Concept explainers

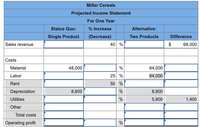

Miller Cereals is a small milling company that makes a single brand of cereal. Recently, a business school intern recommended that the company introduce a second cereal in order to “diversify the product portfolio.” Currently, the company shows an operating profit that is 20 percent of sales. With the single product, other costs were twice the cost of rent.

The intern estimated that the incremental profit of the new cereal would only be 10.5 percent of the incremental revenue, but it would still add to total profit. On his last day, the intern told Miller’s marketing manager that his analysis was on the company laptop in a spreadsheet with a file name, NewProduct.xlsx. The intern then left for a 12-month walkabout in the outback of Australia and cannot be reached.

When the marketing manager opened the file, it was corrupted and could not be opened. She then found an early (incomplete) copy on the company’s backup server. The incomplete spreadsheet is shown as follows. The marketing manager then called a cost

Required:

As the management accountant, fill in the blank cells. (Do not round intermediate calculations. Round your final answers to the nearest whole number. Enter all amounts as positive values.)

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardMultiple Choice Practice Questions-Differential Analysis 1. The condensed income statement for a Fletcher Inc. for the past year is as follows: Sales Costs: Variable costs Fixed costs Total costs Income (loss) F $300,000 b. $30,000 increase c. $20,000 decrease d. $30,000 decrease Product G $210,000 H $340,000 $180,000 $180,000 $220,000 50,000 50,000 40,000 $230,000 $230,000 $260,000 $70,000 $ (20,000) $80,000 Total $850,000 $580,000 140,000 $720,000 $130,000 Management is considering the discontinuance of the manufacture and sale of Product G at the beginning of the current year. The discontinuance would have no effect on the total fixed costs and expenses or on the sales of Products F and H. What is the amount of change in net income for the current year that will result from the discontinuance of Product G? a. $20,000 increasearrow_forwardA company has following details for this yearDetails Total sales($) Total cost($) Details Total sales($) Total cost($)Year ended 31/12/2018 35,78,998 25,89,709Year ended 31/12/2019 48,90,742 31,67,984 Calculate P/V ratio, Fixed cost, break even sales, Margin of safety 2018/2019, Variable cost 2018/2019and percent of fixed cost 2018/2019arrow_forward

- Net Income Planning Selected operating data for Oakbrook Company in four independent situations are shown below. Fill in the blanks for each independent situation. Sales Variable expense Fixed expense Net income (loss) before tax Units sold Unit contribution margin Contribution margin ratio $ $ A $350,000 0 a. 0 b. $25,000 30,000 $5.20 $ B 0 C. $ $ $111,000 $62,000 $15,000 0 d. $7.00 C 0 e. 0 f. $ $53,200 $28,800 0.4 D $520,000 0 g. $178,000 $(22,000) 0 h.arrow_forwardThe following data relates to Campus Goods Inc: Amount in $ Revenue 400000 Operating Profit 20% cost of good sold 55% Operating Expense ( as % of revenue ) 25% Required: Based on the above data determine the following: 8A. Cost of Goods Sold in $ is ___________. 250,000 100,000 150,000 220,000 8B. Gross Profit in $ and % is ___________ and ___________ respectively. 250,000 and 20% 180,0000 and 40% 180,000 and 45% 220,000 and 45% 8C. Operating expenses is ___________. 100,000 150,000 200,000 120,000 8D. Operating profit in $ is ___________. 55,000 65,000 80,000 70,000arrow_forwardDetermine the missing amounts. Unit SellingPrice Unit VariableCosts Unit ContributionMargin Contribution MarginRatio 1. $750 $375 $ (a) % (b) 2. $450 $ (c) $153 % (d) 3. $ (e) $ (f) $760 40 %arrow_forward

- subquestion 1 and 2arrow_forwardMultiproduct breakeven analysis and target profit, taxes Pursuit Company produces two products: Bric and Brac. The following table summarizes the products' details and planned unit sales for the upcoming period: Bric BrAc Sellingpriceperunt...........$S25$30 Variablecostperunit ... $14$17 Planned unit sales volume . . . . . . 800, 000 400,000 Pursuit Company has total fixed costs of $10 million and faces a tax rate of 30%. Required (a)What is Pursuit Company's expected profit at the planned level of sales? (b)Assuming a constant sales mix, what are the unit sales of Bric and Brac required for Pursuit Company to break even? (c) Assuming a constant sales mix, what are the unit sales of Bric and Brac required for Pursuit Company to earn an after-tax income of $910, 000 ?arrow_forwardClay Company: What amount should be reported as operating profit for Segment One? * a. 1250000 b. 1000000 c. 650000 d. 500000arrow_forward

- Assume a company reported the following results: Sales $ 400,e00 Variable expenses Contribution margin Fixed expenses 260,e00 140,000 96,e00 Net operating income $ 44,000 Average operating assets $ 350, 000 The margin is closest to: Muitiple Choice 12.9%. 35.0%. 114.3%.arrow_forwardLL Required Information The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: $ 2,300,00e 670,000 Sales Variable expenses Contribution margin Fixed expenses Net operating income 000'09 Average operating assets $1,437,500 At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: Sales Contribution margin ratio Fixed expenses S0% of sales $ 161,000 The company's minimum required rate of return is 15%. 5. What is the turnover related to this year's investment opportunity? (Round your answer to 1 decimal place.) e here to search 近。 F4 F5 F7 F8 F10 F11 て2 24 4 % 9 08.arrow_forwarddreams demstime dremstph %24 The co ired rate of is 15%. Requlred Information The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: $ 2,300,000 Sales Variable expenses Contribution margin Fixed expensesi 1,630,000 1,170,000 24 460,000 $ 1,437,500 Net operating income Average operating assets At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: $ 460,000 Contribution margin ratio Fixed expenses 50% of sales $ 161,000 The company's minimum required rate of return is 15%. 9. If the company pursues the investment opportunity and otherwise performs the same as last year, what ROI will it earn this year? (Do not round Intermedlate calculations. Round your percentage answer to 1 declmal place (I.e., 0.1234 should be considered as 12.3).)arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning