Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

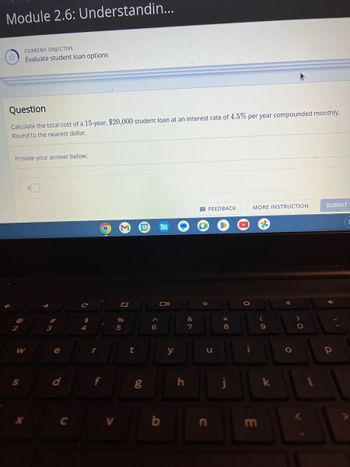

Transcribed Image Text:Module 2.6: Understandin...

Question

Calculate the total cost of a 15-year, $20,000 student loan at an interest rate of 4.5% per year compounded monthly.

Round to the nearest dollar.

CURRENT OBJECTIVE

Evaluate student loan options

Provide your answer below:

@

W

S

3

e

d

C

$

4

r

f

0

%

5

t

A

6

Oll

y

h

&

7

FEEDBACK

J

*

8

j

Von

b

MORE INSTRUCTION

m

(

9

k

O

O

SUBMIT

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Find the interest on the following loan. $1400 at 5.5% for 3 months Only typed solution.arrow_forwardsubject : financearrow_forwardAlexandra received a 30 year loan of $280,000 to purchase a house. The interest rate on the loan was 4.60% compounded semi-annually. a. What is the size of the monthly loan payment? Round to the nearest cent hp SUBMIT QUESTION SAVE PROGRESS 12°Carrow_forward

- Find the payment necessary to amoritize a 4% loan of $1600 compounded quarterly, with 9 quarterly payments The payment size is % (Round to the nearest cent.)arrow_forwardA 30 year, monthly payment ARM has the following characteristics: loan amount = $135,000, index value = 5.00%, margin = 2.50, discount points = 2, teaser rate = 6%. The payment for year one is: d $925.06 A. $943.94 B. $724.71 C. $809.39 D. $793.21arrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $8800 at 6.3% interest; student graduates 2 years and 7 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X oo Karrow_forward

- Given below is the principal owed on a student loan last month, the annual interest rate, and the way the minimum monthly payment is computed. Find this month's minimum payment due. Principal Annual Rate Method for Calculating Minimum Monthly Payment $23,800 3% finance charge+$20+1.5% of principalarrow_forwardFind the monthly payment for the loan. New-car financing of 3.1% on a 30-month $12,250 loan (Round your answer to the nearest cent.)arrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $6400 at 7.9% interest; student graduates 3 years and 9 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X oo → Karrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education