FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

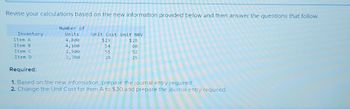

Transcribed Image Text:Revise your calculations based on the new information provided below and then answer the questions that follow.

Number of

Units

4,800

4,100

2,500

2,700

Inventory

Item A

Item B

Item C

Item D

Unit Cost Unit NRV

$29

$28

54

60

55

28

52

25

Required:

1. Based on the new information, prepare the journal entry required:

2. Change the Unit Cost for Item A to $30 and prepare the journal entry required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Do not give image formatarrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning. Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses. Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,700 18,800 8,900 27,500 21,600 20,150 23,800 7,600 11,400 24,500 14,200 7,700 43,500 53,200 294,720 30,000 15,200 Pepper Company $ 19,750 22,350 14,700 23,500 44,200 14,100 18,400 9,600 16,250 52,000 13,120 3,700 58,000 54,700 391,1801 24,200 20,700 1. Compute the total prime costs for both Garcon Company and Pepper Company. 2. Compute the total conversion…arrow_forwardWhat is the beginning inventory? You left it blank. Direct Materials Conversion costs Beginning Inventory ? ? ? Add: Current costs 3798000 2160000 1638000 ($594000+$1044000) Total costs to account for (A) 3798000 2160000 1638000arrow_forward

- Final Exam Units Unit You sell 100 units in $2.00 June. Calculate the cost of goods sold using last-in, first-out. Received Cost June 4 70 June 11 30 $3.00 June 18 60 $2.10 June 25 40 $2.40 A. $2.22 B. $2.10 C. $2.30 D. $2.26 21 Acellus Corporation. All Rights Reserved.arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease provide answer in text (Without image)arrow_forward

- Help pleasearrow_forwardFill in the missing amounts in each of the eight case situations below. Each case is independent of the others. Required: a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being sold in each of the four following case situations: Complete this question by entering your answers in the tabs below. Required A Required B Assume that only one product is being sold in each of the four following case situations: (Loss amounts should be indicat a minus sign.) Units sold Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Contribution margin per unit Required A Required B Sales Variable expenses Contribution margin $ Fixed expenses Net operating income (loss) Contribution margin ratio (percent) $ $ Case 1 8,000 216,000 $ 160,000 56,000 92,000 (36,000) $ 7 $ $ $ Case 2 Case 1 454,000 323,400 65.600 174,000 (12,300) $ 11 $ Assume that more than one product is being sold in each of…arrow_forwardhttps://ezto.mheducation.com/ext/map/index. 01:43:47 eBook Mc Graw Hill 3 XYZ Company manufactures and sells a single product. A partially completed schedule of the company's total costs and costs per unit over the relevant range of 54,000 to 94,000 units is given below: 76°F Sunny Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required: 1. Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. 2. Assume that the company produces and sells 84,000 units during the year at a selling price of $8.60 per unit. Prepare a contribution format income statement for the year. Total cost: Variable cost Fixed cost Total cost Cost per unit: Complete the schedule of the company's total costs and costs per unit as given in the relevant tab below. (Rou variable cost and fixed cost to 2 decimal places.) Variable cost Fixed cost Total cost per unit $ Saved $ $ 54,000 Units Produced and Sold 74,000 140,400 370,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education