FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

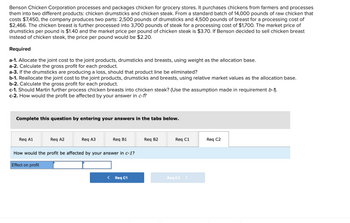

Transcribed Image Text:**Benson Chicken Corporation Case Study**

**Overview:**

Benson Chicken Corporation processes and packages chicken for grocery stores into two different products: chicken drumsticks and chicken steak. Here's a breakdown of their operations and subsequent analysis tasks:

- **Initial Costs and Processing:**

- **Purchase:** 14,000 pounds of raw chicken for $7,450.

- **Outputs:** 2,500 pounds of drumsticks and 4,500 pounds of breasts.

- **Processing Costs:** Drumsticks - $2,466, Breasts further processed into 3,700 pounds of steak - $1,700.

- **Market Prices:**

- **Drumsticks:** $1.40 per pound.

- **Chicken Steak:** $3.70 per pound.

- **Alternative for Breasts:** If sold as is, $2.20 per pound.

**Requirements:**

- **a-1:** Allocate the joint cost between drumsticks and breasts using weight as the allocation base.

- **a-2:** Calculate the gross profit for each product.

- **a-3:** Determine if the drumstick line should be eliminated if it produces a loss.

- **b-1:** Reallocate the joint cost using relative market values as the allocation base.

- **b-2:** Calculate gross profit for each product with the new allocation.

- **c-1:** Decide if it’s better to process chicken breasts into steak (based on requirement b-1).

- **c-2:** Evaluate the effect on profit based on the decision in c-1.

**Interactive Component:**

Participants can enter their responses for each requirement in dedicated tabs labeled Req A1, Req A2, etc. They are encouraged to thoughtfully consider cost allocations and market value impacts when determining profitability and strategic decisions for Benson Chicken Corporation.

Expert Solution

arrow_forward

Step 1

“Since you have posted a question with multiple sub-parts, we will solve first three subparts for you. To get the remaining sub-parts solved, please repost the complete question and mention the sub-parts to be solved.”.

The manufacturing unit manufactures products in the manufacturing unit. When the company got two or more products in a single production process, it's called a joint product.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Healthy Eats produces three products from a single raw material. The total cost is $160,000 and the number of units for each product is as follows: Product A: 10,000 units Product B: 10,000 units Product C: 15,000 units Product A can be sold at the split-off point for $4 per unit, or it can be processed further at a cost of $25,000 and then sold for $10 per unit. Should product A be sold at the split-off point or processed further? Why?arrow_forwardCoffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget include factory overhead of $3,168,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forwardAlmond Treats manufactures various types of cereals that feature almonds. Acme Cereal Company has approached Almond Treats with a proposal to sell the company its top selling cereal at a price of $24,252 for 20,000 pounds. The costs shown are associated with production of 20,000 pounds of almond cereal: Almond Treats cost data Costs Amounts Direct material $12,592 Direct labor 5,810 Manufacturing overhead 8,638 The manufacturing overhead consists of $2,424 of variable costs with the balance being allocated to fixed costs. If Almond Treats buys the cereal, what is the effect on profit? If the effect is negative, use a dash - not parentheses ().arrow_forward

