Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:CENGAGE MINDTAP

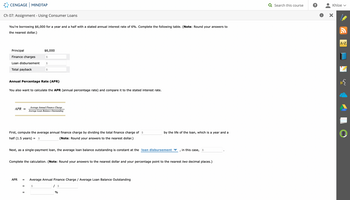

Ch 07: Assignment - Using Consumer Loans

You're borrowing $6,000 for a year and a half with a stated annual interest rate of 6%. Complete the following table. (Note: Round your answers to

the nearest dollar.)

Principal

Finance charges

Loan disbursement $

Total payback

APR =

Annual Percentage Rate (APR)

You also want to calculate the APR (annual percentage rate) and compare it to the stated interest rate.

APR

$6,000

First, compute the average annual finance charge by dividing the total finance charge of $

(Note: Round your answers to the nearest dollar.)

half (1.5 years):

=

$

=

$

Average Annual Finance Charge

Average Loan Balance Outstanding

=

Next, as a single-payment loan, the average loan balance outstanding is constant at the loan disbursement

$

Complete the calculation. (Note: Round your answers to the nearest dollar and your percentage point to the nearest two decimal places.)

Average Annual Finance Charge / Average Loan Balance Outstanding

by the life of the loan, which is a year and a

%

in this case, $

I

Q Search this course

?

Khloe ✓

A-Z

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Calculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the installment loan by using the APR table, Table 13-1. (Round dollar amounts to the nearest cent.) Amount Number of Monthly Financed Payments Payment $14,000 36 Need Help? Read It $503.00 $ Finance Charge Finance Charge per $100 APR %arrow_forwardFor the following loan, find (a) the finance charge and (b) the APR. Use the accompanying table to find the APR to the nearest 0.5%. Joel financed a $1555 computer with 24 monthly payments of $70.32 each. Click the icon to view the annual percentage rate table. (a) The finance charge is $ (Round to the nearest cent as needed.) APR Table Number of Monthly Payments (n)| 6 12 18 24 30 36 48 | 60 4.0% 4.5% 5.0% 5.5% 1.17 2.18 3.20 1.32 1.46 2.45 2.73 3.60 4.00 5.29 6.59 7.90 4.22 4.75 5.25 5.92 6.29 7.09 8.38 9.46 10.54 10.50 11.86 13.23 Annual Percentage Rate (APR) for Monthly Payment Loans Annual Percentage Rate (APR) 3.53 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% Finance Charge per $100 of Amount Financed (h) 1.61 1.76 1.90 2.05 2.20 2.35 2.49 2.64 2.79 2.94 3.08 3.23 3.38 3.00 3.28 3.56 3.83 4.11 4.39 4.66 4.94 5.22 5.50 5.78 6.06 6.34 6.62 4.41 4.82 5.22 5.63 6.04 6.45 6.86 7.28 7.69 8.10 8.52 8.93 9.35 9.77 5.83 6.37 6.91 7.45 8.00 8.55 9.09 9.64 10.19 10.75 11.30 11.86 12.42 12.98 7.29…arrow_forwardCalculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) AmountFinanced Number ofPayments APR TableFactor FinanceCharge MonthlyPayment $6,500 36 10% $ $ $arrow_forward

- A consumer loan requires monthly payments, in equal amounts, $700.00. The next payment is due in one month. Assume that the appropriate discount rate is 21% (APR). What is the effective annual rate? (show them in excel spreadsheet, write your own present value formulas, don't use Excel built-in functions.arrow_forwardYou have just been hired as a loan officer at a national bank. Your first assignment is to calculate the amount of the periodic payment (in $) required to amortize (pay off) the following loan being considered by the bank (use Table 12-2). (Round your answer to the nearest cent.) LoanPayment PaymentPeriod Term ofLoan (years) NominalRate (%) Present Value(Amount of Loan) $ every month 1 1 4 6 $30,000arrow_forwardCalculate the finance charge (in $) and the annual percentage rate for the installment loan by using the APR formula. (Round dollar amounts to the nearest cent and percentages to one decimal place.) Amount Financed 18,200 Number of Payments = 72 Monthly Payment = 424.08 Solve for Finance Charge and APRarrow_forward

- Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase(Cash)Price DownPayment AmountFinanced Add-onInterest Number ofPayments FinanceCharge MonthlyPayment $6,000 15% $ 12 1 2 % 30 $ $arrow_forwardA finance company uses the discount method of calculating interest. The loan principal is $5,000, the interest rate is 10%, and repayment is expected in two years. You will receivearrow_forwardTo borrow $3,400, you are offered an add-on interest loan at 9.6 percent with 12 monthly payments. Compute the 12 equal payments. Use the amount you borrowed and the monthly payments you computed to calculate the APR of the loan. Then, use that APR to compute the EAR of the loan. Note: Do not round intermediate calculations and round your final answer to 2 decimal places. Equal payment Effective annual ratearrow_forward

- Calculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Amount Number of Financed Payments $6,200 36 APR 11% LA Table Factor Finance Charge Monthly Paymentarrow_forwardA $178,000 mortgage loan is offered at an APR of 4%. Follow the instructions below the table. The loan payment formula was used to calculate the monthly payments for the loans and results are reported in the table below. You do NOT have to verify the given payment entries (you already used the formula for calculating payments in the first part Loan term in years Monthly Payment on $178,000 loan (in $) Total amount paid back over the full loan term (in $) Interest over the full loan term (in $) Difference in monthly payment from option above (in $) t = 15 years Pmt = $ 1316.64 F = I = No entry here t = 30 years Pmt = $ 849.80 F = I = Difference in MONTHLY payment t = 40 years Pmt = $ 743.93 F = I = Difference in MONTHLY payment t = 50 years Pmt = $ 686.56 F = I = Difference in MONTHLY payment For each loan term option, calculate the total amount paid back over the…arrow_forwardYou have taken a loan of $78,000.00 for 20 years at 4.9% compounded quarterly. Fill in the table below, rounding all values to the nearest cent. Note that the principal column is listed before the interest column even though the interest calculation is done first. Many lending institutions use this order in the amortization schedules they provide to their customers. Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ S $ $ s Balance $78,000.00 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education