FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

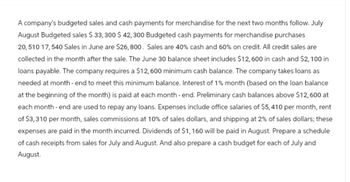

Transcribed Image Text:A company's budgeted sales and cash payments for merchandise for the next two months follow. July

August Budgeted sales $ 33,300 $ 42,300 Budgeted cash payments for merchandise purchases

20,510 17,540 Sales in June are $26,800. Sales are 40% cash and 60% on credit. All credit sales are

collected in the month after the sale. The June 30 balance sheet includes $12,600 in cash and $2,100 in

loans payable. The company requires a $12,600 minimum cash balance. The company takes loans as

needed at month-end to meet this minimum balance. Interest of 1% month (based on the loan balance

at the beginning of the month) is paid at each month-end. Preliminary cash balances above $12,600 at

each month-end are used to repay any loans. Expenses include office salaries of $5,410 per month, rent

of $3,310 per month, sales commissions at 10% of sales dollars, and shipping at 2% of sales dollars; these

expenses are paid in the month incurred. Dividends of $1,160 will be paid in August. Prepare a schedule

of cash receipts from sales for July and August. And also prepare a cash budget for each of July and

August.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Determine the anticipated total cash receipts for the month of January for Madison Co. in preparing a Cash Budget, given the following info: Accounts Receivable balance as of January 1 $296,000.00 Budgeted Sales for January = $860,000.00 Madison Co. assumes all monthly sales are on account. And that 75% of the sales on account will be collected in the month of the sale, and that the remainder will be collected the following month. $688,000.00 $812,000.00 $941,000.00 O $468,000.00arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $ 519,000 $ 468,000 404,000 452,000 353,000 521,000 Kayak requires a minimum cash balance of $40,000 at each month end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forwardThe controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: Line Item Description Sales September October November $103,000 $122,000 $166,000 Manufacturing costs 43,000 52,000 60,000 Selling and administrative expenses Capital expenditures 36,000 37,000 63,000 40,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $10,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of…arrow_forward

- Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February⚫ March Cash Receipts Cash payments $ 521,000 408,000 457,000 $ 467,800 354,800 522,000 Kayak requires a minimum cash balance of $50,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $50,000 is used to repay loans at month-end. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forward5arrow_forwardTomo, Inc. has prepared its third quarter budget and provided the following data: Jul $49,000 Aug $39,800 Sep $47,900 Cash collections Cash payments: Purchases of direct materials Operating expenses Capital expenditures 17,900 11,100 0 The cash balance on June 30 is projected to be $4,600. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. Calculate the final projected cash balance at the end of August taking into consideration all the financing transactions. 31,000 12,100 13,700 O A. $46600 OB. $-8842 OC. $15000 O D. $6158 21,800 8,700 24,900arrow_forward

- The following information is available to assist you in preparing a company's cash budget. a. The cash balance on July 1 is $41,000. b. Actual sales for May and June and expected sales for July are as follows: May $ 68,400 $ 87,400 $ 95,800 $ 415,000 $ 614,000 $ 692,000 June July Cash sales Sales on account Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected In the second month following sale. The remaining 2% is uncollectible. C. Purchases of inventory will total $376,000 for July. Thirty percent of a month's Inventory purchases are paid during the month of purchase. The accounts payable remaining from June's inventory purchases total $174,500, all of which will be paid in July. d. Selling and administrative expenses are budgeted at $452,000 for July. Of this amount, $63,500 is for depreciation. e. A new web server for the Marketing Department costing $86,500 will be…arrow_forwardCastor Incorporated is preparing its master budget. Budgeted sales and cash payments for merchandise purchases for the next three months follow. April $ $ 35,200 26,400 22,220 18,480 18,920 Sales are 50% cash and 50% on credit. Sales in March were $26,400. All credit sales are collected in the month following the sale. The March 31 balance sheet includes balances of $13,200 in cash and $2,200 in loans payable. A minimum cash balance of $13,200 is required. Loans are obtained at the end of any month when the preliminary cash balance is below $13,200. Interest is 1% per month based on the beginning-of-the-month loan balance and is paid at each month-end. If a preliminary cash balance above $13,200 at month-end exists, loans are repaid from the excess. Expenses are paid in the month incurred and include sales commissions (10% of sales), shipping (2% of sales), office salaries ($5,500 per month), and rent ($3,300 per month). Budgeted Sales Cash payments for merchandise purchases Cash…arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $ 525,000 400,000 450,000 $ 475,000 350,000 525,000 Kayak requires a minimum cash balance of $30,000 at each month-end. Loans taken to meet this requirement charge 1% interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $30,000 is used to repay Ibans at month-end. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1. Prepare monthly cash budgets for January, February, and March Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Beginning cash balance Add Cash receipts Total cash available Less Cash payments for Interest on loan Total…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education