods manufactured Finished Goods Iaventory Beginning inventory Cast of goods manufactured Goods available for sale Ending inventory Cost of goods soldarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education