FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

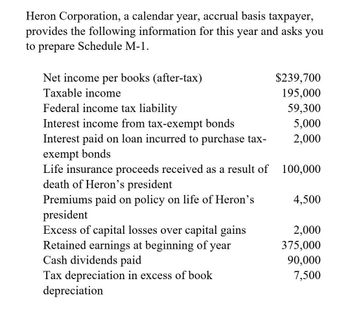

Transcribed Image Text:Heron Corporation, a calendar year, accrual basis taxpayer,

provides the following information for this year and asks you

to prepare Schedule M-1.

Net income per books (after-tax)

$239,700

Taxable income

195,000

Federal income tax liability

59,300

Interest income from tax-exempt bonds

5,000

Interest paid on loan incurred to purchase tax-

2,000

exempt bonds

Life insurance proceeds received as a result of 100,000

death of Heron's president

Premiums paid on policy on life of Heron's

4,500

president

Excess of capital losses over capital gains

2,000

Retained earnings at beginning of year

375,000

Cash dividends paid

90,000

Tax depreciation in excess of book

7,500

depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- LSG Company is a calendar year, cash basis taxpayer. On November 1, 2021, LSG paid $9,450 to the janitorial service that cleans their offices. How much of this expenditure can LSG deduct in 2021 assuming that: The expenditure is a prepayment for 6 months of cleaning services from November 2021 through April 2022? _____________________________________________________________________________________ _____________________________________________________________________________________ The expenditure is a prepayment for 18 months of cleaning services from November 2021 through April 2023? _________arrow_forwardSophie is a single taxpayer. For the first payroll period in July 2022, she is paid wages of $1,100 semimonthly. Sophie claims one allowance on her pre-2020 Form W-4. Click here to access the withholding tables. IRS Publication 15-T, Federal Income Tax Withholding Method Pay period 2022 Allowance Amount Weekly $ 83 Biweekly 165 Semimonthly 179 Monthly 358 Quarterly 1,075 Semiannually 2,150 Annually 4,300 Round intermediate computations and your final answer to two decimal places. a. Use the percentage method to calculate the amount of Sophie's withholding for a semimonthly pay period. Sophie's withholding: $ 921 Xarrow_forwardSubject : Accounting 4- A taxpayer filing as Single has $25,600 of taxable income. Included in gross income is a 1099-INT with Box 1 interest income of $5,000, tax-exempt interest of $3,000, and interest on U.S. savings bonds of$1,200. Additionally, the taxpayer has a 1099-DIV with dividend income of $3,000, of which $2,000 is qualified dividends, and capital gains distributions of $500. Is the following statement accurate about this scenario? The total taxable interest and dividends on the federal tax return is $9,200.arrow_forward

- Subject: accountingarrow_forwardDengerarrow_forwardPrime Corp. is an accrual basis, calendar year C corporation. Its current year reported book income before federal income taxes was $300,000, which included $17,000 corporate bond interest income. A $20,000 expense for term life insurance premiums on corporate officers was incurred. Prime was the policy owner and beneficiary. What was Prime's current year taxable income as reconciled on Prime's Schedule M-1, Reconciliation of Income (Loss) per Books With Income per Return, of Form 1120, U.S. Corporation Income Tax Return? A. $320,000 B. $300,000 C. $283,000 D. $280,000arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Clyde is a cash-method taxpayer who reports on a calendar-year basis. This year Paylate Corporation has decided to pay Clyde a year-end bonus of $1,000. Determine the amount Clyde should include in his gross income this year under the following circumstances. (Leave no answer blank. Enter zero if applicable.) c. Paylate Corporation mailed the check to Clyde before the end of the year (and it was delivered before year-end). Although Clyde expected the bonus payment, he decided not to collect his mail until after year-end. Amount to be included in gross incomearrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] BCS Corporation is a calendar-year, accrual-method taxpayer. BCS was formed and started its business activities on January 1 of this year. It reported the following information for the year. Indicate BCS's deductible amount for this year in each of the following alternative scenarios. (Leave no answers blank. Enter zero if applicable.) d. In June of this year, a display of BCS’s product located in its showroom fell and injured a customer. The customer sued BCS for $500,000. The case is scheduled to go to trial next year. BCS was required to pay $500,000 to a court-appointed escrow fund this year. If BCS loses the case next year, the money from the escrow fund will be transferred to the customer suing BCS.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education