Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text::

nformation

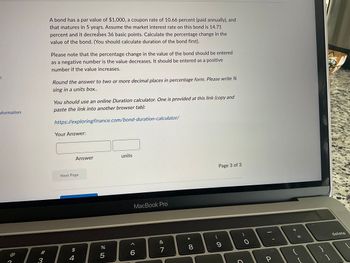

A bond has a par value of $1,000, a coupon rate of 10.66 percent (paid annually), and

that matures in 5 years. Assume the market interest rate on this bond is 14.71

percent and it decreases 36 basic points. Calculate the percentage change in the

value of the bond. (You should calculate duration of the bond first).

Please note that the percentage change in the value of the bond should be entered

as a negative number is the value decreases. It should be entered as a positive

number if the value increases.

Round the answer to two or more decimal places in percentage form. Please write %

sing in a units box..

You should use an online Duration calculator. One is provided at this link (copy and

paste the link into another browser tab):

https://exploringfinance.com/bond-duration-calculator/

Your Answer:

Answer

units

Next Page

MacBook Pro

$

%

5

6

@

4

3

87

&

*

8

00

Page 3 of 3

9

O

C

P

+ 11

{

delete

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A General Power bond carries a coupon rate of 9.7%, has 9 years until maturity, and sells at a yield to maturity of 8.7%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year? b. At what price does the bond sell? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. c. What will happen to the bond price if the yield to maturity falls to 7.7%? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Interest payments b. Price c. Price will by rise fallarrow_forwardA $1,000 bond with a coupon rate of 5.7% paid semiannually has five years to maturity and a yield to maturity of 7%. If interest rates rise and the yield to maturity increases to 7.3%, what will happen to the price of the bond? A. fall by $14.37 B. rise by $11.97 C. fall by $11.97 D. The price of the bond will not change.arrow_forwardConsider a bond with a coupon of 5 percent, seven years to maturity, and a current price of $1,052.80. Suppose the yield on the bond suddenly increases by 2 percent. a. Use duration to estimate the new price of the bond. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Price b. Calculate the new bond price using the usual bond pricing formula. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Pricearrow_forward

- A bond has a coupon rate of 5.2%, and 6.5 years until maturity. If the YTM is 6.2%, what is the price of this bond? TIP: Write the price as a percentage of the bonds par value. All bonds in this class make two coupon payments per year, and have a face value of $1,000. You don't need to write in the "%" sign.arrow_forwardSuppose the current interest rate on a one-year bond is 2% and the current interest rate on a two-year bond is 4%. The term premium on a two-year bond is 1%. According to the expectations hypothesis, what interest rate should we expect on a one-year bond next year? Answer as a percentage to one decimal place and do not include symbols (e.g. $, %, commas) in your answer. Answer:arrow_forwardAssume that a bond will make payments every six months as shown on the following timeline (using six- month periods): Period 0 Cash Flows $20.87 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? 2 $20.87 *** a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) 39 $20.87 40 $20.87 + $1,000arrow_forward

- A bond has a Macaulay duration of 12.00 and is priced to yield 10.0%. If interest rates go up so that the yield goes to 10.5%, what will be the percentage change in the price of the bond? Now, if the yield on this bond goes down to 9.5%, what will be the bond's percentage change in price? Comment on your findings.arrow_forwardIf a bond's yield to maturity does not change, the return on the bond each year will be equal to the yield to maturity. Confirm this for both a premium and a discount bond using a 4-year 4.3 percent coupon bond with annual coupon payments and a face value of $1,000. Assume the yield to maturity is 3.3 percent. Assume the yield to maturity is 5.3 percent.arrow_forwardA newly issued bond pays its coupons once a year. Its coupon rate is 4.7%, its maturity is 15 years, and its yield to maturity is 7.7%. a. Find the holding-period return for a one-year investment period if the bond is selling at a yield to maturity of 6.7% by the end of the year. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Holding-period return % b. If you sell the bond after one year when its yield is 6.7%, what taxes will you owe if the tax rate on interest income is 40% and the tax rate on capital gains income is 30%? The bond is subject to original-issue discount (OID) tax treatment. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Tax on interest income $ Tax on capital gain $ Total taxes $ c. What is the after-tax holding-period return on the bond? (Do not round intermediate calculations. Round your answer to 2 decimal places.)…arrow_forward

- Question Given the following information about a bond, calculate the modified duration of the bond. i) The term-to-maturity is two years. ii) Coupons are payable annually at 5%. iii) The bond is trading at par. Possible Answers A B D 1.859 с 1.928 E 1.881 1.952 Cannot be determined since the yield rate i is not provided.arrow_forwardAssume that a bond will make payments every six months as shown on the following timeline (using six-month periods):arrow_forwardUse Macauly's Duration Price Approximation formula for this. Before a change in interest rates, your bond has the following characteristics: present value of $5,557.56, Duration of 3.69 years with market interest rates of 5%. Calculate the percentage change in the bond's price if market rates fall to 4.85%. Be sure to include the negative sign IF you think the price goes down. Iarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education