FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

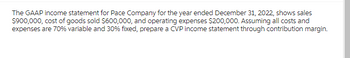

Transcribed Image Text:The GAAP income statement for Pace Company for the year ended December 31, 2022, shows sales

$900,000, cost of goods sold $600,000, and operating expenses $200,000. Assuming all costs and

expenses are 70% variable and 30% fixed, prepare a CVP income statement through contribution margin.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Multiple Product Planning with TaxesIn the year 2017, Pyramid Consulting had the following contribution income statement: PYRAMID CONSULTINGContribution Income StatementFor the Year 2017 Sales revenue $ 1,300,000 Variable costs Cost of services $ 420,000 Selling and administrative 200,000 (620,000) Contribution margin 680,000 Fixed Costs -selling and administrative (285,000) Before-tax profit 395,000 Income taxes (36%) (142,200) After-tax profit $ 252,800 a) Determine the annual break-even point in sales revenue. Round contribution margin ratio to two decimal places for your calculation. Round final answer to nearest dollar. (b) Determine the annual margin of safety in sales revenue. Use rounded answer from above for calculation. (c) What is the break-even point in sales revenue if management makes a decision that increases fixed costs by $57,000? Use rounded contribution margin ratio (2 decimal places) for your calculation. (d) With the…arrow_forwardBolding Inc's contribution margin ratio is 64% and its fixed monthly expenses are $44,500. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $131,000?arrow_forwardIn its income statement for the year ended December 31, 2022, Splish Brothers Inc. reported the following condensed data. Prepare a multiple step income statement , and then calculate the profit margin and gross profit rate. Salaries and wages expenses $576,600 Loss on disposal of plant assets $103,540 Cost of goods sold 1,223,880 Sales revenue 2,740,400 Interest expense 89,460 Income tax expense 31,000 Interest revenue 80,600 Sales discounts 198,400 Depreciation expense 384,400 Utilities expense 136,400arrow_forward

- Last year’s contribution format income statement for Huerra Company is given below: Total Unit Sales $ 1,002,000 $ 50.10 Variable expenses 601,200 30.06 Contribution margin 400,800 20.04 Fixed expenses 316,800 15.84 Net operating income 84,000 4.20 Income taxes @ 40% 33,600 1.68 Net income $ 50,400 $ 2.52 The company had average operating assets of $491,000 during the year. Required: Compute last year’s margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year’s margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. Using Lean Production, the company is able to reduce the average level of inventory by $100,000. The company achieves a cost savings of $10,000 per year by using less costly materials. The company purchases machinery and equipment that increase average operating assets by $125,000.…arrow_forwardplease show the steps to calculate the DOL, DFL and DCL. please write out the stepsarrow_forwardPrepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $1,425,000.arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardEngberg Company installs lawn sod in home yards. The company's most recent monthly.contribution format Income statement follows: Percent of Sales 100% Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 92,000 36,800 55,200. 44,160 $ 11,040 40% 60% Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 7% increase in unit sales. Answer is not complete. Complete this question by entering your answers in the tabs below. increases Required 1 Required 2 Required 3 Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. (Round your intermediate calculations to 2 decimal places. Round your percentage answer to 2 decimal places (.e.1234 should be entered as 12.34).) Net operating income.…arrow_forwardSarratt Corporation's contribution margin ratio is 70% and its fixed monthly expenses are $38,000. Assume that the company's sales for May are expected to be $97,000. Required: Estimate the company's net operating income for May, assuming that the fixed monthly expenses do not change. Net operating incomearrow_forward

- Presented here is the income statement for Big Sky Incorporated for the month of February: Sales $ 60,000 Cost of goods sold 51,900 Gross profit $ 8, 100 Operating expenses 15,200 Operating loss $ (7,100) Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 19%. Required: Rearrange the preceding income statement to the contribution margin format. If sales increase by 10%, what will be the firm's operating income (or loss)? Calculate the amount of revenue required for Big Sky to break even.arrow_forwardPlease give me correct answer with explanation..arrow_forwardLast year’s contribution format income statement for Huerra Company is given below: Total Unit Sales $ 1,002,000 $ 50.10 Variable expenses 601,200 30.06 Contribution margin 400,800 20.04 Fixed expenses 316,800 15.84 Net operating income 84,000 4.20 Income taxes @ 40% 33,600 1.68 Net income $ 50,400 $ 2.52 The company had average operating assets of $491,000 during the year. Required: Compute last year’s margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year’s margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. Using Lean Production, the company is able to reduce the average level of inventory by $100,000. The company achieves a cost savings of $10,000 per year by using less costly materials. The company purchases machinery and equipment that increase average operating assets by $125,000.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education