FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

ss

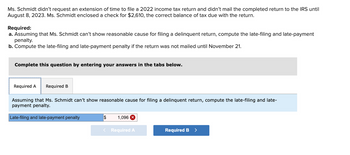

Transcribed Image Text:Ms. Schmidt didn't request an extension of time to file a 2022 income tax return and didn't mail the completed return to the IRS until

August 8, 2023. Ms. Schmidt enclosed a check for $2,610, the correct balance of tax due with the return.

Required:

a. Assuming that Ms. Schmidt can't show reasonable cause for filing a delinquent return, compute the late-filing and late-payment

penalty.

b. Compute the late-filing and late-payment penalty if the return was not mailed until November 21.

Complete this question by entering your answers in the tabs below.

Required A Required B

Assuming that Ms. Schmidt can't show reasonable cause for filing a delinquent return, compute the late-filing and late-

payment penalty.

Late-filing and late-payment penalty

$ 1,096 X

< Required A

Required B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Define charterarrow_forwardanswer pls..arrow_forwardThe following information pertains to Sage Hill Solar Panels, Inc. Sold $144,000 of solar panels to Oriole Company with terms 2/15, n/30. Sage Hill uses the gross method to record cash discounts. Sage Hill estimates allowances of $1,500 will be honored on this sale. July 1 Sold $88,000 of solar panels to Cheyenne Corp. with terms of 3/10, n/60. Sage Hill expects no allowances related to 12 this sale. 18 Cheyenne Corp. paid Sage Hill for its July 12 purchase. Oriole calls to indicate that the panels purchased on July 1 work well, but the color is not quite right. Sage Hill grants a credit of $2,000 as compensation. 20 29 Oriole Company paid Sage Hill for its July 1 purchase. 31 Sage Hill expects allowances of $4,380 to be grated in the future related to solar panel sales in July. Prepare the necessary journal entries for Sage Hill. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education