Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

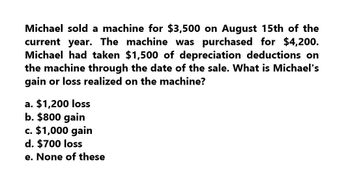

Transcribed Image Text:Michael sold a machine for $3,500 on August 15th of the

current year. The machine was purchased for $4,200.

Michael had taken $1,500 of depreciation deductions on

the machine through the date of the sale. What is Michael's

gain or loss realized on the machine?

a. $1,200 loss

b. $800 gain

c. $1,000 gain

d. $700 loss

e. None of these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nicky receives a car from Sam as a gift. Sam paid 48,000 for the car. He had used it for business purposes and had deducted 10,000 for depreciation up to the time he gave the car to Nicky. The fair market value of the car is 33,000. a. Assuming that Nicky uses the car for business purposes, what is her basis for depreciation? b. Assume that Nicky deducts depreciation of 6,500 and then sells the car for 32,500. What is her recognized gain or loss? c. Assume that Nicky deducts depreciation of 6,500 and then sells the car for 20,000. What is her recognized gain or loss?arrow_forwardIn 2019, Mary sells for $24,000 a machine used in her business. The machine was purchased on May 1,2017, at a cost of $22,000. Mary has deducted depreciation on the machine of $6,000. What is the amount and nature of Mary's gain as a result of the sale of the machine? $2,000 Section 1231 gain $8,000 ordinary income under Section 1245 $6,000 ordinary income and $2,000 Section 1231 gain $6,000 Section 1231 gain and $2,000 ordinary income under Section 1245 None of the abovearrow_forwardWhat is jorge's gain or loss realized on the machine?arrow_forward

- In year 0, Longworth Partnership purchased a machine for $57,250 to use in its business. In year 3, Longworth sold the machine for $44,300. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $24,900. Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. a. What are the amount and character of the gain or loss Longworth will recognize on the sale? Description Total Gain or (Loss) Recognized Character of Recognized Gain or (Loss): Ordinary Gain or (Loss) $1231 gain or (loss) Amountarrow_forwardIn year 0, Longworth Partnership purchased a machine for $56,000 to use in its business. In year 3, Longworth sold the machine for $36,700. Between the date of the purchase and the date of the sale, Longworth depreciated the machine by $29,800. Note: Loss amounts should be indicated by a minus sign. Leave no answers blank. Enter zero if applicable. b. What are the amount and character of the gain or loss Longworth will recognize on the sale if the sale proceeds are increased to $61,250? Description Total Gain or (Loss) Recognized Character of Recognized Gain or (Loss) Ordinary Gain or (Loss) $1231 gain or (loss) Amountarrow_forwardI want to correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT