Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What must have been the net income for the year?

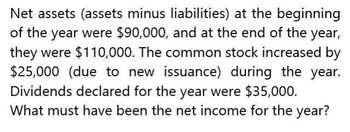

Transcribed Image Text:Net assets (assets minus liabilities) at the beginning

of the year were $90,000, and at the end of the year,

they were $110,000. The common stock increased by

$25,000 (due to new issuance) during the year.

Dividends declared for the year were $35,000.

What must have been the net income for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What must have been the net income for the year?arrow_forwardAssuming that total assets were $8,037,000 at the beginning of the current fiscal year, determine the following: When required, round to one decimal place. a. Ratio of fixed assets to long-term liabilities b. Ratio of liabilities to stockholders' equity c. Asset turnover d. Return on total assets e. Return on stockholders' equity f. Return on common stockholders' equity % % %arrow_forwardSubject: Financial Accounting-The Banner Income Fund's average daily total assets were $100 million for the year just completed. Its stock purchases for the year were $20 million, while its sales were $12.5 million. What was its turnover?arrow_forward

- In the current year, Aveeno reported net income of $54,880, which was a 12% increase over prior year net income. Compute prior year net income. Prior year net incomearrow_forwardCash dividends of $84,300 were declared during the year. Cash dividends payable were $9,231 at the beginning of the year and $15,738 at the end of the year. The amount of cash for the payment of dividends during the year isarrow_forwardCompute the net income for the year?arrow_forward

- Cash dividends of $79,384 were declared during the year. Cash dividends payable were $10,045 at the beginning of the year and $15,078 at the end of the year. The amount of cash for the payment of dividends during the year isarrow_forwardWhat was the net income for the year?arrow_forwardAssume that retained earnings increased by $62,850 from June 30 of year 1 to June 30 of year 2. A cash dividend of $13,500 was declared and paid during the year. Compute the net income for the year.arrow_forward

- What was Bright Growth Fund's turnover of this financial accounting question?arrow_forwardCash dividends of $88,319 were declared during the year. Cash dividends payable were $9,765 at the beginning of the year and $14,005 at the end of the year. The amount of cash for the payment of dividends during the year is Oa. $88,319 Ob. $102,324 Oc. $84,079 Od. $78,554arrow_forwardWhat was the net income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning