FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

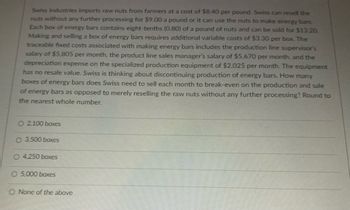

Transcribed Image Text:Swiss Industries imports raw nuts from farmers at a cost of $8.40 per pound. Swiss can resell the

nuts without any further processing for $9.00 a pound or it can use the nuts to make energy bars.

Each box of energy bars contains eight-tenths (0.80) of a pound of nuts and can be sold for $13.20.

Making and selling a box of energy bars requires additional variable costs of $3.30 per box. The

traceable fixed costs associated with making energy bars includes the production line supervisor's

salary of $5,805 per month, the product line sales manager's salary of $5,670 per month, and the

depreciation expense on the specialized production equipment of $2,025 per month. The equipment

has no resale value. Swiss is thinking about discontinuing production of energy bars. How many

boxes of energy bars does Swiss need to sell each month to break-even on the production and sale

of energy bars as opposed to merely reselling the raw nuts without any further processing? Round to

the nearest whole number.

O 2,100 boxes

O 3.500 boxes

O 4,250 boxes

5.000 boxes

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Saskatchewan Soy Products (SSP) buys soy beans and processes them into other soy products. Each tonne of soy beans that SSP purchases for $280 can be converted for an additional $200 into 550 lbs of soy meal and 100 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.48, and soy oil can be sold in bulk for $4.75 per gallon. SSP can process the 550 lbs of soy meal into 700 lbs of soy cookies at an additional cost of $380. Each pound of soy cookies can be sold for $2.48 per pound. The 100 gallons of soy oil can be packaged at a cost of $200 and made into 400 quarts of Soyola. Each quart of Soyola can be sold for $1.35. Required 1. Allocate the joint cost to the cookies and the Soyola using: a. Sales value at splitoff method b. NRV method 2. Should the company have processed each of the products further? What effect does the allocation method have on this decision? www Requirement 1a. Allocate the joint cost to the cookies and the Soyola using the sales value at…arrow_forwardThe Mighty Music Company produces and sells a desktop speaker for $200. The company has the capacity to produce 60,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit-level costs Product-level costs Facility-level costs The company has received a special order for 11,000 speakers. If this order is accepted, the company will have to spend $20,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order? Multiple Choice O O $96.82 $146.82 $104.32 $95 $25 $15 $107.32arrow_forwardThe Slate Company manufactures and sells television sets. Its assembly division (AD) buys television screens from the screen division (SD) and assembles the TV sets. The SD, which is operating at capacity, incurs an incremental manufacturing cost of $65 per screen. The SD can sell all its output to the outside market at a price of $100 per screen, after incurring a variable marketing and distribution cost of $8 per screen. If the AD purchases screens from outside suppliers at a price of $100 per screen, it will incur a variable purchasing cost of $7 per screen. Slate’s division managers can act autonomously to maximize their own division’s operating income. Q. Now suppose that the SD can sell only 70% of its output capacity of 20,000 screens per month on the open market. Capacity cannot be reduced in the short run. The AD can assemble and sell more than 20,000 TV sets per month. a. From the point of view of Slate’s management, how much of the SD output should be transferred to the AD?arrow_forward

- The Fraser Paper Company produces large rolls of white paper weighing 1,000 kilograms for wholesalers for $1,500 each. The wholesalers then cut the paper into standard-sized sheets and package it in 2-kilogram packages. These packages are sold to printers for $4 per package. There is no waste in the cutting process. Fraser Paper currently produces 5 million kilograms of paper annually at a fixed cost of $1 million and a variable cost of $0.80 per kilogram. If Fraser bypassed the wholesalers and cut its own paper for sale directly to printers, Fraser would have to add equipment and personnel with an annual fixed cost of $650,000. Incremental variable costs would be $0.10 per kilogram. Required: 1-a. Calculate the annual profit from further processing. (Enter your answer in whole dollars, not in millions.) Annual profit/loss 1-b. Should Fraser cut its own paper or continue to sell to wholesalers? O Continue to sell to wholesalers O Cut the paper themselvesarrow_forwardUnited Snack Company sells 40-pound bags of peanuts to university dormitories for $48 a bag. The fixed costs of this operation are $509,600, while the variable costs of peanuts are $0.29 per pound. a. What is the break-even point in bags? Break-even point bagsarrow_forwardNervana Soy Products (NSP) buys soybeans and processes them into other soy products. Each ton of soybeans that NSP purchases for $350 can be converted for an additional $210 into 650 lbs of soy meal and 100 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.32 and soy oil can be sold in bulk for $4.5 per gallon. NSP can process the 650 pounds of soy meal into 750 pounds of soy cookies at an additional cost of $300. Each pound of soy cookies can be sold for $2.32 per pound. The 100 gallons of soy oil can be packaged at a cost of $230 and made into 400 quarts of Soyola. Each quart of Soyola can be sold for $1.15. Read the requirements. Requirement 1. Allocate the joint cost to the cookies and the Soyola using the (a) Sales value at splitoff method and (b) NRV method. a. First, allocate the joint cost using the Sales value at splitoff method. (Round the weights to three decimal places and joint costs to the nearest dollar.) Sales value of total production at splitoff…arrow_forward

- Henry Sweet Company currently makes 6-inch candy sticks that it sells for $0.20 each. Henry can make 12-inch candy sticks out of two 6-inch candy sticks by melting them together, which costs an additional $0.03 per 12-inch stick. Henry can sell the 12-inch sticks for $0.45. Henry has enough capacity to make 10,000 6-inch candy sticks per month, and enough demand to sell all of the candy sticks it can manufacture, whether 6- inch or 12-inch. Should Henry sell 6-inch or 12-inch candy sticks, and how much additional profit will its decision bring in per month? Multiple Choice O O Sell 6-inch sticks, additional $100 Sell 6-inch sticks, additional $250 Sell 12-inch sticks, additional $100 Sell 12-inch sticks, additional $250arrow_forwardCorny and Sweet grows and sells sweet corn at its roadside produce stand. The selling price per dozen is $4.00, variable costs are $1.25 per dozen, and total fixed costs are $825.00. How many dozens of ears of corn must Corny and Sweet sell to breakeven?arrow_forwardA small shop in Bulacan fabricates portable threshers for palay producers in the locality. The shop can produce each thresher at a labor cost of P1,800. The cost of materials for each unit is P2,500. The variable costs amount to P650 per unit, while fixed charges incurred per annum totals P69,000. If the portable threshers are sold at P7,800 per unit, how many units must be produced and sold per annum to break-even? Support your answer with computations and also by graphical solution.arrow_forward

- Sony manufactures and sells television sets. Its assembly division (AD) buys television screens from the screen division (SD) and assembles the TV sets. The SD, which is operating at capacity, incurs an incremental manufacturing cost of $60 per screen. The SD can sell all its output to the outside market at a price of $110 per screen, after incurring a variable marketing and distribution cost of $10 per screen. If the AD purchases screens from outside suppliers at a price of $110 per screen, it will incur a variable purchasing cost of $8 per screen. Sony’s division managers can act autonomously to maximize their own division’s operating income. Required: What is the minimum transfer price at which the SD manager would be willing to sell screens to the AD? What is the maximum transfer price at which the AD manager would be willing to purchase screens from the SD? Now suppose that the SD can sell only 80% of its output capacity of 10,000 screens per month on the open market.…arrow_forwardIllion Soy Products (ASP) buys soybeans and processes them into other soy products. Each ton of soybeans that ASP purchases for $250 can be converted for an additional $180 into 700 lbs of soy meal and 80 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.08 and soy oil can be sold in bulk for $4 per gallon. ASP can process the 700 pounds of soy meal into 800 pounds of soy cookies at an additional cost of $370. Each pound of soy cookies can be sold for $2.08 per pound. The 80 gallons of soy oil can be packaged at a cost of $200 and made into 320 quarts of Soyola. Each quart of Soyola can be sold for $1.45. Read the requirements. Requirement 1. Allocate the joint cost to the cookies and the Soyola using the (a) Sales value at splitoff method and (b) NRV method. a. First, allocate the joint cost using the Sales value at splitoff method. (Round the weights to three decimal places and joint costs to the nearest dollar.) Sales value of total production at splitoff…arrow_forwardCarmen Co. can further process Product J to produce Product D. Product J is currently selling for $20.15 per pound and costs $15.25 per pound to produce. Product D would sell for $36.60 per pound and would require an additional cost of $9.05 per pound to produce. The differential cost of producing Product D isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education