- McKenzie’s Soap Sensations, Inc., produces hand soaps with three different scents: morning glory, snowflake sparkle, and sea breeze. The soap is produced through a joint production process that costs $30,000 per batch. Each batch produces 14,800 bottles of morning glory hand soap, 12,000 bottles of snowflake sparkle hand soap, and 10,000 bottles of sea breeze hand soap at the split-off point. Each product is processed further after the split-off point, but the market value of a bottle of any of the flavors at this point is estimated to be $1.25 per bottle. The additional processing costs of morning glory, snowflake sparkle, and sea breeze hand soap are $0.50, $0.55, and $0.60 per bottle, respectively. Morning glory, snowflake sparkle, and sea breeze hand soap are then sold for $2.00, $2.20, and $2.40 per bottle, respectively. 1. Using the net realizable value method, allocate the joint costs of production to each product. Round your answers to two decimal places. Joint Product…arrow_forwardHelsinki Inc. produces premium bottled water. Helsinki purchases artesian water, stores the water in large tanks, and then runs the water through two processes: Filtration, where workers microfilter and ozonate the water Bottling, where workers bottle and package the filtered water During December, the filtration process incurs the following costs in processing 200,000 liters: Wages of workers operating the filtration equipment $11,100 Wages of workers operating ozonation equipment $12,850 Manufacturing overhead allocated to filtration $24,050 Water $120,000 QUESTIONS: 1. Now, assume that the total costs of the filtration process listed in the previous chart yield 160,000 liters that are completely filtered and ozonated, while the remaining 40,000 liters are only partway through the process at the end of December. Is the cost per completely filtered and ozonated liter higher, lower, or the same as in question 2? Why? At Helsinki, water is added at the beginning of the filtration…arrow_forwardSheffield’s Nut House is a processor and distributor of a variety of different nuts. The company buys nuts from around the world and roasts, seasons, and packages them for resale. Sheffield’s Nut House currently offers 15 different types of nuts in one-pound bags through catalogs and gourmet shops. The company’s major cost is that of the raw nuts; however, the predominantly automated roasting and packing processes consume a substantial amount of manufacturing overhead cost. The company uses relatively little direct labor.Some of Sheffield’s nuts are very popular and sell in large volumes, but some of the newer types sell in very low volumes. Sheffield’s prices its nuts at cost (including overhead) plus a markup of 50%. If the resulting prices of certain nuts are significantly higher than the market price, adjustments are made. Although the company competes primarily on the quality of its products, customers are price conscious.Data for the annual budget include manufacturing overhead…arrow_forward

- Sugar beets are batch-processed at Kosakowski Corporation. Farmers charge $66 for a batch of sugar beets, and the company's facility charges $17 to crush them. Beet fibre and juice, two intermediate products, are produced during the crushing process. The beet fibre may be sold for $23 if it is sold as is, or it can be processed further for $13 to produce industrial fibre, which can be sold for $36. The price of the beet juice is $42, or it can be processed further for $20 to create refined sugar, which is then sold for $84. How much more money does the business make (lose) while processing one batch of sugar beets into refined sugar and industrial fibre?a. $22b. ($18)c. ($116)d. $4arrow_forwardBronte Confections is known for its rich dark chocolate fudge. Bronte sells its fudge to local retailers. A "unit" of fudge is a 10-pound batch. The standard quantities of ingredients for a batch include 6 cups of sugar, 23 ounces of chocolate chips, 13 ounces of butter, and 25 ounces of evaporated milk. The standard costs for each of the ingredients are as follows: $0.25 per cup of sugar, $0.14 per ounce of chocolate chips, $0.11 per ounce of butter, and $0.08 per ounce of evaporated milk. Calculate the standard direct material cost per batch of fudge. Calculate the standard direct material (DM) cost per batch of fudge. (Enter all dollar amounts to two decimal places.) Standard Quantity X Standard Price Standard Cost Sugar per cup Chocolate chips per ounce Butter per ounce Evaporated milk per ounce Standard DM cost per batch X Xarrow_forwardCrane Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $179,800 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sulu Incremental profit (loss) Sales Value at Split-Off Point Spock Uhura $209,700 Sulu 300,900 454,100 Save for Later $ Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45).) sold as is Allocated Joint Costs $39.700 60,700 79,400 Spock process further Cost to Process Further $110,400 process further 85,100 249,700 $ Sales Value of Processed Product Indicate whether each of the…arrow_forward

- carrow_forwardAccountarrow_forwardKirk Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $178,800 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sulu Sales Value at Split-Off Point $211,000 299,200 455,600 Allocated Joint Costs Incremental profit (loss) $ $39,700 59,800 79,300 Cost to Process Further $110,800 Spock 85,200 250,000 Sales Value of Processed Product $300,100 400,200 Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 800,800 Uhura Suluarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education