FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

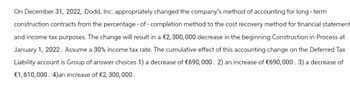

Transcribed Image Text:On December 31, 2022, Dodd, Inc. appropriately changed the company's method of accounting for long-term

construction contracts from the percentage-of-completion method to the cost recovery method for financial statement

and income tax purposes. The change will result in a €2,300,000 decrease in the beginning Construction in Process at

January 1, 2022. Assume a 30% income tax rate. The cumulative effect of this accounting change on the Deferred Tax

Liability account is Group of answer choices 1) a decrease of €690,000. 2) an increase of €690,000. 3) a decrease of

€1,610,000. 4)an increase of €2,300,000.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- At the beginning of 2021, a company had future deductible amounts of $400,000 and the enacted tax rate was 27%. In October 2021, a new income tax act is signed into law that lowers the tax rate to 20% for 2022 and future years. To record the change, the company will (enter 1, 2, 3, or 4 that represents the correct answer): Credit Income Tax Expense by $28,000. Debit Income Tax Expense by $28,000. Credit Deferred Tax Liability by $28,000. Debit Deferred Tax Asset by $28,000.arrow_forwardDry Valley Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2026: Income from continuing operations before income taxes Gain on disposal of discontinued component Loss from operations of discontinued component Dry Valley is subject to a 20% tax rate. Instructions $120,000 28,000 (60,000) Prepare the December 31, 2026, income statement for Dry Valley Corporation, starting with income from continuing operations before income taxes.arrow_forwardA company made $49,000 in installment sales in 2021 and will receive payment from customers in 2022-2025. Taxable income for 2021 is $588,000, the enacted tax rate is 20% for all years, this is the only difference between pretax financial income and taxable income, and there were no deferred taxes at the beginning of 2021. What amount of income tax expense should the company report at the end of 2021?arrow_forward

- Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $75 million. At December 31, 2020, Lance reported a deferred tax asset of $471,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year. Required: Prepare the appropriate journal entry to record Lance's income tax provision for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet > Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journalarrow_forwardNSync Manufacturing has a deferred tax asset account with a balance of P300,000 at the end of 2015 due to a single cumulative temporary difference of P 750,00. At the end of 2016, this same temporary difference has increased to a cumulative amount of P1,000,000. Taxable income for 2016 is P1,700,000. The tax rate is 40% for 2016, but enacted tax rates for all future years are 35%. Assuming it’s probable that 70% of the deferred tax asset will be realized, what amount will be reported on NSync manufacturing statement of financial position for the deferred tax asset at December 31, 2016arrow_forwardAt the beginning of 2025, Pronghorn Construction Company changed from the cost-recovery method to recognizing revenue over time (percentage-of-completion) for financial reporting purposes. The company will continue to use the cost- recovery method for tax purposes. For years prior to 2025, pretax income under the two methods was as follows: percentage-of-completion $114,200, and cost-recovery $78,200. The tax rate is 40%. Pronghorn has a profit-sharing plan, which pays all employees a bonus at year-end based on 2% of pretax income. Compute the indirect effect of Pronghorn's change in accounting principle that will be reported in the 2025 income statement, assuming that the profit-sharing contract explicitly requires adjustment for changes in income numbers. Indirect effectarrow_forward

- Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $80 million. At December 31, 2020, Lance reported a deferred tax asset of $461,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year. Required:Prepare the appropriate journal entry to record Lance’s income tax provision for 2021.arrow_forwardB Co. reported a deferred tax liability of $26.0 million for the year ended December 31, 2017, related to a temporary difference of $65 million. The tax rate was 40%. The temporary difference is expected to reverse in 2019 at which time the deferred tax liability will become payable. There are no other temporary differences in 2017–2019. Assume a new tax law is enacted in 2018 that causes the tax rate to change from 40% to 30% beginning in 2019. (The rate remains 40% for 2018 taxes.) Taxable income in 2018 is $95 million. Required:Determine the effect of the change and prepare the appropriate journal entry to record B’s income tax expense in 2018.arrow_forwardDuring 2021, Raines Umbrella Corporation had sales of $760,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $550,000, $90,000, and $95,000, respectively. In addition, the company had an interest expense of $94,000 and a tax rate of 21 percent. (Ignore any tax loss carryforward provisions and assume that interest is fully deductible.) a. What is the company's net income for 2021? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.) b. What is its operating cash flow? (Do not round intermediate calculations.)arrow_forward

- a. 1 B 4 5 6 7 8 9 0 -1 2 3 54 55 56 67 58 59 70 Direct Materials Variance Price variance: Actual price Standard price Variance Actual quantity (lbs.) Direct materials price variance (favorable) unfavorable Quantity variance: Actual quantity used (lbs.) Standard quantity used (lbs.) Variance (lbs.) Standard price Direct materials quantity variance (favorable) unfavorable Total direct materials cost variance (favorable) unfavorable Total direct materials cost variance: Actual cost Standard cost Total direct materials cost variance (favorable) unfavorable Supporting calculations: Standard quantity used of cocoa: Cases produced Standard amount per case (lbs.) Total Standard quantity used of sugar: Cases produced Standard amount per case (lbs.) Total Direct Labor Variance Rate variance: Actual rate Standard rate Variance Actual time Direct labor rate variance (favorable) unfavorable Time variance Actual tiime Standard time Variance Standard rate Direct labor time variance (favorable)…arrow_forwardGiada Foods reported $970 million in income before income taxes for 2021, its first year of operations. Tax depreciation exceeded depreciation for financial reporting purposes by $130 million. The company also had non-tax-deductible expenses of $92 million relating to permanent differences. The income tax rate for 2021 was 25%, but the enacted rate for years after 2021 is 30%. The balance in the deferred tax liability in the December 31, 2021, balance sheet is:arrow_forwardDuring 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $405,000 for financial reporting and tax purposes. During 2025, Baginski reported income of $225,000 for financial reporting and tax purposes. The enacted tax rate is 25%. Required: Prepare the journal entry to recognize Baginski’s 2025 tax expense or tax benefit. Show the lower portion of the 2025 income statement that reports income tax expense or benefit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education