FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

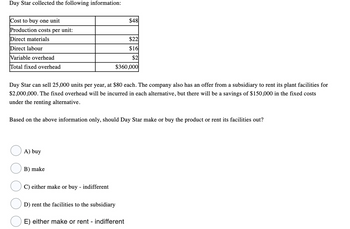

Transcribed Image Text:Day Star collected the following information:

Cost to buy one unit

Production costs per unit:

Direct materials

Direct labour

Variable overhead

Total fixed overhead

Day Star can sell 25,000 units per year, at $80 each. The company also has an offer from a subsidiary to rent its plant facilities for

$2,000,000. The fixed overhead will be incurred in each alternative, but there will be a savings of $150,000 in the fixed costs

under the renting alternative.

A) buy

Based on the above information only, should Day Star make or buy the product or rent its facilities out?

B) make

$22

$16

$2

$360,000

C) either make or buy - indifferent

$48

D) rent the facilities to the subsidiary

E) either make or rent - indifferent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Mighty Safe Fire Alarm is currently buying 61,000 motherboards from MotherBoard, Inc. at a price of $63 per board. Mighty Safe is considering making its own motherboards. The costs to make the motherboards are as follows: direct materials, $34 per unit; direct labor, $11 per unit; and variable factory overhead, $14 per unit. Fixed costs for the plant would increase by $80,000. Which option should be selected and why? a.make, $244,000 increase in profits b.buy, $164,090 more in profits c.buy, $80,000 more in profits d.make, $164,090 increase in profitsarrow_forwardAdams Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $5,900 6,200 3,500 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Adams for $2.60 each. Required X Answer is complete but not entirely correct. $ 19,300 Yes $ 24,180 X No 11,100 26,900 a. Calculate the total relevant cost. Should Adams continue to make the containers? b. Adams could lease the space it currently uses in the manufacturing process. If leasing would produce $11,800 per month, calculate the total avoidable costs. Should Adams continue to make the containers? a. Total relevant cost a. Should Adams continue to make the containers? b. Total avoidable cost b. Should Adams continue to make the containers?arrow_forwardSouthfield Division offers its product to outside markets for $134. It incurs variable costs of $59 per unit and fixed costs of $148,500 per month based on monthly production of 23,900 units. Northfield Division can acquire the product from an alternate supplier for $139 per unit or from Southwest Division for a transfer price of $134 plus $6 per unit in transportation costs. Required: a. What are the costs and benefits of the alternatives available to Southfield Division and Northfield Division with respect to the transfer of Southfield Division's product? Assume that Southfield Division can market all that it can produce. b. How would your answer change if Southfield Division had idle capacity sufficient to cover all of Northfield Division's needs? a. Net benefit b. Net benefit per unit per unitarrow_forward

- Bramble Corp. incurs the following costs to produce 12000 units of a subcomponent: Direct materials $8400 Direct labor 12000 Variable overhead 12000 Fixed overhead 19000 An outside supplier has offered to sell Bramble the subcomponent for $2.15 a unit. No fixed costs are avoidable. If Bramble accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3600. The increase (decrease) in net income from accepting the offer would be O $(3600). $10200. O $(3000). O $3000.arrow_forwardVaughn Manufacturing has the following costs when producing 100000 units: Variable costs $600000 Fixed costs 900000 An outside supplier has offered to make the item at $4.50 a unit. If the decision is made to purchase the item outside, current production facilities could be leased to another company for $167000. The net increase (decrease) in the net income of accepting the supplier's offer is O $317000. O $(17000). O $832000. O $283000.arrow_forwardMighty Safe Fire Alarm is currently buying 57,000 motherboards from MotherBoard, Inc., at a price of $63 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: direct materials, $33 per unit; direct labor, $12 per unit; and variable factory overhead, $15 per unit. Fixed costs for the plant would increase by $90,000. Which option should be selected and why? Oa. a. buy, $90,000 increase in profits Ob. make, $80,940 increase in profits c. make, $171,000 increase in profits Od. buy, $80,940 increase in profitsarrow_forward

- Tamarisk Manufacturing incurs unit costs of $7.20 ($5.20 variable and $2.00 fixed) in making a sub-assembly part for its finished product. A supplier offers to make 17,200 of the parts for $5.70 per unit. If it accepts the offer, Tamarisk will save all variable costs and $1.00 of fixed costs. Prepare an analysis showing the total cost savings, if any, that Tamarisk will realize by buying the part. (Round per unit answers to 2 decimal places, eg. 15.25. If an amount reduces the net income then enter with a negative sign preceding the number, e.g.-15,000 or parenthesis, e.g. (15,000).)arrow_forwardCompany E has two divisions, Division A and Division B. Division A is currently buying Component X from an external seller for $13. Division B produces Component X and has excess capacity. Using the following data, what would the transfer price per unit if Division A purchased Component X from Division B at the cost plus assuming 25% transfer price? • Variable cost per unit $6.38 Fixed cost per unit 1.13 • Division B sales price of Component X 14.50arrow_forwardGilberto Company currently manufactures 65,000 units per year of one of its crucial parts. Variable costs are $1.95 per unit, fixed costs related to making this part are $75,000 per year, and allocated fixed costs are $62,000 per year. Allocated fixed costs are unavoidable whether the company makes or buys the part. Gilberto is considering buying the part from a supplier for a quoted price of $3.25 per unit guaranteed for a three-year period. Should the company continue to manufacture the part, or should it buy the part from the outside supplier?arrow_forward

- Galla Incorporated needs to determine a price for a new product. Galla desires a 25% markup on the total cost of the product. Galla expects to sell 5,000 units. Additional information is as follows: Fixed Costs (total) Variable Costs per Unit Direct materials Direct labor $ 21 Overhead 22 General and administrative 20 26 Overhead General and administrative Using the total cost method what price should Galla charge? $ 45,000 18,000arrow_forwardThe Heating Division of Swifty International produces a heating element that it sells to its customers for $38 per unit. Its unit variable cost is $23, and its unit fixed cost is $8. Top management of Swifty International would like the Heating Division to transfer 15,400 heating units to another division within the company at a price of $31. The Heating Division is operating at full capacity. What is the minimum transfer price that the Heating Division should accept? Minimum transfer price 23arrow_forwardPlymouth corporation sells units for $108 each Variable costs are $39 per unit, and fixed costs are $212,000. If Plymouth leases a bed cast wail increase by $85,000 a year, but production will be more efficient, saving $5 per unit. At what level of production will Plymouth be indifferent between leasing and not leasing the new machine?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education