FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

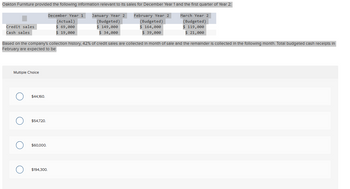

Transcribed Image Text:Oakton Furniture provided the following information relevant to its sales for December Year 1 and the first quarter of Year 2:

January Year 2 February Year 2

(Budgeted)

$ 149,000

$ 34,000

Credit sales

Cash sales

Multiple Choice

O

O

Based on the company's collection history, 42% of credit sales are collected in month of sale and the remainder is collected in the following month. Total budgeted cash receipts In

February are expected to be:

$44,160.

$54,720.

December Year 1

$60,000.

(Actual)

$ 69,000

$ 19,000

$194,300.

(Budgeted)

$ 164,000

$ 39,000

March Year 2

(Budgeted)

$ 119,000

$ 21,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ssume a merchandising company provides the following information from its master budget for the month of May: Sales $ 126,000 Cost of goods sold $ 91,000 Selling and administrative expenses $ 25,000 Accounts receivable, May 1st $ 17,000 Accounts receivable, May 31st $ 36,500 If all of the company’s sales are on account, what is the amount of cash collections from customers included in the cash budget for May?arrow_forwardPlease help me with show all calculation thankuarrow_forwardThe BRS Corporation makes collections on sales according to the following schedule: 45% in month of sale 53% in month following sale 2% in second month following sale The following sales have been budgeted: Sales April $220, 000 $150,000 May June $140, 000 Budgeted cash collections in June would be: Multiple Cholce $140,000 $142,500 $146,900 $140,440arrow_forward

- iiiiarrow_forwardThe BRS Corporation makes collections on sales according to the following schedule: 40% in month of sale 55% in month following sale 5% in second month following sale The following sales have been budgeted: April May June Sales $110,000 $120,000 $110,000 Budgeted cash collections in June would be: Multiple Choice $115,500 $110,000 $110,550 $112,000arrow_forwardFlint, Inc. provided the following information: Projected merchandise purchases . March April $67,000 $75,000 Budgeted cash disbursements $ Flint pays for 40% of merchandise purchases in the month of the purchase and 60% in the following month. General operating expenses are budgeted to be $25,000 per month of which depreciation is $2,000 of this amount. Flint pays operating expenses in the month incurred. Calculate Flint's budgeted cash disbursements for May. May $81,000arrow_forward

- Assume the following budgeted information for a merchandising company: Budgeted sales (all on credit) for November, December, and January are $248,000, $218,000, and $209,000, respectively. • Cash collections related to credit sales are expected to be 70% in the month of sale, 30% in the month following the sale. • The cost of goods sold is 70% of sales. • Each month's ending inventory equals 20% of next month's cost of goods sold. • 30% of each month's merchandise purchases are paid in the current month and the remainder is paid in the following month. • Monthly selling and administrative expenses that are paid in cash in the month incurred total $25,000. • Monthly depreciation expense is $9.000. . The budgeted net operating income for December would be: Multiple Choice $40,400 $25,734 $16,734 $31,400arrow_forwardsubject - accountingarrow_forwardTimpco, a retailer, makes both cash and credit sales (i.e., sales on open account). Information regarding budgeted sales for the last quarter of the year is as follows: October November December Cash sales $ 80,000 $ 71,000 $ 83,000 Credit sales 80,000 85,200 91,300 Total $ 160,000 $ 156,200 $ 174,300 Past experience shows that 5% of credit sales are uncollectible. Of the credit sales that are collectible, 60% are collected in the month of sale; the remaining 40% are collected in the month following the month of sale. Customers are granted a 1.5% discount for payment within 10 days of billing. Approximately 75% of collectible credit sales take advantage of the cash discount. Inventory purchases each month are 100% of the cost of the following month’s projected sales. (The gross profit rate for Timpco is approximately 30%.) All merchandise purchases are made on credit, with 20% paid in the month of purchase and the remainder paid in the following month. No cash discounts…arrow_forward

- sarrow_forwardX-Tel budgets sales of $55,000 for April, $110,000 for May, and $70,000 for June. Sales are 50% cash and 50% on credit. All credit sales are collected in the month following the sale. Total sales for March were $13,000. Prepare a schedule of cash receipts from sales for April, May, and June Sales Cash receipts from: Total cash receipts X-TEL Schedule of Cash Receipts from Sales April $ $ 55,000 $ 0 $ May 110,000 $ 0 $ June 70,000 0arrow_forwardHelp me pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education