FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

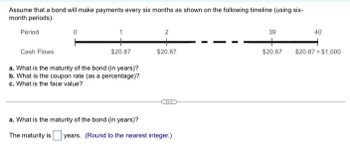

Transcribed Image Text:Assume that a bond will make payments every six months as shown on the following timeline (using six-

month periods):

Period

0

Cash Flows

$20.87

a. What is the maturity of the bond (in years)?

b. What is the coupon rate (as a percentage)?

c. What is the face value?

2

$20.87

***

a. What is the maturity of the bond (in years)?

The maturity is years. (Round to the nearest integer.)

39

$20.87

40

$20.87 + $1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A bank quotes you a nominal interest rate of 12%, compounded monthly, on a savings account. What is the effective annual rate? %arrow_forwardA 24. Subject:- financearrow_forwardd6 Bonds- A mortgage bond with a face value of $10,000 has a bond interest rate of 6% per year payable quarterly. What are the amount and frequency of the interest payments?arrow_forward

- If the company accepted a Notes Receivable on Oct 1, X1 for $60,000 at 8%, due in one year, what is the Maturity value?arrow_forwardAssume the interest is 8% compounded quarterly. a)Find the quarterly effective interest rate for 8% compounded quarterly. (b) Find the future value at the end of the 8th quarter of the cash flows identified at the end of quarter 4 and quarter 8. (c) Find the end of quarter deposits, A, that are equivalent to the future value you calculated in part b.arrow_forwardCalculate the effective interest rate per month for an interest rate of 14% in continuously compounded account? a. 1.488% b. 1.258% c. 1.671% d. 1.174%arrow_forward

- 7arrow_forward5. Which of the following bank accounts has the highest effective annual return (EAR)? a. An account that pays 8% nominal interest with monthly compounding. b. An account that pays 8% nominal interest with annual compounding. c. An account that pays 7% nominal interest with daily (365-day) compounding. d. An account that pays 7% nominal interest with monthly compounding. 6. Which of the following statements regarding a 30-year monthly payment amortized mortgage with a fixed nominal interest rate of 10% is CORRECT? a. The monthly payments will increase over time. b. A larger proportion of the first monthly payment will be interest, and a smaller proportion will be principal, than for the last monthly payment. c. The total dollar amount of interest being paid off each month gets larger as the loan approaches maturity. d. The amount representing interest in the first payment would be higher if the nominal interest rate were 7% rather than 10%. 7. What is the present value of the following…arrow_forwardAssuming a 360-day year, when a $12,919, 90-day, 6% interest-bearing note payable matures, total payment will amount to:arrow_forward

- Assuming a 360-day year, when a $16,098, 90-day, 8% interest-bearing note payable matures, total payment will bearrow_forwardAssuming a 360-day year, when a $11,200, 90-day, 5% interest-bearing note payable matures, the total payment will be Oa. $560 Ob. $140 Oc. $11,760 Od. $11,340 0 0 0 0arrow_forward(1)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education