Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

5

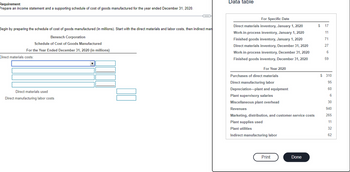

Transcribed Image Text:Requirement

Prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended December 31, 2020.

Begin by preparing the schedule of cost of goods manufactured (in millions). Start with the direct materials and labor costs, then indirect man

Benesch Corporation

Schedule of Cost of Goods Manufactured

For the Year Ended December 31, 2020 (in millions)

Direct materials costs:

C

Direct materials used

Direct manufacturing labor costs

Data table

For Specific Date

Direct materials inventory, January 1, 2020

Work-in-process inventory, January 1, 2020

Finished goods inventory, January 1, 2020

Direct materials inventory, December 31, 2020

Work-in-process inventory, December 31, 2020

Finished goods inventory, December 31, 2020

For Year 2020

Purchases of direct materials

Direct manufacturing labor

Depreciation-plant and equipment

Plant supervisory salaries

Miscellaneous plant overhead

Revenues

Marketing, distribution, and customer-service costs

Plant supplies used

Plant utilities

Indirect manufacturing labor

Print

Done

$ 17

11

71

27

6

59

$ 310

95

60

6

30

940

265

11

32

62

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of cost of goods manufactured and income statement for a manufacturing company The following information is available for Robstown Corporation for 20Y8: Instructions 1. Prepare the 20Y8 statement of cost of goods manufactured. 2. Prepare the 20Y8 income statement.arrow_forwardStatement of cost of goods manufactured and income statement for a manufacturing company The following information is available for Shanika Company for 20Y6: Instructions 1. Prepare the 20Y6 statement of cost of goods manufactured. 2. Prepare the 20Y6 income statement.arrow_forwardUsing the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forward

- Required: 1) Calculate the raw material used by Pro-Leather Company. 2) Calculate the indirect materials used by Pro-Leather Company 3) What is the total manufacturing overhead cost incurred by Pro-Leather Company during the period? 4) Determine the prime cost & conversion cost of the cases manufactured. 5) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2020, clearly showing total manufacturing cost & total manufacturing costs to account for. 6) Prepare an income statement for Pro-Leather Company for the year ended December 31, 2020. List the non-manufacturing overheads in order of size starting with the largest. 7) What is the factory cost per case if Pro-Leather manufactured 19,200 cases for tablets for the year? 8) How does the format of the income statement for a manufacturing concern differ from the income statement of a merchandising entity? thank you very mucharrow_forwardTrying to figure out how to calculate manufacturer compute cost of goods manufactured and cost of goodssoldarrow_forwardinfo in imagesarrow_forward

- Leather Authentic Company is a manufacturer of leather cases for tablets. The following information pertains to operations during the 2023 calendar year. Sales Revenue Direct Factory Labor Indirect Factory Labor $14,275,000 3,877,400 1,232,250 Total Depreciation ¹ 400,000 Total Utilities 2 525.000 Distribution & Customer Service Costs 76,800 Hireage of Special Labeling Equipment Insurance on Plant & Equipment Property Taxes 3 Administrative Wages & Salaries Advertising Expenses Sales Commission 6% of Sales Revenue 1 Of the total depreciation, 80% relates to factory plant & equipment and 20% relates to general and administrative costs. ² Of the total utilities, 75% relates to production and 25% relates to general and administrative costs. 3 The property taxes should be shared: 85% production & 15% general & administrative costs The following additional information is also available: 75,200 585,000 90,000 1,076,000 57,700 Inventory Data: 1/1/2023 Purchases 31/12/2023 Raw Materials…arrow_forwardConsider the following data Required: Calculate the cost of goods manufacturedarrow_forwardConcepts and Terminology From the choices presented in parentheses, choose the appropriate term for completing each of the following sentences: Appr Sentence comp a. An example of factory overhead is (electricity used to run assembly line, CEO salary). b. Direct materials costs combined with direct labor costs are called (prime, conversion) costs. c. Long-term plans are called (strategic, operational) plans. d. Materials for use in production are called (supplies, materials inventory). e. The phase of the management process that uses process information to eliminate the source of problems in a process so that the process delivers the correct product in the correct quantities is called (directing, improving). f. The plant manager's salary would be considered (direct, indirect) to the product. g. The salaries of salespeople are normally considered a (period, product) cost. Previous Nextarrow_forward

- Under a standard cost system, when recording the use of direct materials in the production process, the debit to Work-in-Process Inventory is A. actual quantity times actual cost per unit of direct materials B. actual quantity times standard cost per unit of direct materials C. standard quantity for actual production times actual cost per unit of direct materials D. standard quantity for actual production times standard cost per unit of direct materialsarrow_forwardClassic manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. The following items (in millions) pertain to Classic Corporation. Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured. Begin by preparing the supporting schedule of cost of goods manufactured (in millions). Start with the direct materials and direct labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured. For Specific Date Work-in-process inventory, January 1, 2020 $12 Direct materials inventory, December 31, 2020 8 Finished-goods inventory, December 31, 2020 11 Accounts payable, December 31, 2020 20 Accounts receivable, January 1, 2020 59 Work-in-process inventory, December 31, 2020 1 Finished-goods inventory, January 1, 2020 46 Accounts receivable, December 31,…arrow_forwardUmbria, Inc. has compiled the following data: View the data. Compute the amount of direct materials used. I = Direct Materials Used Data Purchases of Direct Materials Freight In Property Taxes Ending Direct Materials Beginning Direct Materials Print Done O $ 6,600 800 1,400 1,600 4,400 Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,