FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

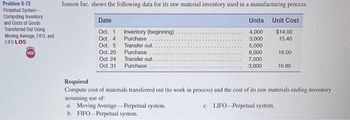

Transcribed Image Text:Problem 9-72

Perpetual System-

Computing Inventory

and Costs of Goods

Transferred Out Using

Moving Average, FIFO, and

LIFO LOS

MBC

Jonson Inc. shows the following data for its raw material inventory used in a manufacturing process.

Date

Oct. 1

Oct. 4

Oct. 5

Oct. 20

Oct. 24

Oct. 31

Inventory (beginning)

Purchase

Transfer out.

Purchase

Transfer out.

Purchase

Units

4,000

3,000

5,000

8,000

7,000

3,000

a. Moving Average-Perpetual system.

b. FIFO Perpetual system.

Unit Cost

$14.00

15.40

16.00

16.80

Required

Compute cost of materials transferred out (to work in process) and the cost of its raw materials ending inventory

assuming use of:

c. LIFO Perpetual system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- nkt.1arrow_forwardCost of materials issuances under the FIF0 method Instructions Chart of Accounts Materials Inventory Journal Final Question Instructions X. An incomplete subsidiary ledger of materials inventory for May is as follows: RECEIVED ISSUED BALANCE Receiving Materials Report Unit Requisition Unit Number Quantity Price Number Quantity Amount Date Quantity Price Amount May 1 284 $30.00 $8,520 139 $32.90 May 4 91 373 May 10 44 117 38.80 May 21 97 100 May 27 Required: A. Complete the materials issuances and balances for the materials subsidiary ledger under FIFO. Round your unit price answers to two decimal places and final answers to the nearest dollar. B. Determine the materials inventory balance at the end of May. Round your answer to the nearest dollar. C. Journalize the summary entry on May 31 to transfer materials to work in process. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to the nearest dollar. D. Explain how the materials ledger might be used…arrow_forwardComplete the missing figures: Q15 Purchases of raw materials during that year Q16 Raw materials use in production during the year Q17 Cost of units completed during the year Q 18 Finished goods inventory Q19 Cost of units sold during the yeararrow_forward

- Jasper & Williams made purchases of a particular product In the current year as follows: 1 Beginning inventory 7 Purchased Jan. 120 units e $2.10 @$2.20 @ $2.30 252 Mar. 250 units 55e July 28 Purchased 500 units 1,150 Oct. Purchased 69 units e$2.45 147 Totals 930 units $ 2,099 Assume that the specific Identification method is used to assign costs to cost of goods sold ending inventory. The units in ending Inventory were specifically identified as follows. • 80 units from beginning Inventory • 27 units from the March 7 purchase, and • 48 units from the July 28 purchase. Required: Determine the cost to be assigned to ending Inventory and cost of goods sold. (Round the final answers to 2 decimal places.) Ending inventory Cost of goods soldarrow_forwardAlpesharrow_forwardPlease complete the Income statement Calculation of Direct Materials Used (Analyze Raw Materials Account) Beginning Raw Materials Inventory 2,373.75 Plus: Purchases of Direct Materials, Freight-in, Duties 26111.25 Materials Available for Use 28485 Less: Ending Raw Materials Inventory 18,041.32 <<<To balance sheet Direct Materials Used 10443.68 Calculation of Cost of Goods Manufactured (Analyze WIP Inventory) Beginning WIP Inventory 0 Plus Manufacturing Costs Incurred: 355,428.68 Direct Materials Used 10443.68 Direct Labor 135,000.00 Manufacturing Overhead 191,943.68 Total Manufacturing Costs to Account For 337,387.36 Less: Ending WIP Inventory 18,041.32 <<<To balance sheet Cost of Goods Manufactured 319346.04 Calculation of Cost of Goods Sold (Analyze Finished Goods Inventory)…arrow_forward

- The following information has been taken from the perpetual inventory system of Elite Mfg Co. for the month ended August 31: Purchases of direct materials Direct materials used Direct labor costs assigned to production $60,000 $50,000 $25,000 Manufacturing overhead costs incurred (and applied) $35,000 發 Balances in inventory August 31 August 1 Materiais Work in Process Finished Goods $65,000547,000 $60.000 *Sue00 M The total amount of inventory to be included in Elite's August 31st balance sheet amounts to A. $135,000 B. $210,000 C. $160,000 D. Some other amount 1 1109arrow_forwardGive typing answer with explanation and conclusion nvex Mechanical Supplies produces a product with the following costs as of July 1, 20X1: Material $6 Labor 4 Overhead 3 $13 Beginning inventory at these costs on July 1 was 6,100 units. From July 1 to December 1, Convex produced 17,000 units. These units had a material cost of $10 per unit. The costs for labor and overhead were the same. Convex uses FIFO inventory accounting. a. Assuming that Convex sold 19,000 units during the last six months of the year at $20 each, what would gross profit be? b. What is the value of ending inventory?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education