Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the amount of income or loss?

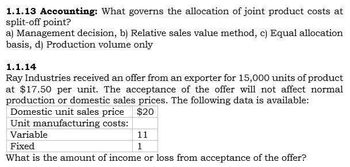

Transcribed Image Text:1.1.13 Accounting: What governs the allocation of joint product costs at

split-off point?

a) Management decision, b) Relative sales value method, c) Equal allocation

basis, d) Production volume only

1.1.14

Ray Industries received an offer from an exporter for 15,000 units of product

at $17.50 per unit. The acceptance of the offer will not affect normal

production or domestic sales prices. The following data is available:

Domestic unit sales price

Unit manufacturing costs:

Variable

Fixed

$20

11

1

What is the amount of income or loss from acceptance of the offer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help answerarrow_forwardFollowing information is related to Product X of Zempa Company: Current replacement cost $230 Cost to distribute $42 Historical cost Normal profit margin Selling price $215 $36 $245 If lower-of-cost-or-market rule (LCM Rule) is applied, then the value of Product X that would be reported in the balance sheet is: a. $215 b. $230 C. $203 d. S167arrow_forwardProblemsarrow_forward

- Following information is related to Product X of Zempa Company: Current replacement cost $230 Cost to distribute $42 Historical cost Normal profit margin Selling price $215 $36 $245 If lower-of-cost-or-market rule (LCM Rule) is applied, then the value of Product X that would be reported in the balance sheet is: a.arrow_forwardAssignmentarrow_forwardSolve this question and accounting questionarrow_forward

- need answer so please providearrow_forwardAccounting assessment qnarrow_forwardRequired information [The following information applies to the questions displayed below.] Information for Pueblo Company follows: Sales Revenue Less: Total Variable Cost Contribution Margin Weighted average CM ratio Product A Product B $ 60,000 $ 31,490 $ 28,510 Required: Determine Pueblo's (overall) weighted-average contribution margin ratio. Note: Do not round intermediate calculations. % $ 57,000 $ 11,800 $ 45,200arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning