FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I want to correct answer general accounting question

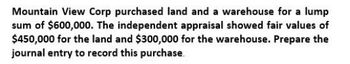

Transcribed Image Text:Mountain View Corp purchased land and a warehouse for a lump

sum of $600,000. The independent appraisal showed fair values of

$450,000 for the land and $300,000 for the warehouse. Prepare the

journal entry to record this purchase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,710,000. Harding paid $455,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $481,000; Building, $1,430,000 and Equipment, $949,000. What journal entry would be used to record the purchase of the above assets? (Do not round intermediate calculations.)arrow_forwardRegal Properties (RP) just acquired land and a building for a single sum of $500,000. An independent appraisal determined the fair values of the assets (if purchased separately) at $350,000 for the land and $250,000 for the building. Prepare the journal entry in table format to record the purchase of the land and building. Need answerarrow_forwardFresh Veggies, Incorporated (FVI), purchases land and a warehouse for $490,000. In addition to the purchase price, FVI makes the following expenditures related to the acquisition: broker's commission, $29,000; title insurance, $1,900; and miscellaneous closing costs, $6,000. The warehouse is immediately demolished at a cost of $29,000 in anticipation of building a new warehouse. Determine the cost of the land and record the purchase (assuming cash was paid for all expenditures). (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the purchase of the land. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general Journalarrow_forward

- Pinewood Company purchased two buildings on four acres of land. The lump-sum purchase price was $1,800,000. According to independent appraisals, the fair values were $855,000 (building A) and $475,000 (building B) for the buildings and $570,000 for the land. Required:Determine the initial valuation of the buildings and the land.arrow_forwardCarver Inc. purchased a building and the land on which the building is situated for a total cost of $922,800 cash. The land was appraised at $244,081 and the building at $817,139. What is the accounting term for this type of acquisition? Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. Would the company recognize a gain on the purchase? Record the purchase in a horizontal statements model.arrow_forwardTonto Company purchased all property for $280,000. The property included a building, equipment, and land. The building was appraised at $175,000, the land at $126,000, and the equipment at $49,000. Prepare the journal entry to record the property basket purchase.arrow_forward

- Buckeye Co. purchased equipment, a building, and land for $500,000 ($200,000 in cash and $300,000 in notes). After the purchase, the property was appraised. Fair market values were determined to be $120,000 for the equipment, $270,000 for the building, and $210,000 for the land. Prepare the entry to record the purchase of this property by Buckeye Co.arrow_forwardFresh Veggies, Inc. (FVI), purchases land and a warehouse for $490,000. In addition to the purchase price, FVI makes the following expenditures related to the acquisition: broker’s commission, $29,000; title insurance, $1,900; and miscellaneous closing costs, $6,000. The warehouse is immediately demolished at a cost of $29,000 in anticipation of building a new warehouse. Determine the amount FVI should record as the cost of the land.arrow_forwardCarver Inc. purchased a building and the land on which the building is situated for a total cost of $700,000 cash. The land was appraised at $320,000 and the building at $480,000. Required What is the accounting term for this type of acquisition? Determine the amount of the purchase cost to allocate to the land and the amount to allocate to the building. Would the company recognize a gain on the purchase? Record the purchase in a horizontal statements model.arrow_forward

- Samtech Manufacturing purchased land and a building for $4 million. In addition to the purchase price, Samtech made the following expenditures in connection with the purchase of the land and building: Title insurance Legal fees for drawing the contract Pro-rated property taxes for the period after acquisition State transfer fees An independent appraisal estimated the fair values of the land and building, if purchased separately, at $3.2 and $1.8 million, respectively. Shortly after acquisition, Samtech spent $92,000 to construct a parking lot and $50,000 for landscaping. Required: 1. Determine the initial valuation of each asset Samtech acquired in these transactions. 2. Determine the initial valuation of each asset, assuming that immediately after acquisition, Samtech demolished the building. Demolition costs were $350,000 and the salvaged materials were sold for $6,000. In addition, Samtech spent $89,000 clearing and grading the land in preparation for the construction of a new…arrow_forwardPlease help mearrow_forwardSamtech Manufacturing purchased land and a building for $4 million. In addition to the purchase price, Samtech made the following expenditures in connection with the purchase of the land and building: Title insurance. Legal fees for drawing the contract Pro-rated property taxes for the period after acquisition State transfer fees $ 25,000 9,500 45,000 4,900 An independent appraisal estimated the fair values of the land and building, if purchased separately, at $3 and $2 million, respectively. Shortly after acquisition, Samtech spent $91,000 to construct a parking lot and $49,000 for landscaping. Required: 1. Determine the initial valuation of each asset Samtech acquired in these transactions. 2. Determine the initial valuation of each asset, assuming that immediately after acquisition, Samtech demolished the building. Demolition costs were $340,000 and the salvaged materials were sold for $5,500. In addition, Samtech spent $88,000 clearing and grading the land in preparation for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education