Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

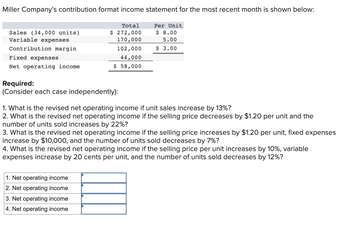

Transcribed Image Text:Miller Company's contribution format income statement for the most recent month is shown below:

Per Unit

$ 8.00

5.00

$ 3.00

Sales (34,000 units)

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Total

$ 272,000

170,000

102,000

44,000

$ 58,000

Required:

(Consider each case independently):

1. What is the revised net operating income if unit sales increase by 13%?

2. What is the revised net operating income if the selling price decreases by $1.20 per unit and the

number of units sold increases by 22%?

3. What is the revised net operating income if the selling price increases by $1.20 per unit, fixed expenses

increase by $10,000, and the number of units sold decreases by 7%?

4. What is the revised net operating income if the selling price per unit increases by 10%, variable

expenses increase by 20 cents per unit, and the number of units sold decreases by 12%?

1. Net operating income

2. Net operating income

3. Net operating income

4. Net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Miller Company's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (25, 800 units) $ 232,200 $ 9.00 Variable expenses 139,320 5.40 Contribution margin 92,880 $ 3.60 Fixed expenses 54,180 Net operating income $ 38,700 Required: (Consider each of the four requirements independently): Assume the sales volume increases by 4, 128 units: What is the revised net operating income? What is the percent increase in unit sales? Using the most recent month's degree of operating leverage, what is the percent increase in net operating income? What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 23 % ? What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 7 % ? What is the revised net operating income if the selling price per unit increases by 20%, variable…arrow_forwardMiller Company's contribution format income statement for the most recent month is shown below: Sales (40,000 units) Variable expenses Fixed expenses Contribution margin 19 Net operating income Required: Total $ 280,000 160,000 120,000 43,000 $ 77,000 Per Unit $ 7.00 4.00 $ 3.00 (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 12%? 2. What is the revised net operating income if the selling price decreases by $1.40 per unit and the number of units sold increases by 17%? 3. What is the revised net operating income if the selling price increases by $1.40 per unit, fixed expenses increase by $5,000, and the number of units sold decreases by 6%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 10 cents per unit, and the number of units sold decreases by 12%? Answer is complete but not entirely correct. 1. Net operating income $ 91,400 2. Net operating income $…arrow_forwardMiller Company's contribution format income statement for the most recent month is shown below: Per Unit $ 7.00 4.00 $3.00 Sales (45,000 units) Variable expenses Contribution margin Fixed expenses Net operating income. Total $ 315,000 180,000 135,000 44,000 $91,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 14%? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 15%? 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 8%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 5%? > Answer is complete but not entirely correct. 1. Net operating income $ 109,900 2. Net operating income $…arrow_forward

- The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 1,008,000 $ 50.40 Variable expenses 604,800 30.24 Contribution margin 403,200 20.16 Fixed expenses 323,200 16.16 Net operating income 80,000 4.00 Income taxes @ 40% 32,000 1.60 Net income $ 48,000 $ 2.40 The company had average operating assets of $499,000 during the year. Required: 5. As a result of a more intense effort by sales people, sales are increased by 10%; operating assets remain unchanged. 6. At the beginning of the year, obsolete inventory carried on the books at a cost of $18,000 is scrapped and written off as a loss, thereby lowering net operating income. 7. At the beginning of the year, the company uses $178,000 of cash (received on accounts receivable) to repurchase some of its common stock.arrow_forwardiller Company's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (32,000 units) $ 160,000 $5.00 Variable expenses 64,000 2.00 Contribution margin 96,000 $ 3.00 Fixed expenses 50,000 Net operating income $ 46,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 12% ? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 22% ? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 4% ? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 12% ?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 18.00 $ 13.00 Sales (8,600 units) Variable expenses Contribution, margin Fixed expenses Net operating income Total $ 266,600 154,800 111,800 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 56,000 $ 55,800 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is.7,600 units?arrow_forward

- Miller Company's contribution format income statement for the most recent month is shown below: Per Unit $ 9.00 6.00 $ 3.00 Sales (41,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): Total $ 369,000 246,000 123,000 42,000 $ 81,000 1. What is the revised net operating income if unit sales increase by 13%? 2. What is the revised net operating income if the selling price decreases by $1.20 per unit and the number of units sold increases by 21%? 3. What is the revised net operating income if the selling price increases by $1.20 per unit, fixed expenses increase by $8,000, and the number of units sold decreases by 5%? 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 11%? X Answer is complete but not entirely correct. 1. Net operating income $ 96,990 2. Net operating income $…arrow_forwardGreen Valley Corp.'s contribution format income statement for the most recent month follows: Sales $ 506,000 Variable expenses 236,500 Contribution margin 269,500 Fixed expenses 241,700 Net operating income $ 27,800 Required: a. Compute the degree of operating leverage to two decimal places. b. Using the degree of operating leverage, estimate the percentage change in net operating income that should result from a 3% increase in sales. c. If Green Valley’s competitor Black Mountain Inc. has a degree of operating leverage as 8, which company has the higher operating risk?arrow_forwardThe following data are available for the Valentine Corporation for a recent month: Product A Product B Product C Total Selling price $23 $69 $115 Sales $115,000 $172,500 $287,500 |Variable |$91,000 $104,000 $27,000 Expenses Contribution $24,000 $68,500 $260,500 Margin Fixed $55,000 Expenses Net Operating Income What is the sales revenue required from Product C at the break even point?arrow_forward

- pre.3arrow_forwardMiller Company’s contribution format income statement for the most recent month is shown below: Total Per Unit Sales (36,000 units) $ 180,000 $ 5.00 Variable expenses 72,000 2.00 Contribution margin 108,000 $ 3.00 Fixed expenses 43,000 Net operating income $ 65,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 17%? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 24%? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 3%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 13%?arrow_forwardDhapaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education