FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

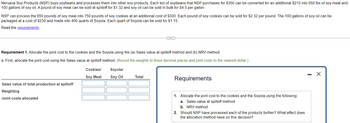

Transcribed Image Text:Nervana Soy Products (NSP) buys soybeans and processes them into other soy products. Each ton of soybeans that NSP purchases for $350 can be converted for an additional $210 into 650 lbs of soy meal and

100 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.32 and soy oil can be sold in bulk for $4.5 per gallon.

NSP can process the 650 pounds of soy meal into 750 pounds of soy cookies at an additional cost of $300. Each pound of soy cookies can be sold for $2.32 per pound. The 100 gallons of soy oil can be

packaged at a cost of $230 and made into 400 quarts of Soyola. Each quart of Soyola can be sold for $1.15.

Read the requirements.

Requirement 1. Allocate the joint cost to the cookies and the Soyola using the (a) Sales value at splitoff method and (b) NRV method.

a. First, allocate the joint cost using the Sales value at splitoff method. (Round the weights to three decimal places and joint costs to the nearest dollar.)

Sales value of total production at splitoff

Weighting

Joint costs allocated

Cookies/

Soy Meal

Soyola/

Soy Oil

C

Total

Requirements

1. Allocate the joint cost to the cookies and the Soyola using the following:

a. Sales value at splitoff method

b. NRV method

2. Should NSP have processed each of the products further? What effect does

the allocation method have on this decision?

-

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As a boba manufacturer company, Ngeboba supplies boba to Gula Hula and BobaTime. Ngeboba supplies 100 kgs to Gula Hula per month and also 500 kgs to Boba Time per month. Ngeboba as one of the founders of Gula Hula and BobaTime, felt responsible for the supply of boba for both brands. Ngeboba itself has a product cost of IDR 10,000 per kilo. Ngeboba sells to other customers than Gula Hula and BobaTime for IDR 20,000 per kilogram. GulaHula gets prices from other suppliers at IDR 17,000 per kilogram, while BobaTime gets 2,000 cheaper prices per kilogram than the price obtained by Gula Hula because it buys more.In general, Ngeboba's production capacity is 2 (two) tons per month. During the 3rd quarter,Ngeboba felt that his sales had risen drastically, so Ngeboba was faced with the following conditions: Demand from customers is full up to 2 (two) tons in July because it is the dry season. With Ngeboba, they felt that they couldn't help but they need to supply Gula Hula and BobaTime. In…arrow_forwardCorny and Sweet grows and sells sweet corn at its roadside produce stand. The selling price per dozen is $4.00, variable costs are $1.25 per dozen, and total fixed costs are $825.00. How many dozens of ears of corn must Corny and Sweet sell to breakeven?arrow_forwardHelp me pleasearrow_forward

- Urmilaarrow_forwardMartin Chicken Corporation processes and packages chicken for grocery stores. It purchases chickens from farmers and processes them into two different products: chicken drumsticks and chicken steak. From a standard batch of 12,000 pounds of raw chicken that costs $7,000, the company produces two parts: 2,800 pounds of drumsticks and 4,200 pounds of breast for a processing cost of $2,450. The chicken breast is further processed into 3,200 pounds of steak for a processing cost of $2,000. The market price of drumsticks per pound is $1.25 and the market price per pound of chicken steak is $4.20. If Martin decided to sell chicken breast instead of chicken steak, the price per pound would be $2.20. Required: a-1. Allocate the joint cost to the joint products, drumsticks and breasts, using weight as the allocation base. (Round "Allocation Rate" to 2 decimal places and other answers to the nearest dollar amount.) Allocation Rate Weight of Base Allocated Cost Product Drumsticks Chicken breast…arrow_forwardBeLuxe Company manufactures a variety of natural skin care products that are used in spas across Canada. Its most popular product is its “Cleopatra Gold” serum, made with locally produced ingredients. Currently, the company is operating at about 80 percent capacity, and is quite profitable. BeLuxe has been approached by a distributor in South Korea, asking to purchase 8,000 units of the serum, at a price of $40 per unit. BeLuxe’s product cost for each unit of Cleopatra Gold serum includes the following: Direct materials $ 16 Direct labour 10 Variable manufacturing overhead 8 Fixed manufacturing overhead 15 Total manufacturing cost $49 BeLuxe will save $2 per unit in sales commission costs on this order as it has come directly from the customer, and the distributor will cover all shipping costs. Currently, the serum is sold for $65 to its other customers. Production management believes that it can handle the special order without disrupting its…arrow_forward

- Accountarrow_forwardKosakowski Corporation processes sugar beets in batches. A batch of sugar beets costs $66 to buy from farmers and $17 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $23 or processed further for $13 to make the end product industrial fiber that is sold for $36. The beet juice can be sold as is for $42 or processed further for $20 to make the end product refined sugar that is sold for $84. How much more profit (loss) does the company make by processing one batch of sugar beets into the end products industrial fiber and refined sugar? Select one: a. $22 b. ($18) c. ($116) d. $4arrow_forwardIllion Soy Products (ASP) buys soybeans and processes them into other soy products. Each ton of soybeans that ASP purchases for $250 can be converted for an additional $180 into 700 lbs of soy meal and 80 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.08 and soy oil can be sold in bulk for $4 per gallon. ASP can process the 700 pounds of soy meal into 800 pounds of soy cookies at an additional cost of $370. Each pound of soy cookies can be sold for $2.08 per pound. The 80 gallons of soy oil can be packaged at a cost of $200 and made into 320 quarts of Soyola. Each quart of Soyola can be sold for $1.45. Read the requirements. Requirement 1. Allocate the joint cost to the cookies and the Soyola using the (a) Sales value at splitoff method and (b) NRV method. a. First, allocate the joint cost using the Sales value at splitoff method. (Round the weights to three decimal places and joint costs to the nearest dollar.) Sales value of total production at splitoff…arrow_forward

- Stinehelfer Beet Processors, Inc., processes sugar beets in batches. A batch of sugar beets costs $56 to buy from farmers and $13 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $24 or processed further for $12 to make the end product industrial fiber that is sold for $31. The beet juice can be sold as is for $43 or processed further for $29 to make the end product refined sugar that is sold for $91. What is the financial advantage (disadvantage) for the company from processing the intermediate product beet juice into refined sugar rather than selling it as is? Multiple Choicearrow_forwardMaxim manufactures a hamster food product called Green Health. Maxim currently has 18,500 bags of Green Health on hand. The variable production costs per bag are $3.50 and total fixed costs are $27,000. The hamster food can be sold as it is for $10.00 per bag or be processed further into Premium Green and Green Deluxe at an additional cost. The additional processing will yield 18,500 bags of Premium Green and 4,700 bags of Green Deluxe, which can be sold for $9 and $7 per bag, respectively. The incremental revenue of processing Green Health further into Premium Green and Green Deluxe would be: Multiple Choice O $199,400. $14,400. $194,400. $5,000. $9,400.arrow_forwardUnderground Food Store has 6,000 pounds of raw beef nearing its expiration date. Each pound has a cost of $4.40. The beef could be sold "as is" for $3.00 per pound to the dog food processing plant, or roasted and sold in the deli. The cost of roasting the beef will be $2.70 per pound, and each pound could be sold for $6.40. What should be done with the beef, and why? If required, round final answers to two decimal places. The beef should be processed further since the sales price will increase by $??? per pound and the cost only increase by $???? per pound.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education