FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Current Attempt in Progress

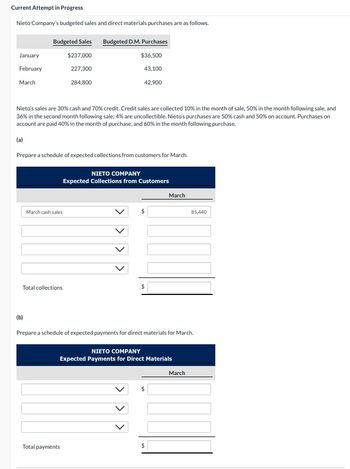

Nieto Company's budgeted sales and direct materials purchases are as follows.

January

February

March

Budgeted Sales

$237,000

227,300

284,800

(b)

Nieto's sales are 30% cash and 70% credit. Credit sales are collected 10% in the month of sale, 50% in the month following sale, and

36% in the second month following sale; 4% are uncollectible. Nieto's purchases are 50% cash and 50% on account. Purchases on

account are paid 40% in the month of purchase, and 60% in the month following purchase.

(a)

Prepare a schedule of expected collections from customers for March.

March cash sales

Total collections

Budgeted D.M. Purchases

$36,500

43,100

42,900

NIETO COMPANY

Expected Collections from Customers

Total payments

>

Prepare a schedule of expected payments for direct materials for March.

NIETO COMPANY

Expected Payments for Direct Materials

March

$

$

85,440

March

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 19. SalaRita's sales are 32% cash and 68% credit. Of the credit sales, 40% of credit sales are collected in the month of sale, 45% in the month following the sale, and 15% is collected two months after. Budgeted sales data is as follows: June July August $200,000 120,000 150,000 How much is total cash collected during August? A) $145,920 B) $105,120 C) $88,800 D) $144,000arrow_forwardFedor, Inc. has prepared the following direct materials purchases budget: Budgeted DM Purchases $69.000 77,000 78,700 77,800 76,200 All purchases are paid for as follows: 40% in the month of purchase, 50% in the following month, and 10% two months after purchase. Calculate total budgeted cash payments made in October for purchases. Month June July August September October OA. $77,250 OB. $46,770 OC. $38,350 O D. $69,380arrow_forwardThe BRS Corporation makes collections on sales according to the following schedule: 45% in month of sale 53% in month following sale 2% in second month following sale The following sales have been budgeted: Sales April $220, 000 $150,000 May June $140, 000 Budgeted cash collections in June would be: Multiple Cholce $140,000 $142,500 $146,900 $140,440arrow_forward

- iiiiarrow_forwardThe BRS Corporation makes collections on sales according to the following schedule: 40% in month of sale 55% in month following sale 5% in second month following sale The following sales have been budgeted: April May June Sales $110,000 $120,000 $110,000 Budgeted cash collections in June would be: Multiple Choice $115,500 $110,000 $110,550 $112,000arrow_forwardBuilt-Tight is preparing its master budget for the quarter ended September 30. Budgeted sales and cash payments for product costs for the quarter follow. July August September Budgeted sales $ 55,000 $ 71,000 $ 57,000 Budgeted cash payments for Direct materials 15,360 12,640 12,960 Direct labor 3,240 2,560 2,640 Factory overhead 19,400 16,000 16,400 Sales are 20% cash and 80% on credit. All credit sales are collected in the month following the sale. The June 30 balance sheet includes balances of $15,000 in cash; $44,200 in accounts receivable; and a $4,200 balance in loans payable. A minimum cash balance of $15,000 is required. Loans are obtained at the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If an excess balance of cash exists, loans are repaid at the end of the month. Operating expenses are…arrow_forward

- am. 108.arrow_forwardGriffith Company has budgeted purchases of inventory for December of $105,000. Expected beginning inventory on December 1 and ending inventory on December 31 are $120,000 and $129,000, respectively. If the cost of goods sold averages 75% of sales, what are budgeted sales for December? A. $114,000 B. $152,000 C. $120,000 D. $128,000arrow_forwardKuzma Foods, Inc. has budgeted sales for June and July at $680,000 and $765,000, respectively. Sales are 80% credit, of which 60% is collected in the month of sale and 40% is collected in the following month. What is the budgeted Accounts Receivable balance on July 31? OA. $306,000 OB. $217,600 OC. $612,000 OD. $244,800arrow_forward

- A company's budgeted sales and cash payments for merchandise for the next two months follow. July August Budgeted sales $ 33,300 $ 42,300 Budgeted cash payments for merchandise purchases 20,510 17,540 Sales in June are $26,800. Sales are 40% cash and 60% on credit. All credit sales are collected in the month after the sale. The June 30 balance sheet includes $12,600 in cash and $2,100 in loans payable. The company requires a $12,600 minimum cash balance. The company takes loans as needed at month-end to meet this minimum balance. Interest of 1% month (based on the loan balance at the beginning of the month) is paid at each month-end. Preliminary cash balances above $12,600 at each month-end are used to repay any loans. Expenses include office salaries of $5,410 per month, rent of $3,310 per month, sales commissions at 10% of sales dollars, and shipping at 2% of sales dollars; these expenses are paid in the month incurred. Dividends of $1,160 will be paid in August. Prepare a schedule…arrow_forwardGalina, Inc. has prepared the following direct materials purchases budget. Budgeted DM Purchases Month June July August $68,000 74,500 76,600 September October 79,600 70,600 All purchases are paid for as follows: 10% in the month of purchase, 40% in the following month, and 50% two months after purchase. Calculate the budgeted balance of accounts payable at the end of October. A. $63,540 B. $75,100 OC. $39,800 D. $103,340arrow_forwardA company makes collections on sales according to the following schedule: 50% in month of sale 45% in month following sale 5% in second month following sale The following sales have been budgeted: April May June Sales $180,000 $190,000 $180,000 Budgeted cash collections in June would be:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education