Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

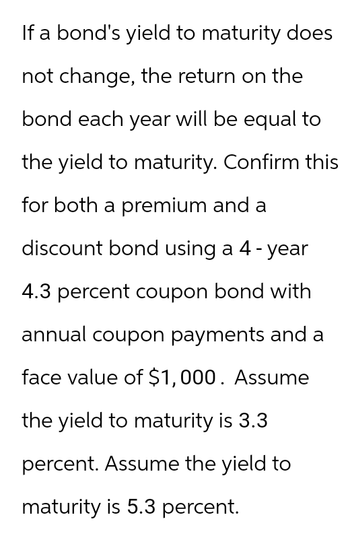

Transcribed Image Text:If a bond's yield to maturity does

not change, the return on the

bond each year will be equal to

the yield to maturity. Confirm this

for both a premium and a

discount bond using a 4-year

4.3 percent coupon bond with

annual coupon payments and a

face value of $1,000. Assume

the yield to maturity is 3.3

percent. Assume the yield to

maturity is 5.3 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the duration (and price ) of a bond with the following characteristics: A semi - annual payment bond with a $1,000 face value, a 4.5% coupon rate, a 7.8% YTM, and 8 years to maturity. Show your table of calculations or show Excel inputs if using the Excel commands.arrow_forwardAssume you have a bond with a semi-annual interest payment of $50, a par value of $1 comma 000, and a current market price of $870. What is the current yield of the bond?arrow_forwardSuppose a five-year bond with an 8% coupon rate and semi-annual compounding is trading for a price of £951.58. Calculate the bond's yield to maturity (YTM) based on the expression of an annual percentage rate (APR).arrow_forward

- The bond's duration is the sum of the present value of each payment weighted by the time period in which the payment is received, with the resulting quantity divided by the price of the bond. Therefore, solve for the bond's duration given the following variables: A $1,000 par bond is priced at 95% of par, the bond's annual coupon rate is 6%, and the bond has 4 years to maturity. Additionally, show your calculator's function keys for the 5th column titled, "What is the Present Value Interest Factor at ? %" PV =, FV =, PMT =,N=, and I = .... and CPT key = ? 0.0000 CUIT CPT SET ENTER DEL INS Column 1 Column 2 Column 3 Column 4 Column 5 2ND CF NPV IRR PM AMORT DON CLR TVM PV PMT FV RAND Number (#) of "X" means "multiplied each by" payment Amount of payment "A $1,000 par bond is priced "X" means "multiplied by" What is the Present Value Interest 呢 VE 1/x HYP SIN مر at 95% of par" so $950 x .06 = $57?) 1 X $ 57 X Factor at ? % ? (show calculator function keys: PV=, FV = PMT =, N =, & I=? ? =…arrow_forwardA 30-year maturity bond making annual coupon payments with a coupon rate of 11.00% has a ation of 13.50 years. The bond currently sells at a yield to maturity of 5.75%. Ducation a. Find the exact dollar price of the bond if its yield to maturity falls to 4.75%. What is the % change in price? b. Assume that you need to make a quick approximation using the duration rule. What is the % change in price as approximated by the duration rule when the yield to maturity falls to 4.75%? c. Does the duration-rule provide a good approximation of the % price change in this case? Why or why not?arrow_forwardAssuming annual coupon payment, a 3-year 8% coupon bond has a yield to maturity 9 percent. What is the duration? If market rate decrease by 0.75%, what’s the percentage change in bond price using the duration estimation approach?arrow_forward

- Assume that the real, risk-free rate of interest is expected to be constant over time at 3 percent, and that the annual yield on a 6-year corporate bond is 8.00 percent, while the annual yield on a 10-year corporate bond is 7.75 percent: you may assume that the default risk and liquidity premium are the same for both bonds. Also assume that the maturity risk premium for all securities can be estimated as MRP, (0.1%) *(t-1), where t is the number of periods until maturity. Finally assume that inflation is expected to be constant at 3 percent for Years 1-6, and then constant at some rate for Years 7-10 (4 years). Given this information, determine what the market must anticipate the average annual rate of inflation will be for Years 7-10. 2.583% O 1979% 2.281% 1.375 % O 1.677 % 4arrow_forwardBond A is a premium bond with a 9 percent coupon. Bond B is a 5 percent coupon bond currently selling at a discount. Both bonds make annual payments, have a YTM of 6 percent, and have five years to maturity. The face value is $1000 for both bonds. a. Why is the capital gain yield of the premium bond different from that of the discount bond? Which bond is better in terms of yields? b. What is the holding period return for each bond, if both bonds are held over the next year and sold at the year ned?arrow_forwardConsider 3-year 6% bond with the par of $100 and semi- annual coupon payments. The YTM of the bond is 8%. Also, suppose that the dollar duration is 253.96. What would be the bond price if the yield were 9%? What would be the price change due to duration? What would be the price change due to convexity? Price = 97.26; Change due to Duration = +2.54; Change due to Convexity = -0.04 Price = 96.84; Change due to Duration = +2.12 ; Change due to Convexity = -0.04 Price = 92.26; Change due to Duration = -2.54; Change due to Convexity = +0.04 Price = 92.68; Change due to Duration = -2.12 ; Change due to Convexity = +0.04arrow_forward

- A 15-year bond with a face value of $1,000 currently sells for $850. Which of the following statements is most correct? The bond's yield to maturity is greater than its coupon rate. If the yield to maturity stays constant until the bond matures, the bond's price will remain at $850. The bond's current yield is equal to the bond's coupon rate. The bond's yield to maturity is the same as capital gain yield. All of the statements above are correct. None of the above are correctarrow_forwardSuppose a 10-year, $1,000 bond with a coupon rate of 8.7% and semiannual coupons is trading for $ 1,034.28 a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b If the bond's yield to maturity changes to 9.9% APRwhat will be the bond's price?arrow_forwardA bond offers a coupon rate of 4%, paid annually, and has a maturity of 6 years. The current market yield is 13%. Face value is $1,000. If market conditions remain unchanged, what should be the Capital Gains Yield of the bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education