FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

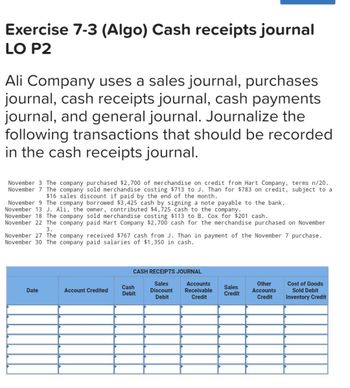

Transcribed Image Text:Exercise 7-3 (Algo) Cash receipts journal

LO P2

Ali Company uses a sales journal, purchases

journal, cash receipts journal, cash payments

journal, and general journal. Journalize the

following transactions that should be recorded

in the cash receipts journal.

November 3 The company purchased $2,700 of merchandise on credit from Hart Company, terms n/20.

November 7 The company sold merchandise costing $713 to J. Than for $783 on credit, subject to a

$16 sales discount if paid by the end of the month.

November 9 The company borrowed $3,425 cash by signing a note payable to the bank.

November 13 J. Ali, the owner, contributed $4,725 cash to the company.

November 18 The company sold merchandise costing $113 to B. Cox for $201 cash.

November 22 The company paid Hart Company $2,700 cash for the merchandise purchased on November

3.

November 27 The company received $767 cash from J. Than in payment of the November 7 purchase.

November 30 The company paid salaries of $1,350 in cash.

Date

Account Credited

CASH RECEIPTS JOURNAL

Sales

Discount

Debit

Cash

Debit

Acco

Receivable

Credit

Sales

Credit

Accounts

Credit

Cost Good

Sold Debit

Inventory Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the month of September, the following transactions occurred. The applicable sales tax rate is 6%. Sept. 2 Sold merchandise on account to Sam Larson, $1,400, plus sales tax. 7 Sold merchandise on account to David Mitchell, $1,900, plus sales tax. 12 Issued credit memorandum to Sam Larson for $689, including sales tax of $39. 22 Sold merchandise on account to Matt Feustal, $500, plus sales tax. 28 Sold merchandise on account to Ana Cardona, $850, plus sales tax. Enter the transactions in the general journal. If an amount box does not require an entry, leave it blank.arrow_forwardMayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 5.5% service charge for sales on its credit card. Access deducts a 4.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $700 of merchandise on credit (that had cost $350) to Natara Morris. 5 Sold $6,700 of merchandise (that had cost $3,350) to customers who used their Zisa cards. 6 Sold $5,656 of merchandise (that had cost $2,828) to customers who used their Access cards. 8 Sold $4,680 of merchandise (that had cost $2,340) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $606 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required:Prepare journal…arrow_forwardLevchenko Company purchased inventories from a vendor for $16,000 on July 1. The purchase was financed through a $10,000 note with the remainder paid in cash. The vendor charged an additional $400 for shipping, on account. Levchenko paid a moving company $700 cash to move the inventory to a different warehouse. Interest on the note totaled $50, payable in August. a. Determine the cost to be assigned to the inventory. $ b. Record the transactions using the financial statement effects template. Note: Use negative signs with your answers, when appropriate. Select "N/A" as your answer if a part of the accounting equation is not affected. Transaction a. Inventory purchase b. Shipping charge c. Moving cost d. Interest incurred Totals Cash Asset ♦ ◆ ◆ ◆ 0 + Noncash Asset ◆ ◆ ◆ ◆ 0 Balance Sheet Liabilities ◆ ◆ ◆ 0 Contributed + Capital + Earned Capital ♦ ◆ ♦ ♦ 0 Revenues Income Statement Expenses ◆ ◆ ◆ 0 Net = Income 0arrow_forward

