FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Hi there,

Need help with attached question, thanks kindly!

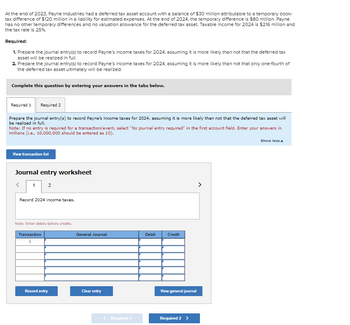

Transcribed Image Text:At the end of 2023, Payne Industries had a deferred tax asset account with a balance of $30 million attributable to a temporary book-

tax difference of $120 million in a liability for estimated expenses. At the end of 2024, the temporary difference is $80 million. Payne

has no other temporary differences and no valuation allowance for the deferred tax asset. Taxable income for 2024 is $216 million and

the tax rate is 25%.

Required:

1. Prepare the journal entry(s) to record Payne's income taxes for 2024, assuming it is more likely than not that the deferred tax

asset will be realized in full.

2. Prepare the journal entry(s) to record Payne's income taxes for 2024, assuming it is more likely than not that only one-fourth of

the deferred tax asset ultimately will be realized.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare the journal entry(s) to record Payne's income taxes for 2024, assuming it is more likely than not that the deferred tax asset will

be realized in full.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in

millions (i.e., 10,000,000 should be entered as 10).

View transaction list

Journal entry worksheet

<

1

2

Record 2024 income taxes.

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Required 1

Debit

Credit

View general journal

Required 2 >

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi can u post this transaction for me please ( the current Answers are wrong)arrow_forwardgu an inlo channel. 6. Effective communication means the transference and understanding of meaning, but you cannot know if someone has received your message and comprehended it in the way you intended unless you seek O informal communication. O one-way communication. Ononverbal communication. O feedback. o search 84°F Mostly sunny 近arrow_forwardplease help mearrow_forward

- In the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardI need help with questions 1 and 2arrow_forwardCould you show me to solve this problem step by step. Pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education