FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

How much will profit decrease by?

Transcribed Image Text:Your answer is correct.

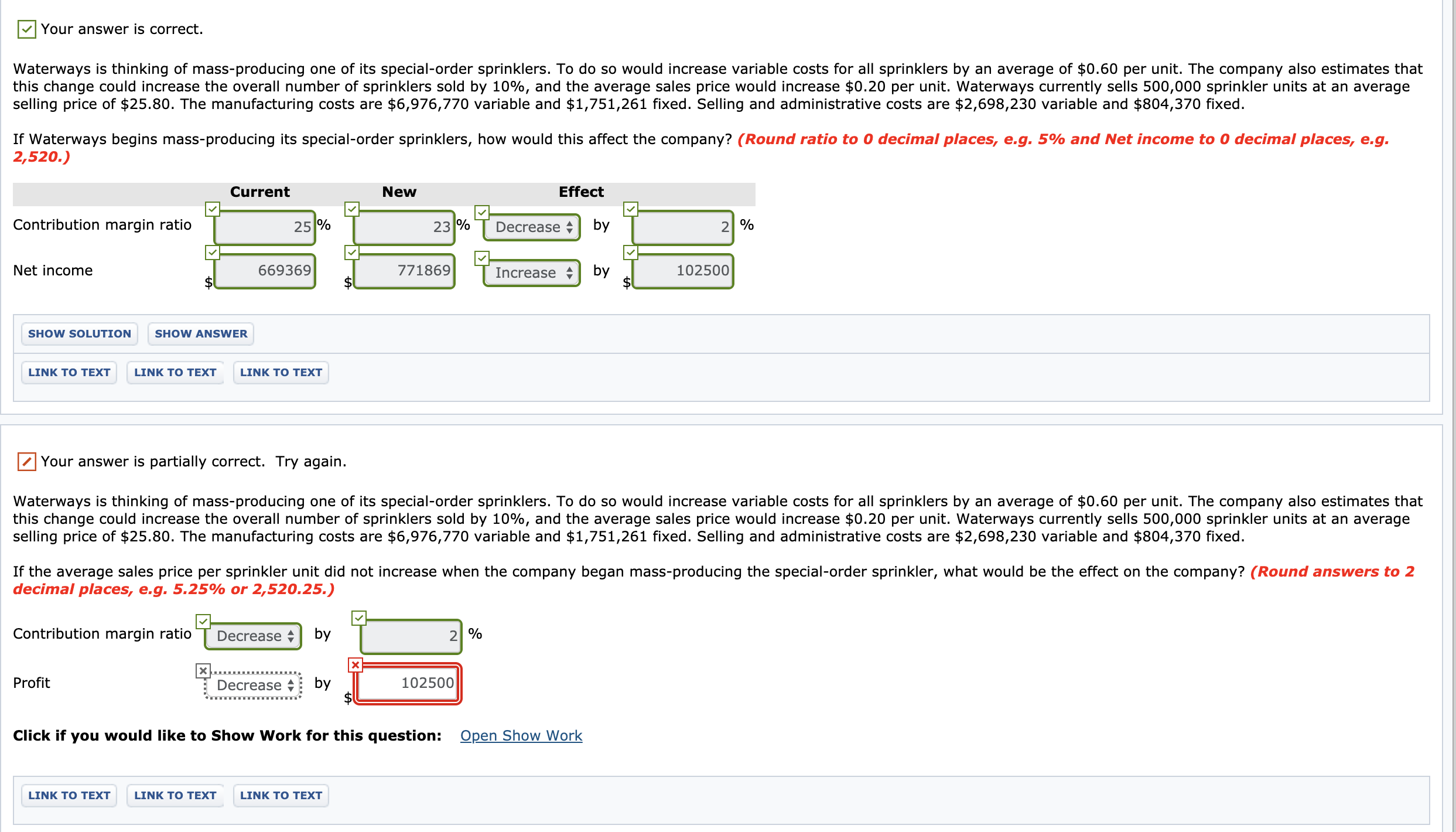

Waterways is thinking of mass-producing one of its special-order sprinklers. To do so would increase variable costs for all sprinklers by an average of $0.60 per unit. The company also estimates that

this change could increase the overall number of sprinklers sold by 10%, and the average sales price would increase $0.20 per unit. Waterways currently sells 500,000 sprinkler units at an average

selling price of $25.80. The manufacturing costs are $6,976,770 variable and $1,751,261 fixed. Selling and administrative costs are $2,698,230 variable and $804,370 fixed.

If Waterways begins mass-producing its special-order sprinklers, how would this affect the company? (Round ratio to 0 decimal places, e.g. 5% and Net income to 0 decimal places, e.g.

2,520.)

Current

New

Effect

Contribution margin ratio

25 %

23 %

Decrease +

by

2| %

Net income

669369

771869

Increase

by

102500

SHOW SOLUTION

SHOW ANSWER

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

Your answer is partially correct. Try again.

Waterways is thinking of mass-producing one of its special-order sprinklers. To do so would increase variable costs for all sprinklers by an average of $0.60 per unit. The company also estimates that

this change could increase the overall number of sprinklers sold by 10%, and the average sales price would increase $0.20 per unit. Waterways currently sells 500,000 sprinkler units at an average

selling price of $25.80. The manufacturing costs are $6,976,770 variable and $1,751,261 fixed. Selling and administrative costs are $2,698,230 variable and $804,370 fixed.

If the average sales price per sprinkler unit did not increase when the company began mass-producing the special-order sprinkler, what would be the effect on the company? (Round answers to 2

decimal places, e.g. 5.25% or 2,520.25.)

Contribution margin ratio

Decrease

by

2 %

Profit

Decrease +

by

102500

Click if you would like to Show Work for this question: Open Show Work

LINK TO TEXT

LINK TO TEXT

LINK TO TEXT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When the level of activity decreases, variable cost will increase or decrease ?arrow_forwardWhat do the Profitability ratios show?arrow_forwardWhich of the following is not another way of describing the marginal propensity to consume? a. autonomous consumption spending b. the slope of the consumption function c. the amount by which real consumption spending rises when real disposable income increases by one dollar d. MPC e. the change in real consumption spending divided by the change in real disposable incomearrow_forward

- 1. Now change all of the dollar amounts in the data area of your worksheet so that it looks like this: 1 2 3 Data 4 Sales Variable costs: 5 67 00 8 A Chapter 1: Applying Excel 9 10 11 Cost of goods sold Variable selling Variable administrative Fixed costs: Fixed selling Fixed administrative $ $ $ $ $ $ B 32,000 16,000 1,600 1,400 2,500 1,500arrow_forwardWhat effect does an increase in sales price have on contribution margin? An increase in fixed costs? An increase in variable costs?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education