Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Help

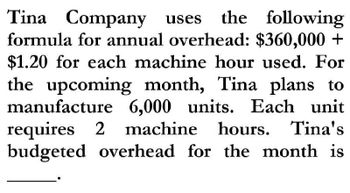

Transcribed Image Text:Tina Company uses the following

formula for annual overhead: $360,000 +

$1.20 for each machine hour used. For

the upcoming month, Tina plans to

manufacture 6,000 units. Each unit

requires 2 machine hours. Tina's

budgeted overhead for the month is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forwardIf a factory operates at 100% of capacity one month, 90% of capacity the next month, and 105% of capacity the next month, will a different cost per unit be charged to the work-in-process account each month for factory overhead assuming that a predetermined annual overhead rate is used?arrow_forwardA company estimates its manufacturing overhead will be $840,000 for the next year. What is the predetermined overhead rate given each of the following Independent allocation bases? Budgeted direct labor hours: 90,615 Budgeted direct labor expense: $750000 Estimated machine hours: 150,000arrow_forward

- Crystal Pools estimates overhead will utilize 250,000 machine hours and cost $750,000. It takes 2 machine hours per unit, direct material cost of $14 per unit, and direct labor of $20 per unit. What is the cost of each unit produced?arrow_forwardPatterson Corporation expects to incur 70,000 of factory overhead and 60,000 of general and administrative costs next year. Direct labor costs at 5 per hour are expected to total 50,000. If factory overhead is to be applied per direct labor hour, how much overhead will be applied to a job incurring 20 hours of direct labor? a. 120 b. 260 c. 28 d. 140arrow_forwardGent Designs requires three units of part A for every unit of Al that it produces. Currently, part A is made by Gent, with these per-unit costs in a month when 4.000 units were produced: Variable manufacturing overhead is applied at $1.00 per unit. The other $0.30 of overhead consists of allocated fixed costs. Gent will need 6,000 units of part A for the next years production. Cory Corporation has offered to supply 6,000 units of part A at a price of $7.00 per unit. It Gent accepts the offer, all of the variable costs and $1,200 of the fixed costs will be avoided. Should Gent Designs accept the offer from Cory Corporation?arrow_forward

- Box Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardA company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forwardRemarkable Enterprises requires four units of part A for every unit of Al that it produces. Currently, part A is made by Remarkable, with these per-unit costs in a month when 4,000 units were produced: Variable manufacturing overhead is applied at $1.60 per unit. The other $0.50 of overhead consists of allocated fixed costs. Remarkable will need 8,000 units of part A for the next years production. Altoona Corporation has offered to supply 8,000 units of part A at a price of $8.00 per unit. If Remarkable accepts the offer, all of the variable costs and $2,000 of the fixed costs will be avoided. Should Remarkable accept the offer from Altoona Corporation?arrow_forward

- When setting its predetermined overhead application race, Tasty Box Meals estimated its overhead would be $100,000 and would require 25,000 machine hours in the next year. At the end of the year. It found that actual overhead was $102,000 and required 26,000 machine hours. Determine the predetermined overhead rate. What is the overhead applied during the year? Prepare the journal entry to eliminate the under applied or over applied overhead.arrow_forwardTina Company uses the following formula for annual overhead: $360,000 + $1.20 for each machine hour used. For the upcoming month, Tina plans to manufacture 6,000 units. Each unit requires 2 machine hours. Tina's budgeted overhead for the month is _. Help me tutor give me answer of this accounting questionarrow_forwardTina Company uses the following formula for annual overhead: $360,000 + $1.20 for each machine hour used. For the upcoming month, Tina plans to manufacture 6,000 units. Each unit requires 2 machine hours. Tina's budgeted overhead for the month is _. Help me tutorarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,