FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:a.

b

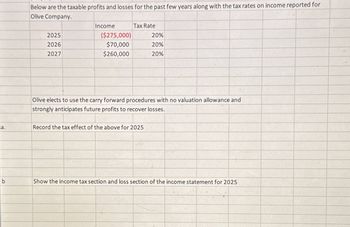

Below are the taxable profits and losses for the past few years along with the tax rates on income reported for

Olive Company.

2025

2026

2027

Income

($275,000)

$70,000

$260,000

Tax Rate

20%

20%

20%

Olive elects to use the carry forward procedures with no valuation allowance and

strongly anticipates future profits to recover losses.

Record the tax effect of the above for 2025

Show the income tax section and loss section of the income statement for 2025

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- H4arrow_forwardGreene Co. has pretax book income for the year ended December 31, 2022 in the amount of $315,000 and has a tax rate of 30%. Depreciation for tax purposes exceeded book depreciation by $10,500.What should Greene Co. record as its deferred tax liability for 2022? Group of answer choices $94,500 $0 $91,350 $3150arrow_forwardCurrent Attempt in Progress Wildhorse Inc. reports the following pre-tax incomes (losses) for both financial reporting purposes and tax purposes: Year 2021 2022 2023 2024 Accounting Income (Loss) $129,000 94,000 (302,000) 221,000 Tax Rate 25 % 25 % 30 % 30 % The tax rates listed were all enacted by the beginning of 2021. Wildhorse reports under the ASPE future income taxes method.arrow_forward

- Violet Corporation reported a loss in 2022 of $610,000 and carried back the loss to the extent allowed. The company reported taxable income of $215,000 in 2020 and $245,000 in 2021. It has no permanent or temporary differences and its tax rate is 30%.Violet reported taxable income of $345,000 in 2023. What is the necessary journal entry for 2023? Group of answer choices Income Tax Expense 183,000 Income Tax Payable 138,000 Deferred Tax Asset 45,000 Income Tax Expense 103,500 Income Tax Payable 58,500 Deferred Tax Asset 45,000 Income Tax Refund Receivable 138,000 Deferred Tax Asset 45,000 Income Tax Benefit 183,000 Income Tax Refund Receivable 58,500 Deferred Tax Asset 45,000 Income Tax Benefit 103,500arrow_forwardThe pretax financial income (or loss) figures for Shamrock Company are as follows. 2017 81,000 2018 (51,000 ) 2019 (35,000 ) 2020 111,000 2021 95,000 Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years.Prepare the journal entries for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforwards. All income and losses relate to normal operations. (In recording the benefits of a loss carryforward, assume that no valuation account is deemed necessary.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit 2017 enter an account title to record carryback enter a debit amount enter a…arrow_forwardcarala vista company has the following two temporary difference between its income tax expense and income taxes payable 2025 2026 2027 pretax financial income 854,000. 949,000. 962,000 excess deprecaition expense on tax return (29,800. (41,800) (9900) excess warranty expense in financial income 19800 10500 8100 taxable income 844000 917700 960200 the income tax rate for all years is 20% indicate how deferred taxes will be reported on the 2027 balance sheet carla vistas product warranty is or 12 monthsarrow_forward

- Caesar Corporation reported income before taxes of $220,000 for the years 2020, 2021, and 2022. In 2023 they experienced a loss of $220,000. The company had a tax rate of 35% in 2020 and 2021, and a rate of 45% in 2022 and 2023. Assuming Caesar uses the carryback provisions for the net operating loss, by what amount will the income tax benefit reduce the net loss in 2023? Group of answer choices $88,000 $77,000 $99,000 $220,000arrow_forwardh3arrow_forwardGudubhaiarrow_forward

- Blossom Ltd. reported the following income for each of the years indicated. For each year, accounting income and income for tax purposes were the same. All tax rates indicated were enacted by the beginning of 2023. Blossom's policy is to carry back any tax losses first before carrying forward any remaining losses to future years. Year Income/(Loss) Tax Rate 2023 55,000 25% 2024 65,600 28% 2025 14,600 30% 2026 (145,700) 33% 2027 (73,800) 27% 2028 93,400 27% Prepare the journal entries for the years 2023 to 2028 to record income taxes. Assume that, at the end of each year, the loss carryforward benefits are judged more likely than not to be realized in the future. Blossom Ltd. follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and List all debit dit atrios)arrow_forwardWildhorse Company has the following two temporary differences between its income tax expense and income taxes payable. 2025 2026 2027 Pretax financial income $820,000 $927,000 $912,000 Excess depreciation expense on tax return (28,700) (42,000) (9,700) Excess warranty expense in financial income Taxable income 20,100 10,400 7,800 $811,400 $895,400 $910,100 The income tax rate for all years is 20%. (a) Your answer is partially correct. Assuming there were no temporary differences prior to 2025, prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2025, 2026, and 2027. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.)arrow_forwarddon't give answer in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education