FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

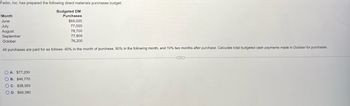

Transcribed Image Text:Fedor, Inc. has prepared the following direct materials purchases budget:

Budgeted DM

Purchases

$69.000

77,000

78,700

77,800

76,200

All purchases are paid for as follows: 40% in the month of purchase, 50% in the following month, and 10% two months after purchase. Calculate total budgeted cash payments made in October for purchases.

Month

June

July

August

September

October

OA. $77,250

OB. $46,770

OC. $38,350

O D. $69,380

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounting Consider the following third-quarter budget data for TAP & Brothers: TAP & Brothers Third-Quarter Budget Data July August September Credit Sales 256,167 262,962 282,872 Credit Purchases 97,465 111,565 137,292 Wages, Taxes, and Expenses 26,506 31,621 33,707 Interest 7,239 7,773 8,091 Equipment Purchases 54,832 61,271 0 The company predicts that 4% of its credit sales will never be collected, 30% of its sales will be collected in the month of the sale, and the remaining 66% will be collected in the following month. Credit purchases will be paid in the month following the purchase. In June, credit sales were $138,282, and credit purchases were $102,770 July’s beginning cash is $184,797 If TAP maintains a policy of always keeping a minimum cash balance of $75,000 as a buffer against uncertainty and forecasting errors, what is the cash surplus/deficit at the end of the quarter (i.e., end of…arrow_forwardQuestion 10 Cash Budget Daybook Inc. collects 30% of its sales on account in the month of the sale and 70% in the month following the sale. If sales on account are budgeted to be $105,000 for September and $116,000 for October, what are the budgeted cash receipts from sales on account for October?arrow_forwardA company's budgeted sales and cash payments for merchandise for the next two months follow. July August Budgeted sales $ 33,300 $ 42,300 Budgeted cash payments for merchandise purchases 20,510 17,540 Sales in June are $26,800. Sales are 40% cash and 60% on credit. All credit sales are collected in the month after the sale. The June 30 balance sheet includes $12,600 in cash and $2,100 in loans payable. The company requires a $12,600 minimum cash balance. The company takes loans as needed at month-end to meet this minimum balance. Interest of 1% month (based on the loan balance at the beginning of the month) is paid at each month-end. Preliminary cash balances above $12,600 at each month-end are used to repay any loans. Expenses include office salaries of $5,410 per month, rent of $3,310 per month, sales commissions at 10% of sales dollars, and shipping at 2% of sales dollars; these expenses are paid in the month incurred. Dividends of $1,160 will be paid in August. Prepare a schedule…arrow_forward

- gop.9arrow_forwardSchedule of cash payments for a service company EastGate Physical Therapy Inc. is planning its cash payments for operations for the first quarter (January-March). The Accrued Expenses Payable balance on January 1 is $26,200. The budgeted expenses for the next three months are as follows: January February March Salaries $60,300 $73,400 $81,200 Utilities 5,000 5,500 6,600 Other operating expenses 46,400 50,600 $5,700 Total $111,700 $129,500 $143,500 Other operating expenses include $3,300 of monthly depreciation expense and $800 of monthly insurance expense that was prepaid for the year on May 1 of the previous year of the remaining expenses, 80% are paid in the month in which they are incurred, with the remainder paid in the following month. The Accrued Expenses Payable balance on January 1 relates to the expenses incurred in December. Prepare a schedule of cash payments for operations for January, February, and March. EastGate Physical Therapy Inc. Schedule of Cash Payments for…arrow_forwardCash budget Consider the budgeted income statement for Carlson Company for June 20X4 in Exhibit 7-13.The cash balance, May 31, 20x4, is $ 15.000. Sales proceeds are collected as follows: 80% the month od sale, 10% the second month, and 10% the third month. Accounts receivable are $44.000 on May 31, 20x4, consisting od $20.000 from April sales and $24.000 from May sales. Accounts payable on May 31, 20x4, are $145.000. Carlson Company pays 25% of purchases during the month of purchase and the remainder during the following month. All operating expenses requiring cash are paid during the month of recongnition, except that insurance and property taxes are paid annually in December for the forthcoming year. Prepare a cash budget for June Confine your analysis to the given data. Ignore income taxes. Exhibit 7-13, Carlson Company - Budgetes Income Statement for the Month Ended June 30,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education