Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:MMA MATHEMATICAL ASSOCIATION OF AMERICA

Simple and Compound Interest / 5

Previous Problem Problem List Next Problem

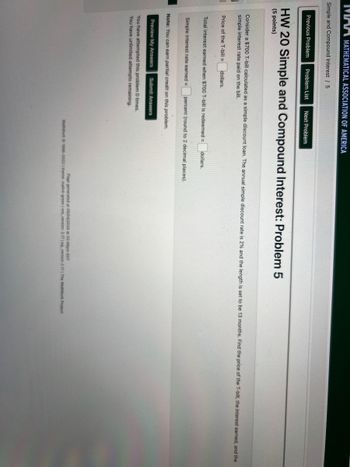

HW 20 Simple and Compound Interest: Problem 5

(5 points)

Consider a $700 T-bill calculated as a simple discount loan. The annual simple discount rate is 2% and the length is set to be 13 months. Find the price of the T-bill, the interest earned, and the

simple interest rate paid on the bill.

Price of the T-bill= dollars.

Total interest earned when $700 T-bill is redeemed = dollars.

Simple interest rate earned = percent (round to 2 decimal places).

Note: You can earn partial credit on this problem.

Preview My Answers Submit Answers

You have attempted this problem 0 times.

You have unlimited attempts remaining.

Page generated at 05/04/2024 at 02:46pm EDT

WeBWorK 1996-2022 theme: math4-green | www.version: 2.17 Pg version 2.17 | The WaßWork Project

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- write down an answer, without showing any work, you will receive only half credit for that problem if you are correct (anc rong). The point is that I want to see that you know how to set up each problem. Question 1 Calculate the effective interest rate for each nominal annual interest rate and compounding frequency shown. Round your answer to 2 decimal places. a. 12% Quarterly compounding b. 7% Semiannual compounding C. 14% Continuous compounding Upload Choose a File Question 2 You are looking at buying a new sorting machine for recycling plastics that sod 6 11-15odarrow_forward4arrow_forwardple and Compound Interest 4 Previous Problem Problem List Next Problem HW 20 Simple and Compound Interest: Problem 4 5 points) Consider a $6500 T-bill calculated as a simple discount loan. The annual simple discount rate is 2.9% and the length is set to be 3 years. Find the price of the T-bill, the interest earned, and the simple interest rate paid on the bill. Price of the T-bill= dollars. Total interest earned when $6500 T-bill is redeemed= dollars. Simple interest rate earned = percent (round to 2 decimal places). Note: You can earn partial credit on this problem. Preview My Answers Submit Answers You have attempted this problem 0 times. You have unlimited attempts remaining, Page generated at 05/04/2024 at 02:47pm EDT WebWork 1996-2022 theme mathd-green ww.version: 2.171pgxersion 2.17 The WeWork Projectarrow_forward

- Question content area top Part 1 You just took out a variable-interest-rate consumer loan set at 33 percent over prime. After 1 year, your rate jumps to 44 percent over prime. Treasury bills are currently paying 22 percent. What is the new interest rate on your consumer loan? Question content area bottom Part 1 The new interest rate on your consumer loan is: (Select the best answer below.) A. 99 percent, which is the Treasury bill rate (prime), plus your original rate over prime, plus 44 percent. B. 66 percent, which is the Treasury bill rate (prime) plus 44 percent. C. 55 percent, which is the Treasury bill rate (prime) plus 33 percent. D. 77 percent, which is your original rate over prime plus 44 percent.arrow_forwardMonthly payment of loan b, rounded to the nearest centarrow_forwardNeed all four quest...arrow_forward

- MAA MATHEMATICAL ASSOCIATION OF AMERICA Simple and Compound Interest / 8 Previous Problem Problem List Next Problem HW 20 Simple and Compound Interest: Problem 8 (2 points) How much do you need to invest in an account earning an annual interest rate of 3.734% compounded weekly, so that your money will grow to $7,550.00 in 44 weeks? The amount you need to invest is (Note: Your answers should include a dollar sign and be accurate to two decimal places) Preview My Answers Submit Answers You have attempted this problem 0 times. You have unlimited attempts remaining. Page generated at 05/04/2024 at 02:45pm EDT WeBWorK 1996-2022 | theme: math4-green | ww_version: 2.17 | pg.version 2.17 | The WaßWork Projectarrow_forwardvv.1arrow_forwardfx D. Amount of loan: %24 50,000 Annual payment: %24 10,000 Interest rate: 8% 6. How many years will it take to pay off the loan?arrow_forward

- Calculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.)arrow_forwardBusiness Math Worksheet 8.2: Installment loans-Amount Financed Name Background: An installment loan is repaid in several equal payments over a specified period of time. Usually, you make a down payment to cover a portion of the cash price of the item. The amount you finance is the portion of the cash price that you owe after making the down payment. Amount Financed = Cash Price - Down Payment Down Payment = Cash Price x Percent 1. Flora Quinton is buying a new air compressor for her auto repair shop. It sells for $1,299. She makes a down payment of $199 and finances the remainder. How much does she finance? 2. Beatriz Ruiz is buying new office furniture. It sells for a cash price of $2,358.60. The down payment is $200.00. What is the amount financed 3. An office remodeling project costs $15,880. If you pay $3,680 towards the project, how much do you finance?arrow_forwardSparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education