- Presented below is information from Larkspur Computers Incorporated. July 1 Sold $19,200 of computers to Robertson Company with terms 3/15, n/60. Larkspur uses the gross method to record cash discounts. Larkspur estimates allowances of $1,248 will be honored on these sales. 10 Larkspur received payment from Robertson for the full amount owed from the July transactions. 17 Sold $192,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30. 30 The Clark Store paid Larkspur for its purchase of July 17. Prepare the necessary journal entries for Larkspur Computers.arrow_forwardMayfair Co. allows select customers to make purchases on credit. Its other customers can use either of two credit cards: Zisa or Access. Zisa deducts a 4.5% service charge for sales on its credit card. Access deducts a 3.5% service charge for sales on its card. Mayfair completes the following transactions in June. June 4 Sold $500 of merchandise on credit (that had cost $250) to Natara Morris. 5 Sold $6,800 of merchandise (that had cost $3,400) to customers who used their Zisa cards. 6 Sold $5,616 of merchandise (that had cost $2,808) to customers who used their Access cards. 8 Sold $4,890 of merchandise (that had cost $2,445) to customers who used their Access cards. 13 Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $395 balance in McKee’s account stemmed from a credit sale in October of last year. 18 Received Morris’s check in full payment for the purchase of June 4. Required:Prepare journal…arrow_forwardFollowing are the merchandising transactions of Dollar Store. November 1 Dollar Store purchases merchandise for $1,300 on terms of 2/5, n/30, FOB shipping point, invoice dated November 1. November 5 Dollar Store pays cash for the November 1 purchase. November 7 Dollar Store discovers and returns $150 of defective merchandise purchased on November 1, and paid for on November 5, for a cash refund. November 10 Dollar Store pays $65 cash for transportation costs for the November 1 purchase. November 13 Dollar Store sells merchandise for $1,404 with terms n/30. The cost of the merchandise is $702. November 16 Merchandise is returned to the Dollar Store from the November 13 transaction.. The returned items are priced at $290 and cost $145; the items were not damaged and were returned to inventory. Journalize the above merchandising transactions for the Dollar Store assuming it uses a perpetual inventory system and the gross method. View transaction list Journal entry worksheetarrow_forward

- Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 1/10, n/30). March 1 Purchased $37,000 of merchandise from Van Industries, terms 1/15, n/30. March 2 Sold merchandise on credit to Min Cho, Invoice Number 854, for $14,800 (cost is $7,400). March 3 (a) Purchased $1,110 of office supplies on credit from Gabel Company, terms n/30. March 3 (b) Sold merchandise on credit to Linda Witt, Invoice Number 855, for $7,400 (cost is $3,700). March 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $18,500 of office equipment on credit from Spell Supply, terms n/30. March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for $3,700 (cost is $1,850). March 12 Received payment from Min Cho for the March 2 sale less the discount of $148. March 13 (a) Sent Van Industries Check Number 416 in payment of the March 1 invoice less the discount of $370.…arrow_forwardRecord the transactions on the books of Martinez corporation.arrow_forwardOn March 2. Metlock Company sold $936,300 of merchandise to Ivanhoe Company on account, terms 2/10, n/30. The cost of the merchandise sold was $571.70o. On March 6, Ivanhoe Company returned $110,600 of the merchandise purchased on March 2. The cost of the merchandise returned was $62,200. On March 12, Metlock Company received the balance due from Ivanhoe Company. Debit Credit Date Account Titles and Explanation ck if you would like to Show Work for this question: Open Show Work Versia I Q 2000-2021 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. %23 3/1 hp 米 fe 4+ pr IOI 144 & 24 4. 6. L. 8. { E R T. Y U D F G H K C alt ctrl V Σ 3.arrow_forward

- The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31 Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. Jul. 1 Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for…arrow_forwardApr. 30 Received $495,000 from Commerce Bank after signing a 12-month, 5 percent, promissory note. June Purchased merchandise on account at a cost of $68,000. (Assume a perpetual inventory 6 system.) July 15 Paid for the June 6 purchase. Aug. Signed a contract to provide security service to a small apartment complex and collected six months' fees in advance amounting to $19,800. (Use an account called Unearned Revenue.) 31 Dec. 31 Determined salary and wages of $33,000 were earned but not yet paid as of December 31 (ignore payroll taxes). Dec. 31 Adjusted the accounts at year-end, relating to interest. Dec. 31 Adjusted the accounts at year-end, relating to security service. Required: 182. Complete the required journal entries for each of the above transactions. (Do not round Intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld.) 1. Record the borrowing of $495,000. 2. Record the purchase of inventory…arrow_forwardOn March 2, Blossom Company sold $960,000 of merchandise on account to Pina Company, terms 3/10, n/30. The cost of the merchandise sold was $562,000. On March 6, Pina Company returned $96,000 of the merchandise purchased on March 2. The cost of the returned merchandise was $59,000. On March 12, Blossom Company received the balance due from Pina Company. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter 0 for the amounts) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education