FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

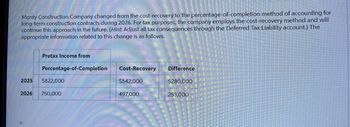

Transcribed Image Text:Monty Construction Company changed from the cost-recovery to the percentage-of-completion method of accounting for

long-term construction contracts during 2026. For tax purposes, the company employs the cost-recovery method and will

continue this approach in the future. (Hint. Adjust all tax consequences through the Deferred Tax Liability account.) The

appropriate information related to this change is as follows.

Pretax Income from

Percentage-of-Completion

2025 $822,000

2026 750,000

Cost-Recovery

$542,000

497,000

Difference

$280,000

253,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Computing and Reporting Deferred Income TaxesEarly in January 2019, Oler, Inc., purchased equipment costing $24,000. The equipment had a 2‑year useful life and was depreciated in the amount of $12,000 in 2019 and 2020. Oler deducted the entire $24,000 on its tax return in 2019. This difference was the only one between its tax return and its financial statements. Oler’s income before depreciation expense and income taxes was $354,000 in 2019 and $367,500 in 2020. The tax rate in each year was 25%. Requireda. What amount of deferred tax liability should Oler report in 2019 and 2020? 2019 2020 b. Prepare the journal entries to record income taxes for 2019 and 2020. General Journal Description Debit Credit Income taxes payable To record income taxes for 2019. Income tax expense To record income taxes for 2020. c. Repeat requirement b if in 2019 the U.S. enacts a permanent tax rate change to be effective in…arrow_forwardSINCO Ltd. purchased a piece of equipment in the year 2018 for the sum of $ 200,000. The company is subject to a tax depreciation rate of 25%. According to the following table, what is the depreciation allowance that this company can claim in 2020? (in the following picture : Année is year)arrow_forwardDengararrow_forward

- a. b Below are the taxable profits and losses for the past few years along with the tax rates on income reported for Olive Company. 2025 2026 2027 Income ($275,000) $70,000 $260,000 Tax Rate 20% 20% 20% Olive elects to use the carry forward procedures with no valuation allowance and strongly anticipates future profits to recover losses. Record the tax effect of the above for 2025 Show the income tax section and loss section of the income statement for 2025arrow_forwardSubject :- Account At the end of 2024, its first year of operations, Blossom Company prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $2,890,000 Estimated litigation expense 3890000 Extra depreciation for taxes (5892000) Taxable income $888,000 The estimated litigation expense of $3890000 will be deductible in 2025 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $1964000 in each of the next 3 years. The income tax rate is 20% for all years. The deferred tax asset at the end of 2024 to be recognized isarrow_forwardGudubhaiarrow_forward

- Nonearrow_forwardHi there, Need help with attached question, thanks kindly!arrow_forwardWildhorse Company has the following two temporary differences between its income tax expense and income taxes payable. 2025 2026 2027 Pretax financial income $820,000 $927,000 $912,000 Excess depreciation expense on tax return (28,700) (42,000) (9,700) Excess warranty expense in financial income Taxable income 20,100 10,400 7,800 $811,400 $895,400 $910,100 The income tax rate for all years is 20%. (a) Your answer is partially correct. Assuming there were no temporary differences prior to 2025, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2025, 2026, and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)arrow_forward

- Nonearrow_forwardHardevarrow_forwardConcord Construction Company changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2021. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. (Hint: Adjust all tax consequences through the Deferred Tax Liability account.) The appropriate information related to this change is as follows. Pretax Income from: Percentage-of-Completion Completed-Contract Difference 2020 $747,000 $539,000 $208,000 2021 673,000 468,000 205,000 (a) Assuming that the tax rate is 30%, what is the amount of net income that would be reported in 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education