FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

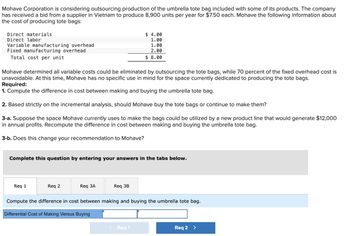

Transcribed Image Text:Mohave Corporation is considering outsourcing production of the umbrella tote bag included with some of its products. The company

has received a bid from a supplier in Vietnam to produce 8,900 units per year for $7.50 each. Mohave the following information about

the cost of producing tote bags:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Total cost per unit

Mohave determined all variable costs could be eliminated by outsourcing the tote bags, while 70 percent of the fixed overhead cost is

unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags.

Required:

1. Compute the difference in cost between making and buying the umbrella tote bag.

2. Based strictly on the incremental analysis, should Mohave buy the tote bags or continue to make them?

3-a. Suppose the space Mohave currently uses to make the bags could be utilized by a new product line that would generate $12,000

in annual profits. Recompute the difference in cost between making and buying the umbrella tote bag.

3-b. Does this change your recommendation to Mohave?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2

Req 3A

$ 4.00

1.00

1.00

2.00

$ 8.00

Req 3B

Compute the difference in cost between making and buying the umbrella tote bag.

Differential Cost of Making Versus Buying

< Req 1

Req 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Day Star collected the following information: Cost to buy one unit Production costs per unit: Direct materials Direct labour Variable overhead Total fixed overhead Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for $2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs under the renting alternative. A) buy Based on the above information only, should Day Star make or buy the product or rent its facilities out? B) make $22 $16 $2 $360,000 C) either make or buy - indifferent $48 D) rent the facilities to the subsidiary E) either make or rent - indifferentarrow_forwardThe Salsa Division of the Spicy Foods Company has provided you with the following information at a volume of 40,000 bottles: Cost Per unit Direct material $8.00 Direct labor $4.00 Variable overhead $3.00 Fixed overhead - Traceable $6.00 Fixed overhead - Allocated $5.00 Total $26.00 An outside vendor has approached Salsa and offered to produce 30,000 bottles of salsa at a price of $22.00 per unit. By outsourcing, the company could begin operating a new line of Hot Sauce that is expected to generate sales of $500,000. Outsourcing will also allow Salsa to eliminate 30% of the division's traceable fixed overhead. NOTE: The contribution margin ratio for Hot Sauce = 40%. Determine the impact on income if Salsa accepts the outside supplier's offer.arrow_forwardHow do I prepare an analysis showing whether Jensen should process the assemblies further?arrow_forward

- Stripe Company has been purchasing a component, Part Q, for P19.20 per unit. Stripe is currently operating at 70% of capacity, and no significant increase in production is anticipated in the near future. The cost of manufacturing a unit of Part Q is estimated as follows: Direct materials P11.50 Direct labor 4.50 Variable factory overhead 1.12 Fixed factory overhead 3.15 Total P20.27 Should the company make or buy the component? Prepare a differential analysis report dated March 12 of the current year to support your answer.arrow_forwardVoltaic Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 36,000 parts is $ 100,000, which includes fixed costs of $ 40,000 and variable costs of $ 60,000. The company can buy the part from an outside supplier for $2 per unit and avoid 20% of the fixed costs. Assume that the company can use the freed manufacturing space to make another product that can earn a profit of $ 15,000. If Voltaic outsources, what will be the effect on operating income?A. decrease of $11,000B. increase of $ 11,000C. increase of $ 15,000D . decrease of $ 8,000arrow_forwardVista Company manufactures electronic equipment. It currently purchases the special switches used in each of its products from an outside supplier. The supplier charges Vista $5.20 per switch. Vista 's CEO is considering purchasing either machine A or machine B so the company can manufacture its own switches. The projected data are as follows: Machine A Machine B Annual fixed costs $ 582, 450 $ 792, 100 Variable cost per switch 1.67 0.75 Required: 1. For each machine, what is the minimum number of switches that Vista must make annually for total costs to equal outside purchase cost? 2. What volume level would produce the same total costs regardless of the machine purchased? 3. What is the most profitable alternative for producing 230,000 switches per year and what is the total cost of that alternative?arrow_forward

- Leach Finishing makes various metal fittings for the construction industry. Three of the fittings, models X-12, X-24, and X-30, require grinding on a patented machine of which Leach has only one. The cost of production information for the three products follow: X-12 $35 $ 20 18.0 Price per fitting Variable cost per fitting Units per hour of grinding The testing machine used for both models has a capacity of 3,230 hours annually. Fixed manufacturing costs are $496,000 annually. Required A Required B X-24 $ 51 $ 27 12.5 Required: a. Suppose that Leach Finishing can sell at most 59,200 units of any one fitting. How many units of each fitting model should Leach Finishing produce annually? b. Suppose that Leach Finishing can sell at most 18,000 units of any one fitting. How many units of each fitting should Leach Finishing produce annually? X-30 $ 70 $ 44 10.0 Complete this question by entering your answers in the tabs below. X-12 X-24 X-30 units units units Suppose that Leach Finishing can…arrow_forwardValue Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 32,000 parts is $90,000, which includes fixed costs of $30,000 and variable costs of $60,000. The company can buy this part from an external supplier for $5 per unit and avoid 10% of the fixed costs. If Value Electronics decides to outsource the production of the part, how will it impact its operating income? A. Operating income increases by $97,000. B. Operating income decreases by $100,000. C. Operating income decreases by $97,000. D. Operating income increases by $100,000.arrow_forwardJade Ltd. manufactures a product, which regularly sells for $67.75. This product has the following costs per unit at the expected production of 47,500 units: Cost Amount Direct labour $20.00 Direct materials 10.50 Manufacturing overhead (36% is variable) 24.00 The company has the capacity to produce 52,250 units. A wholesaler has offered to pay $77 for 12,000 units. If Jade Ltd. accepts this special order, operating income would increase (decrease) by how much?arrow_forward

- Smooth Company manufactures decorative mugs and has been approached by a new customer with an offer to purchase 15,000 units at a price of P70/unit. The new customer is geographically separated from Smooth Company's other customers and existing sales will not be affected. Smooth Company normally produce and sell only 65,000 units in the year. The normal sales price is P120 per unit. Production cost information is as follows: Direct materials P30.00 P22.50 P11.50 Direct labor Variable overhead Fixed overhead P18.00 If Smooth Company accepted the order, they would have to purchase a special logo labelling machine that will cost P120,000. The machine will be used to label the 15,000 units and will be scrapped afterwards. In addition, each logo requires additional direct materials of P2.00. Which alternative is best for Smooth Company? By how much profit will increase or decrease if the order is accepted?arrow_forwardTolkien Transporthas a small facility adjacent to its Leeds depot which it uses to manufacture tarpaulins for its lorries. The facility currently produces3000 tarpaulins a year. The company’s Finance Manager has estimated the cost per tarpaulin at this level of output to be: Cost per unit Direct Materials £50 Direct Labour (cutting, trimming and sewing) £45 Variable manufacturing overhead £37 Fixed manufacturing overhead £43 An outside supplier has offered to supply all the tarpaulins required by Tolkien for £145 each. If Tolkien decided not to make the tarpaulins, there would be no other use for the production facilities and none of the fixed manufacturing overhead cost could be avoided. Required: Calculate how much higher or lower Tolkien’s net operating income would be if it purchased the tarpaulins from the outside supplier, showing all calculations. Would you advise Tolkien to accept the offer? Clearly explain to Tolkien’s Finance…arrow_forwardPlease solve this onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education