Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

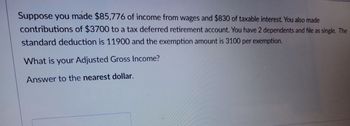

Transcribed Image Text:Suppose you made $85,776 of income from wages and $830 of taxable interest. You also made

contributions of $3700 to a tax deferred retirement account. You have 2 dependents and file as single. The

standard deduction is 11900 and the exemption amount is 3100 per exemption.

What is your Adjusted Gross Income?

Answer to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Find the amount returned to a single taxpayer who made $17000 last year and can deduct $12000. The withholding amount was $2000. (Note: assume no earned income credit)arrow_forwardHow do I calculate self-employment taxes with self-employment earnings. For example Bob Marks has self-employment earnings of 149,200, what would be his total self-employment taxes for 2021.arrow_forwardDd1.arrow_forward

- Use the following information Molly has collect to help her determine her taxable income for the year: Salary from her job 115,100 Interest earn from 1,280 savings Interest paid on student loans Your Answer: Answer 905 Standard deduction 12,950 Itemized deductions 842 Child tax credit 2000arrow_forwardSee picture for details.arrow_forwardDetermine the self-employment tax for an individual who has $111,700 in wages, $4,000 in interest income, and $20,000 in self-employment income. The self employment tax is________?arrow_forward

- Find the gross income, the adjusted gross income, and the taxable income. A taxpayer earned wages of $61,300, received $880 in interest from a savings account, and contributed $2,200 to a tax-deferred retirement plan. He was entitled to a personal exemption of $4050 and had deductions totaling $6,930. OA. $62,180; $59,980; $55,930 OB. $64,380; $60,330; $53,400 OC. $62,180; $59,980; $49,000 D. $64,380; $60,330; $55,930 Harrow_forwardDarius' net income from self-employment reported on Schedule C is $25,000. Calculate his self-employment tax. Group of answer choices $1,766 $23,088 $3,825 $3,532arrow_forwardA single person has taxable income of $85,000 per year. She earns $1,800 in interest from a certificate of deposit. How much federal income tax expense will be calculated on these earnings? Tax year 2019. Deduction amount 12,200. Tax rate 24%arrow_forward

- Use the following information to calculate the federal average tax rate (ignore tax credits) for a taxpayer who earned $115,000 from employment, and where bonds were sold for $20,000 during the year that originally cost $10,000: Taxable income Up to $47,630 On the next $47,629 On the next $52,408 On the next $62,704 Over $210,371 Select one: Tax Rate 15% 20.5% Based on the above, the average tax rate (ATR) is closest to: a. 19.15% b. 19,45% c. 20.5% d. 26.0% 26% 29% 33%arrow_forwardIf you are not self-employed and earn $86,000, what are your FICA taxesarrow_forwardCompute for the tax due of the following individuals using the RA 10963 tax table. Show computations. 1. An employee with monthly salary of P25,000, monthly allowable deductionsof P1,300, bonus of P25,000 for the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education