Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

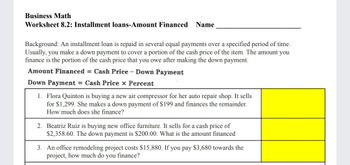

Transcribed Image Text:Business Math

Worksheet 8.2: Installment loans-Amount Financed Name

Background: An installment loan is repaid in several equal payments over a specified period of time.

Usually, you make a down payment to cover a portion of the cash price of the item. The amount you

finance is the portion of the cash price that you owe after making the down payment.

Amount Financed = Cash Price - Down Payment

Down Payment = Cash Price x Percent

1. Flora Quinton is buying a new air compressor for her auto repair shop. It sells

for $1,299. She makes a down payment of $199 and finances the remainder.

How much does she finance?

2. Beatriz Ruiz is buying new office furniture. It sells for a cash price of

$2,358.60. The down payment is $200.00. What is the amount financed

3. An office remodeling project costs $15,880. If you pay $3,680 towards the

project, how much do you finance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Marsha Jones has bought a used Mercedes horse transporter for her Connecticut estate. It cost $54,000. The object is to save on horse transporter rentals.Marsha had been renting a transporter every other week for $219 per day plus $1.95 per mile. Most of the trips are 80 or 100 miles in total. Marsha usually gives Joe Laminitis, the driver, a $30 tip. With the new transporter she will only have to pay for diesel fuel and maintenance, at about $0.64 per mile. Insurance costs for Marsha’s transporter are $2,150 per year.The transporter will probably be worth $34,000 (in real terms) after eight years, when Marsha’s horse Spike will be ready to retire. Assume a nominal discount rate of 7% and a 4% forecasted inflation rate. Marsha’s transporter is a personal outlay, not a business or financial investment, so taxes can be ignored.Calculate the NPV of the investment. (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.)arrow_forwardA father is now planning a savings program to put his daughter through college. She is 13, plans to enroll at the university in 5 years, and she should graduate 4 years later. Currently, the annual cost (for everything - food, clothing, tuition, books, transportation, and so forth) is $15,000, but these costs are expected to increase by 6% annually. The college requires total payment at the start of the year. She now has $9,000 in a college savings account that pays 8% annually. Her father will make six equal annual deposits into her account; the first deposit today and sixth on the day she starts college. How large must each of the six payments be? (Hint: Calculate the cost (inflated at 6%) for each year of college and find the total present value of those costs, discounted at 8%, as of the day she enters college. Then find the compounded value of her initial $9,000 on that same day. The difference between the PV of costs and the amount that would be in the savings account must be…arrow_forwardGarrick is purchasing equipment for his job as a builder. The equipment costs $1000 and he wants to make monthly payments of $125. He has two different credit cards that he can use to finance the purchase. • Card A charges 9.9%, compounded daily, but it also charges a fee of $65 for all purchases over $1000 that is immediately added to the balance. • Card B charges 13.3%, compounded daily. What is the total cost of both options? Enter the total cost of the cheaper option here: Answer:arrow_forward

- 80) The Jacksons' gross monthly income is $8000. They have 17 remaining payments of $333 on a new car and 3 remaining payments of $69 on a washer and dryer. The taxes and insurance on the house are $135 per month. What maximum monthly payment does the bank's loan officer feel that the Jacksons can afford?arrow_forwardYour parents have accumulated a $120,000 nest egg. They have been planning to use this money to pay college costs to be incurred by you and your sister, Courtney. However, Courtney has decided to forgo college and start a nail salon. Your parents are giving Courtney $15,000 to help her get started, and they have decided to take year-end vacations costing $10,000 per year for the next four years. How much money will your parents have at the end of four years to help you with graduate school? You plan to work on a master's and perhaps a PhD. If graduate school costs $26,353 per year, approximately how long will you be able to stay in school based on these funds? Use 9 percent as the appropriate interest rate throughout this problem. Round all values to whole numbers. Refer to this information to solve the rest of the questions. What are the funds available after the Nail Salon? ○ $100,000 ○ $105,000 ○ $72,000 $98,500 What is the Present Value of the vacations? $32,397 $37,900 $45,000…arrow_forwardA company lends money to small businesses. The total amount per project is $ 50,000. The borrowers can benefit for once from this deal. Mr. Roger applies for a loan, and gets $ 40,000 according to his business' conditions. He needs $ 60,000 for his project, so he finances the needed money from his own money. The interest rate applied by the company on the loans is 5%, and Mr. Roger wants to remunerate himself for 3% on his own participation. Find the capital structure for the project of Mr. Roger What is the average cost of capital for Mr. Roger (in %) If Mr. Roger can repay only $ 30,000 to the company, what would be the credit risk for the company?arrow_forward

- Ali is a student at the University. He recently purchased a car for OMRS,000 to use it for going to the University. Ali also expects that other friends might ask for transportation from him. He expects a total monthly revenue of OMR60. He expects fuel cost to be OMR30 per month. One of Ali's friends is a taxi driver. He offered Ala to take him to University for a monthly fee of OMR10. Because he does not have to drive, Ali believes that he can perform online work that would earn him a monthly revenue of OMR10. What is the differential cost in this scenario? Select one: O a. OMR50 Ob.OMR1O OCOMR4O O d. OMR2O Oe. OMRBOarrow_forwardYou run a school in Florida. Fixed monthly cost is $5,220.00 for rent and utilities, $5,974.00 is spent in salaries and $1,762.00 in insurance. Also every student adds up to $102.00 per month in stationary, food etc. You charge $612.00 per month from every student now. You are considering moving the school to another neighborhood where the rent and utilities will increase to $10,325.00, salaries to $6,544.00 and insurance to $2,172.00 per month. Variable cost per student will increase up to $157.00 per month. However you can charge $1,180.00 per student. At what point will you be indifferent between your current of operation and the new option? PLEASE SHOW EASIEST MOST SIMPLE WAY TO FIND THE ANSWERarrow_forwardWhat is the amount of Laura’s monthly cash outflows if she chooses to rent the apartment by her herself? Use the rent amount for the one bedroom apartment to complete her budget?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education